2024 North American Summer Meeting: June, 2024

Mandatory Disclosure, Investment Efficiency, and Learning

Jianda Bi, Jingong Huang, Xiuping Hua

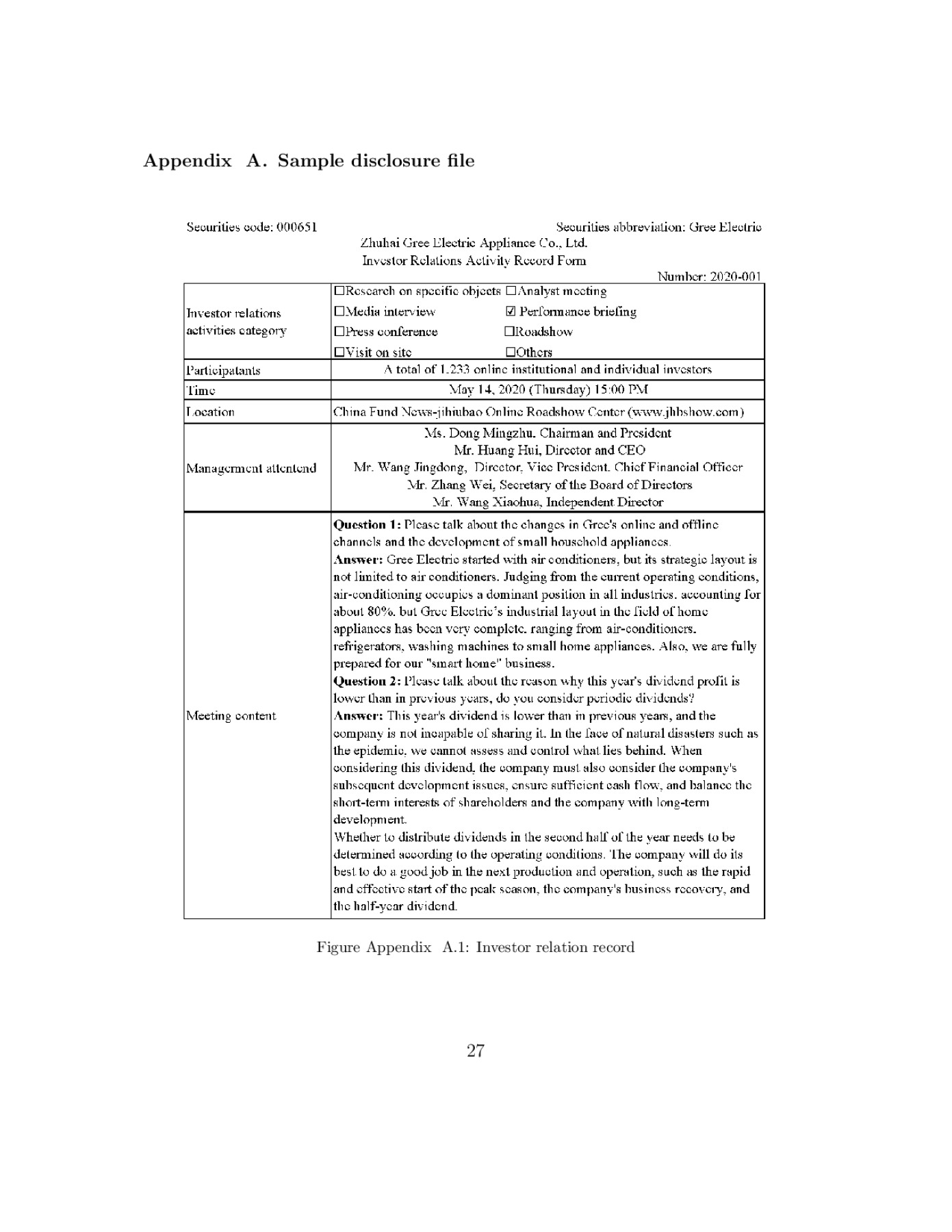

