2024 North American Summer Meeting: June, 2024

Inflation Uncertainty from Firms’ Perspective, Overconfidence and Credibility of Monetary Policy

Fernando Borraz, Anna Orlik, Laura Zacheo

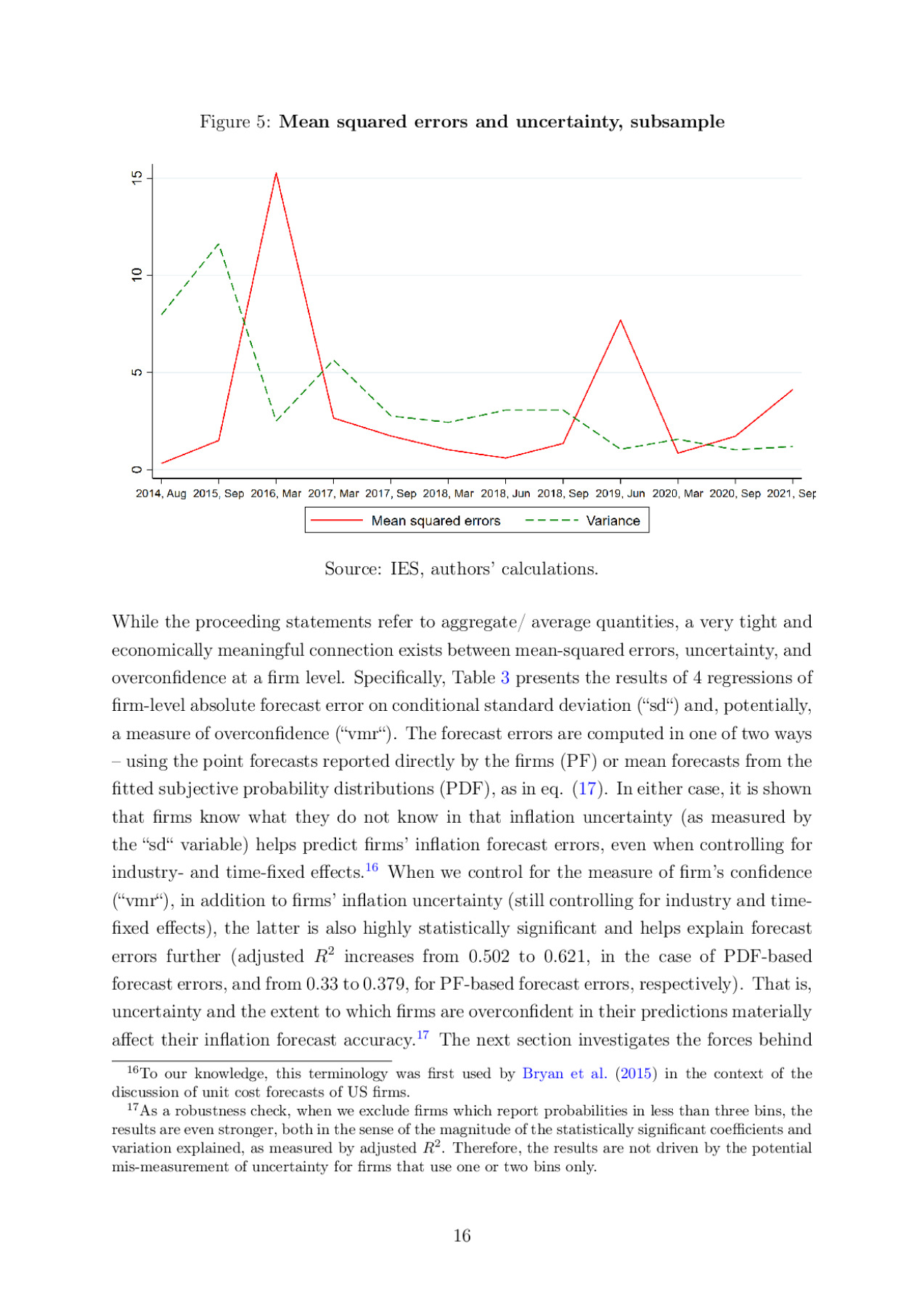

This paper uses survey data to gauge firms’ inflation uncertainty. First, it shows how commonly used proxies of uncertainty, such as ex post squared forecast errors or forecast dispersion differ from measures of actual ex ante inflation uncertainty. Second,

