2024 North American Summer Meeting: June, 2024

A General Theory of Holdouts

Xiaobo Yu

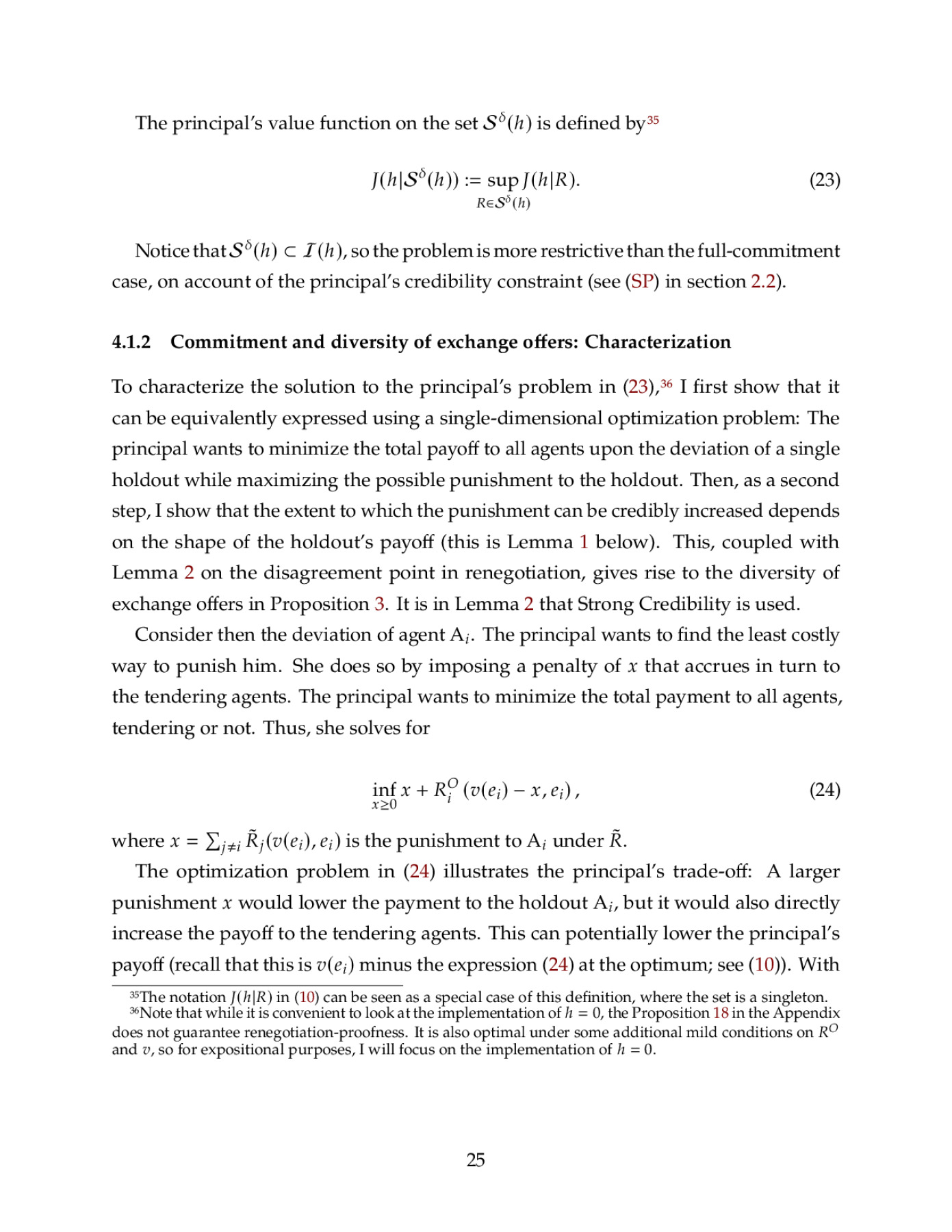

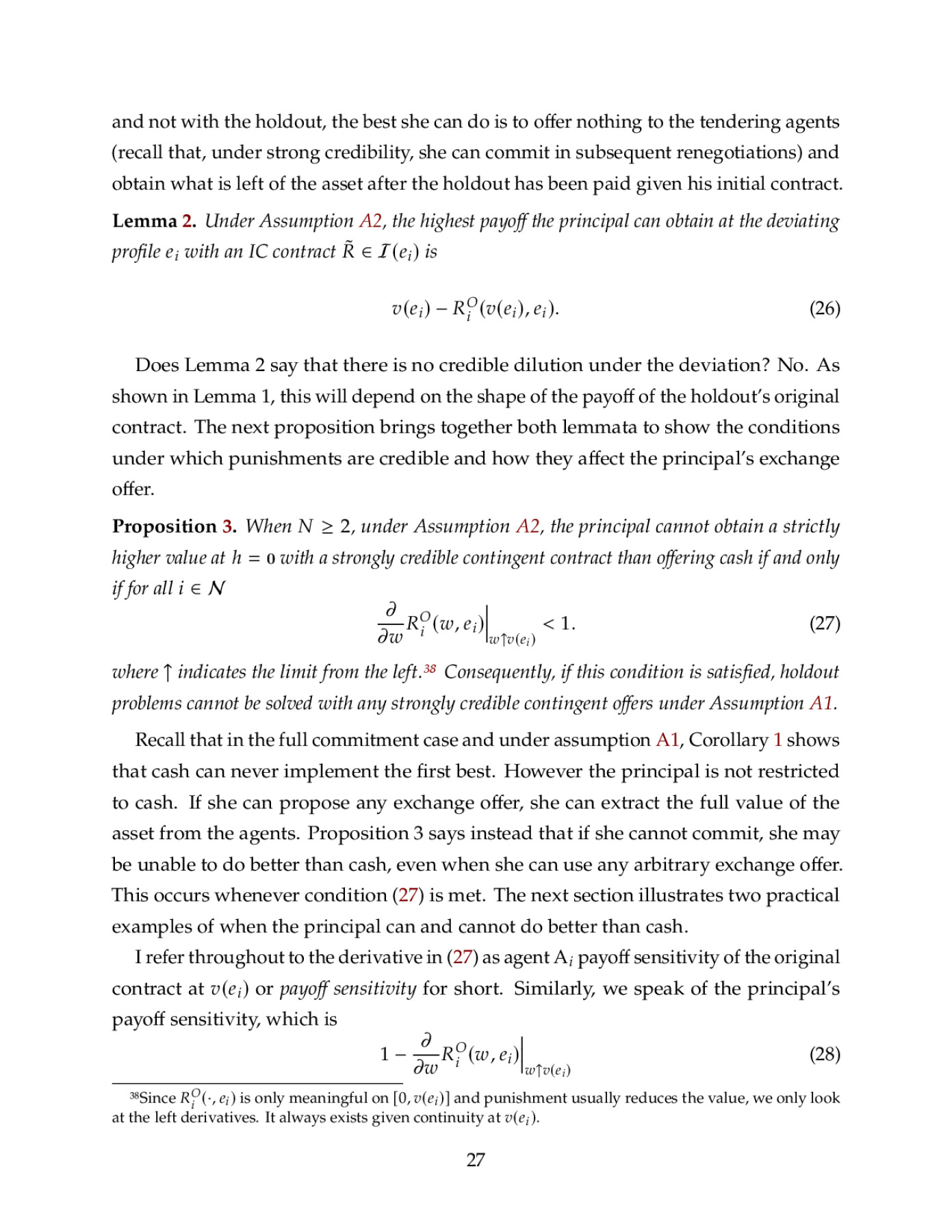