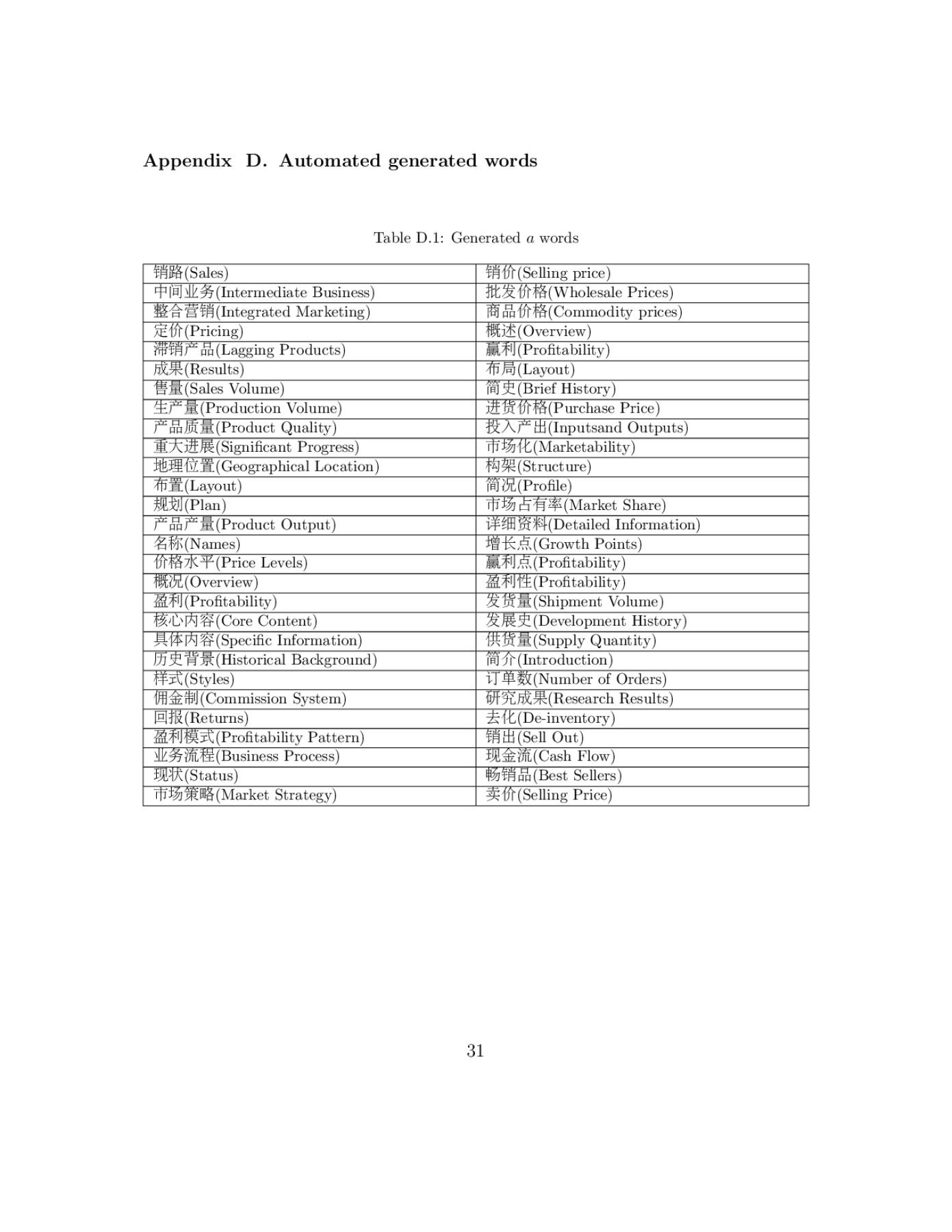

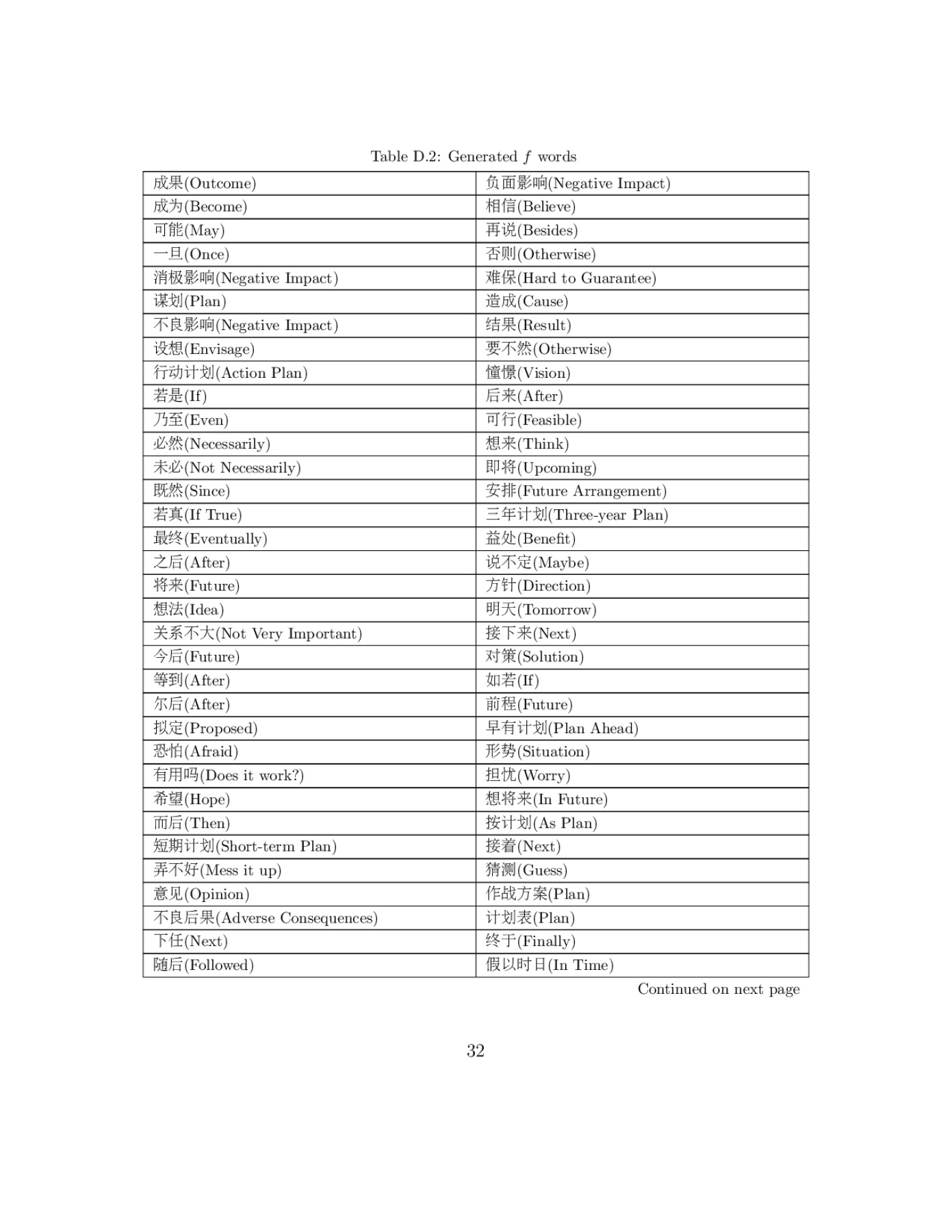

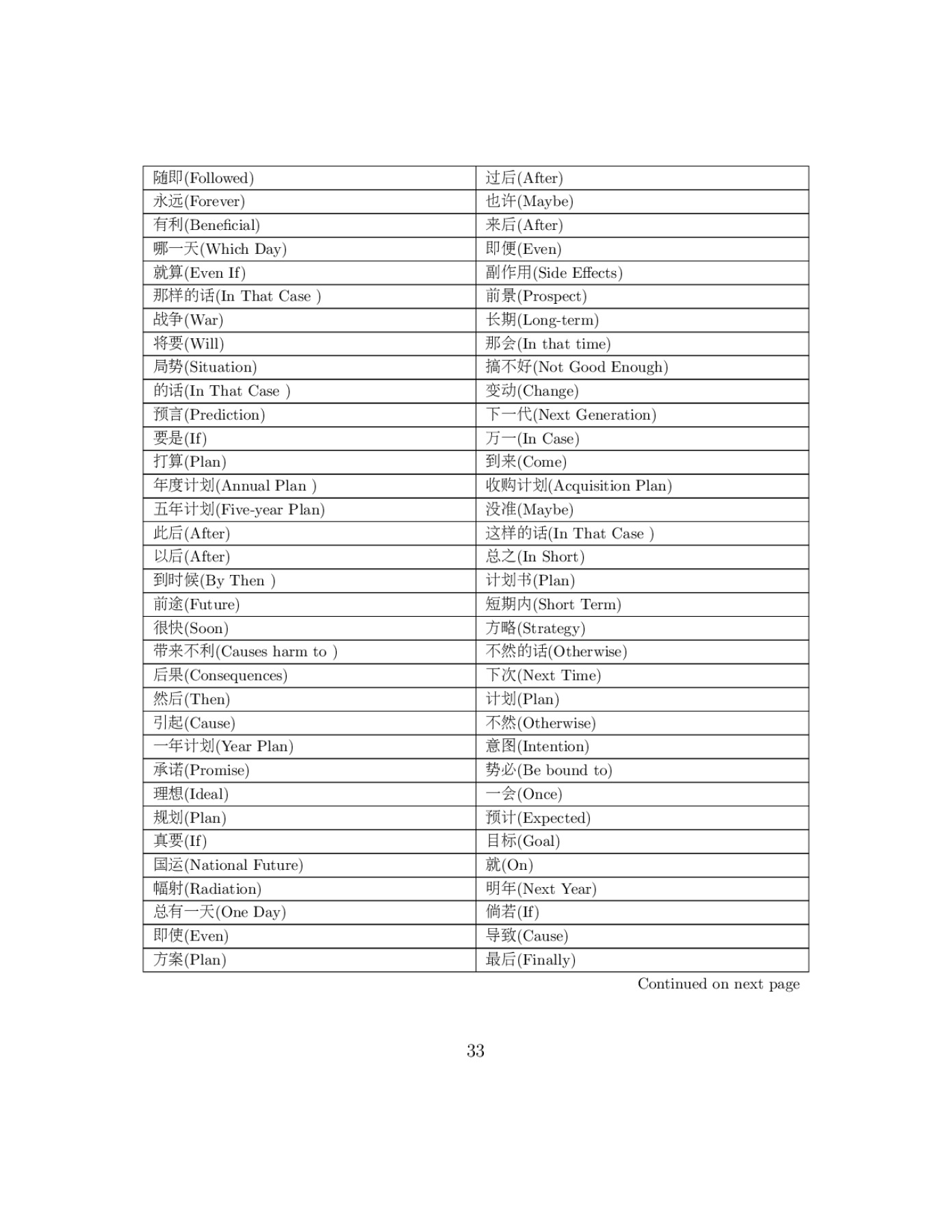

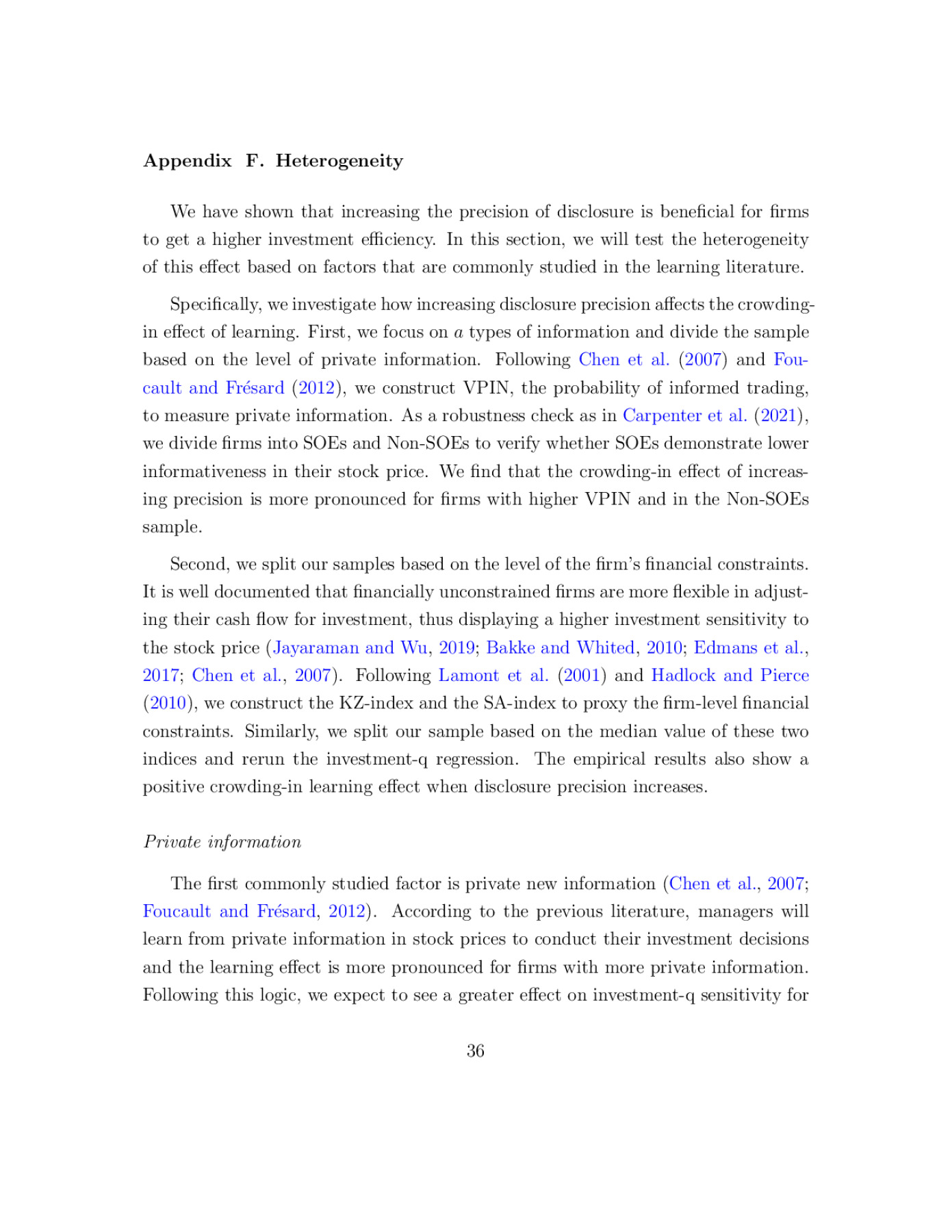

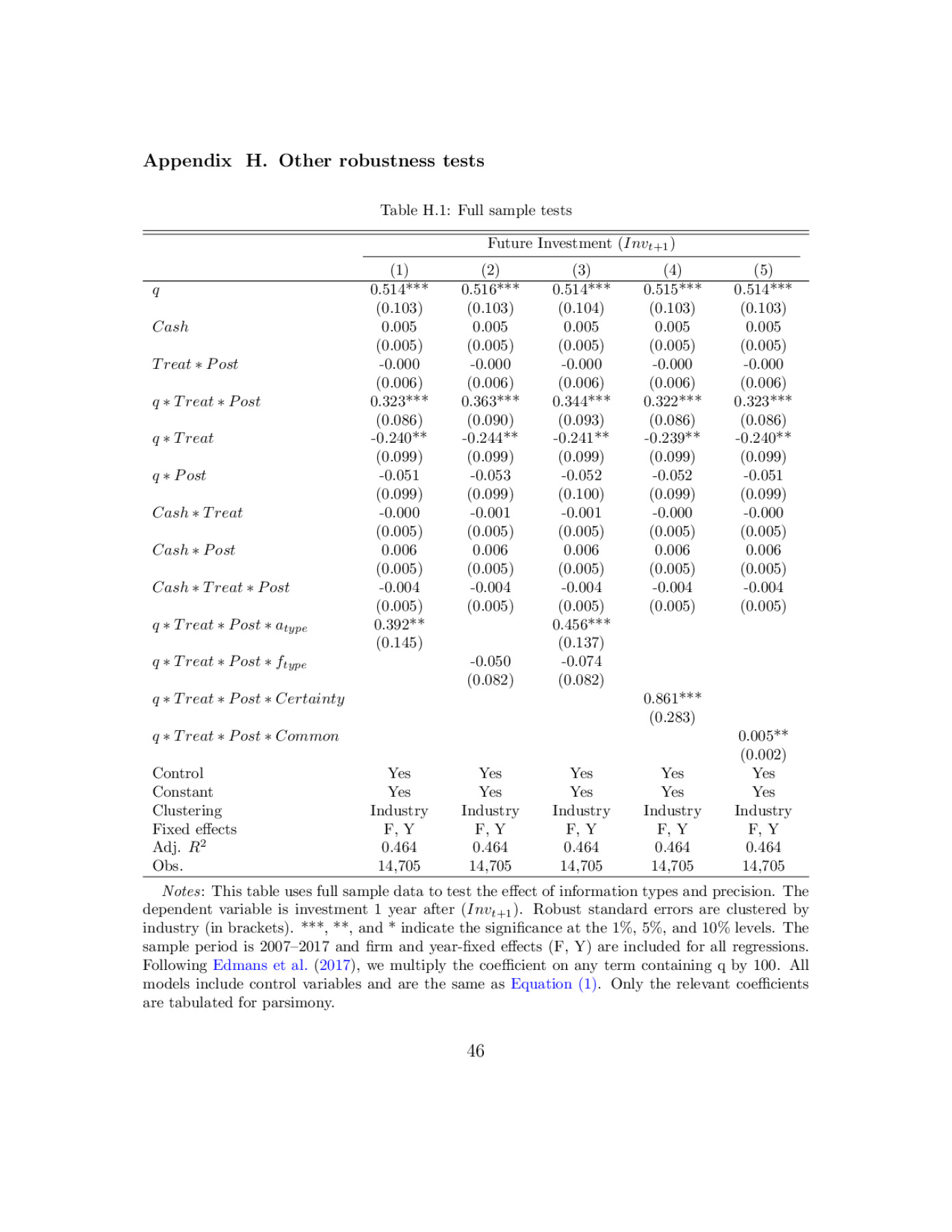

Mandatory disclosure could increase price informativeness by crowding in the manager’s unknown information into the price. By learning from the price, the manager increases the firm’s investment efficiency. In this study, we use the mandatory disclosure regulation of company visits as an exogenous shock to test the learning channel. We find that there is a positive learning effect in the Chinese market. Consistent with the learning theory, we show that the effect is determined by the information types of disclosure. In addition, a higher disclosure precision will amplify this effect: firms that disclose more precise information exhibit a stronger learning effect. Overall, we add to the existing literature novel empirical evidence on the learning channel of mandatory disclosure and its real effect.

Preview