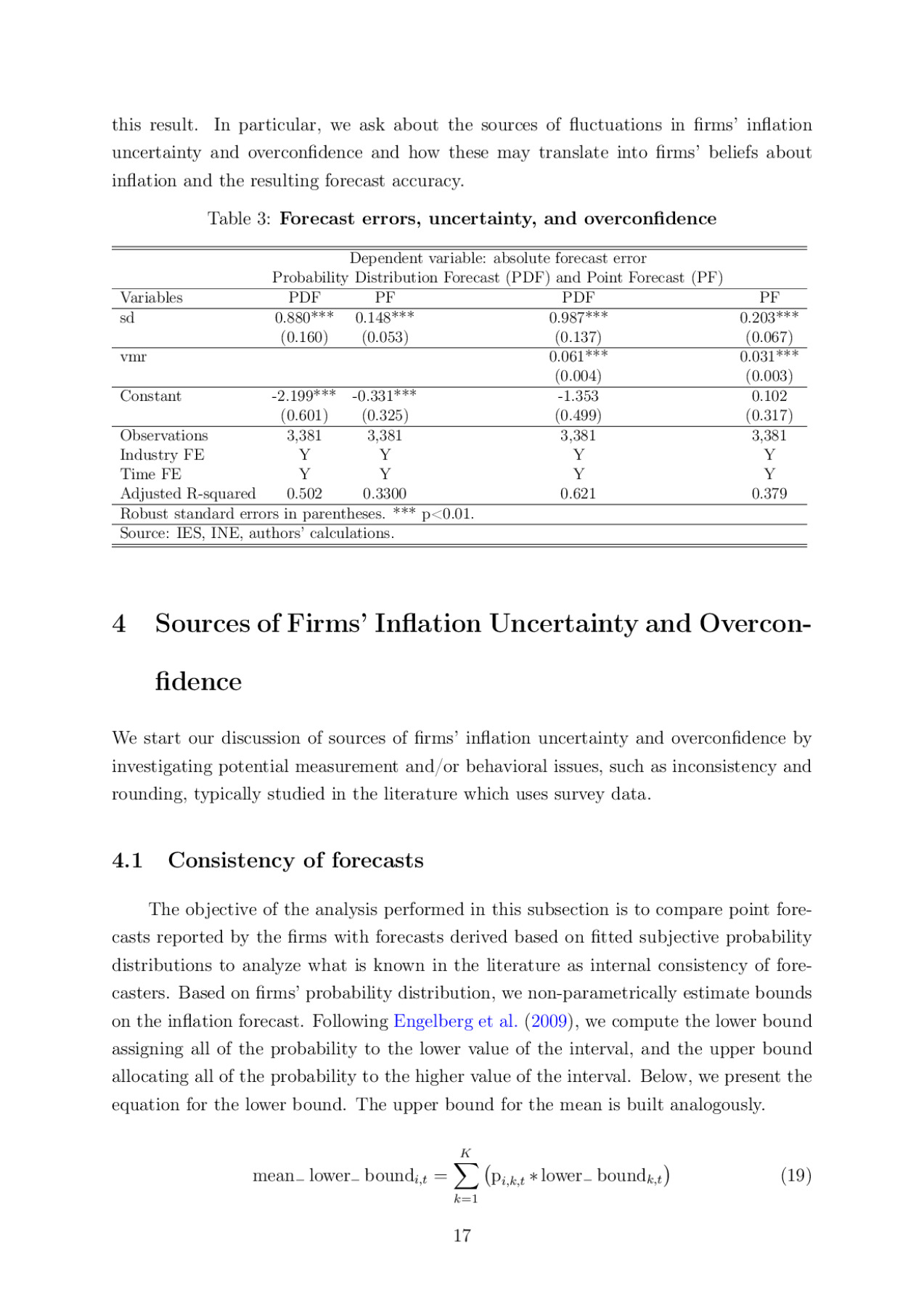

this paper documents novel stylized facts: firms’ uncertainty and overconfidence – low ex ante variances compared to ex post (squared) forecast errors – are shown to be relevant for how firms’ form their beliefs about inflation and their inflation forecasts accuracy (firms know what they do not know) and to impact firms’ beliefs about credibility of monetary policy.

this paper documents novel stylized facts: firms’ uncertainty and overconfidence – low ex ante variances compared to ex post (squared) forecast errors – are shown to be relevant for how firms’ form their beliefs about inflation and their inflation forecasts accuracy (firms know what they do not know) and to impact firms’ beliefs about credibility of monetary policy.

Preview