2024 Australasia Meeting, Melbourne, Australia: December, 2024

To Follow the Lead or Retrocede to Followers? An Auction Model of the Reinsurance Market

Chang Liu

This study models competing reinsurance syndicates vying for underwriting risk in a common-value setting. In the market-wide

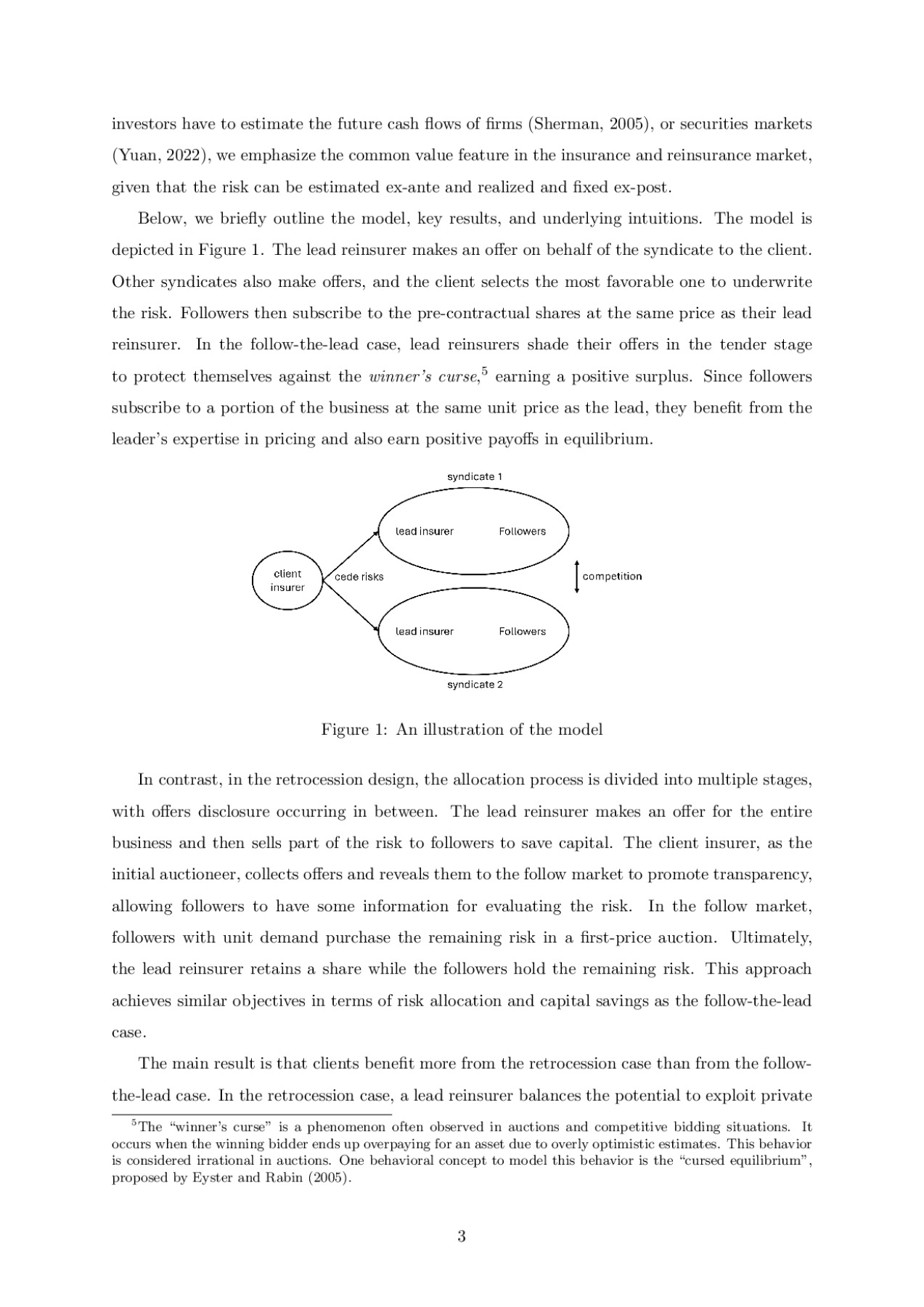

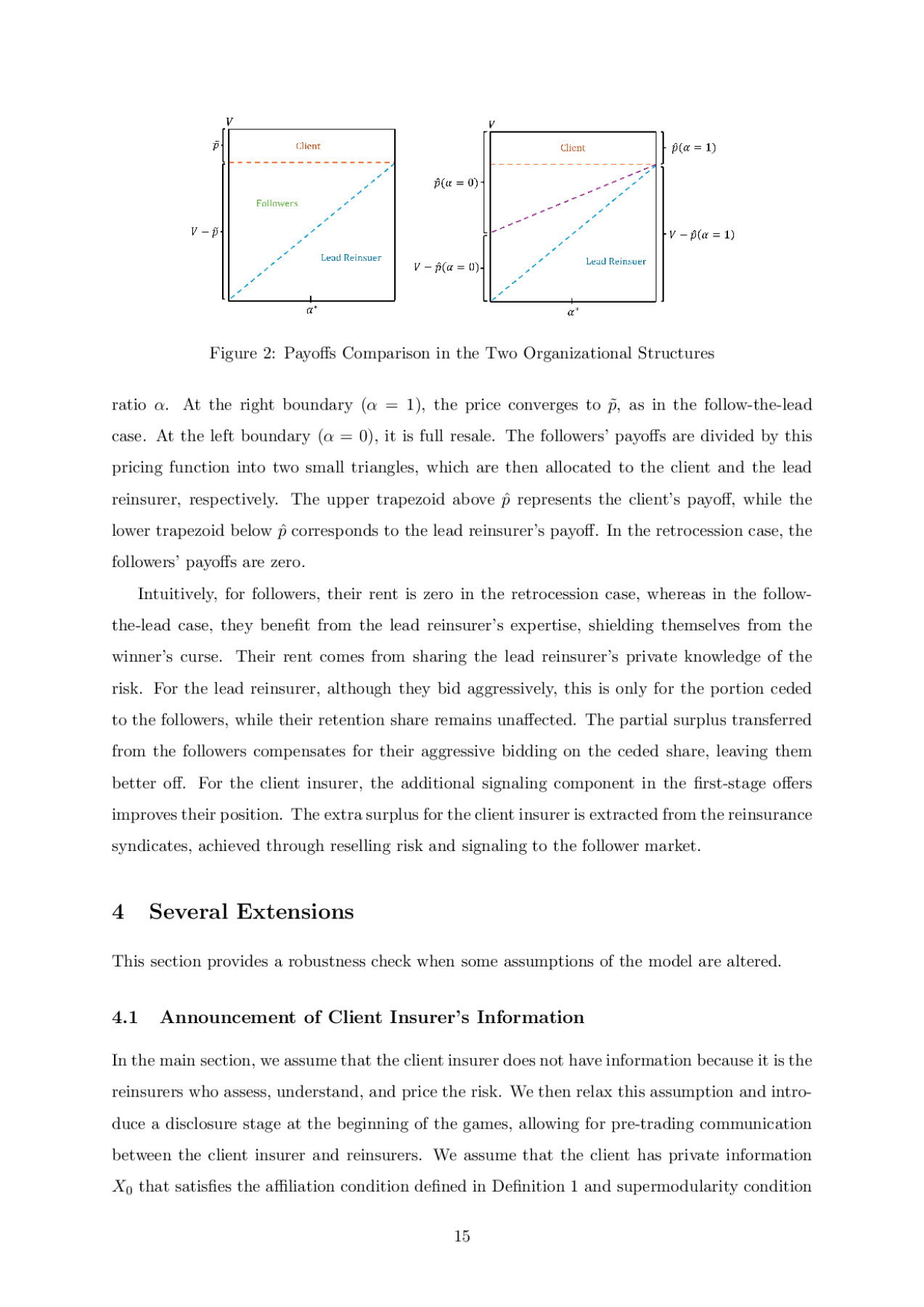

follow-the-lead practice, the lead reinsurer makes an offer directly to clients based on their risk assessment, while followers, who typically provide capital and capacity, are locked into a single unit price determined at the tender stage. Whether this premium alignment benefits the client remains underexplored. Inspired by the design of spectrum auctions, we restructure the allocation process into two stages, with information revelation occurring between these stages, referred to as the retrocession case. In this scenario, the lead reinsurer makes an offer for the entire business and cedes partial risk to the followers. Similar risk allocation and capital-saving outcomes are achieved. We compare this situation with the follow-the-lead practice and find that, under the follow-the-lead scenario, lead reinsurers shade their offers to avoid the winner’s curse, allowing followers to benefit. Conversely, in the case of a retrocession, lead reinsurers make more aggressive offers to signal information. This not only favors the lead reinsurer, but also benefits the initial clients, as explained through an information transmission channel.

follow-the-lead practice, the lead reinsurer makes an offer directly to clients based on their risk assessment, while followers, who typically provide capital and capacity, are locked into a single unit price determined at the tender stage. Whether this premium alignment benefits the client remains underexplored. Inspired by the design of spectrum auctions, we restructure the allocation process into two stages, with information revelation occurring between these stages, referred to as the retrocession case. In this scenario, the lead reinsurer makes an offer for the entire business and cedes partial risk to the followers. Similar risk allocation and capital-saving outcomes are achieved. We compare this situation with the follow-the-lead practice and find that, under the follow-the-lead scenario, lead reinsurers shade their offers to avoid the winner’s curse, allowing followers to benefit. Conversely, in the case of a retrocession, lead reinsurers make more aggressive offers to signal information. This not only favors the lead reinsurer, but also benefits the initial clients, as explained through an information transmission channel.

Versions available:

Preview