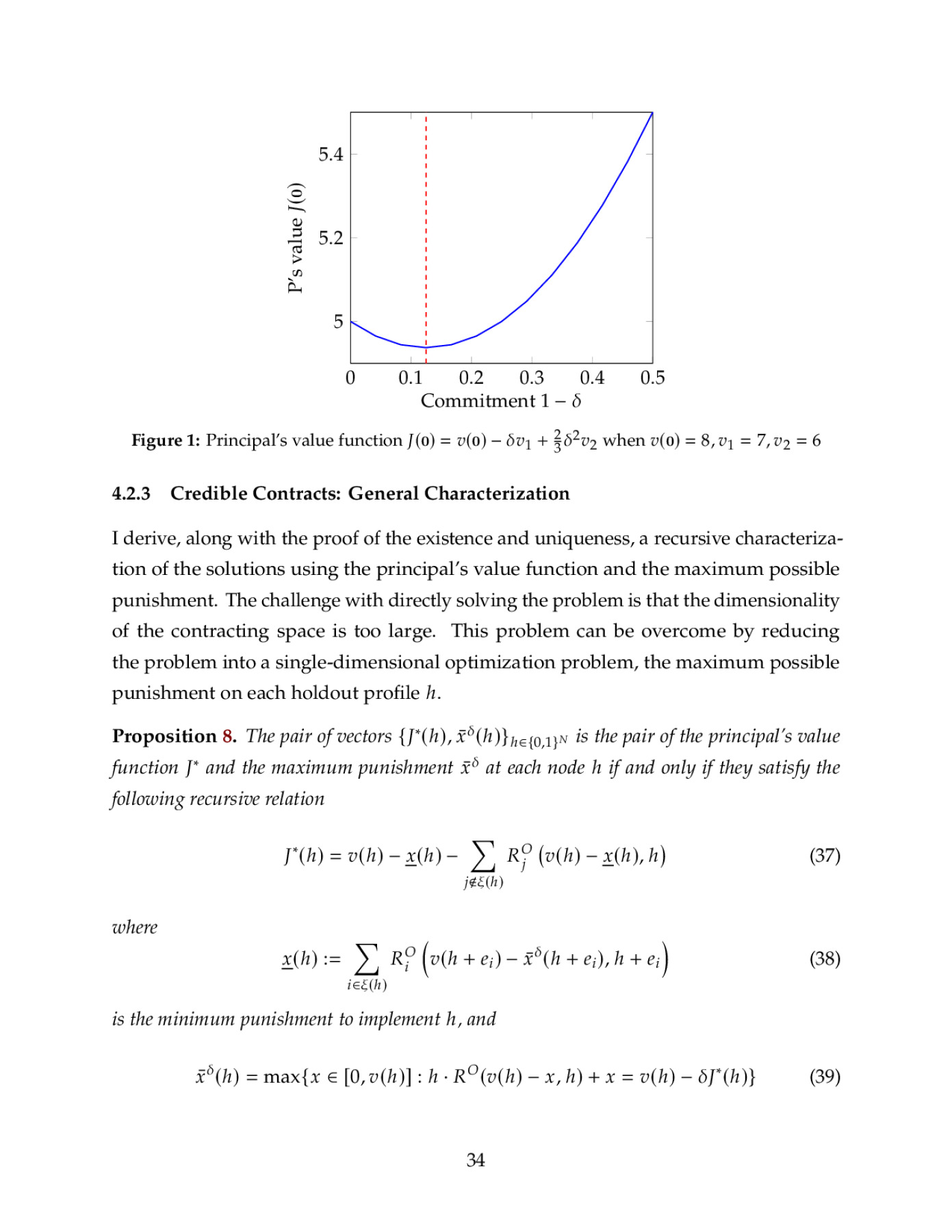

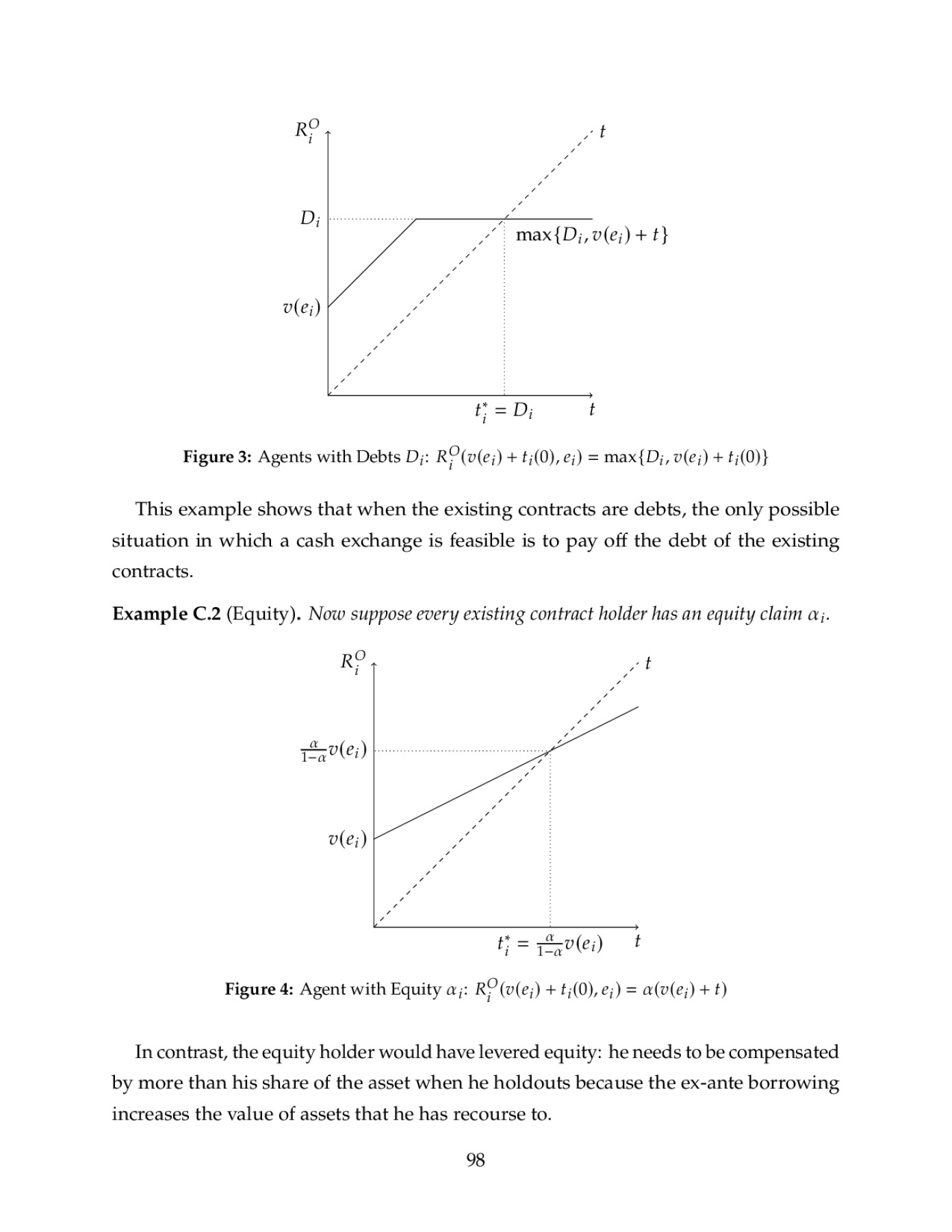

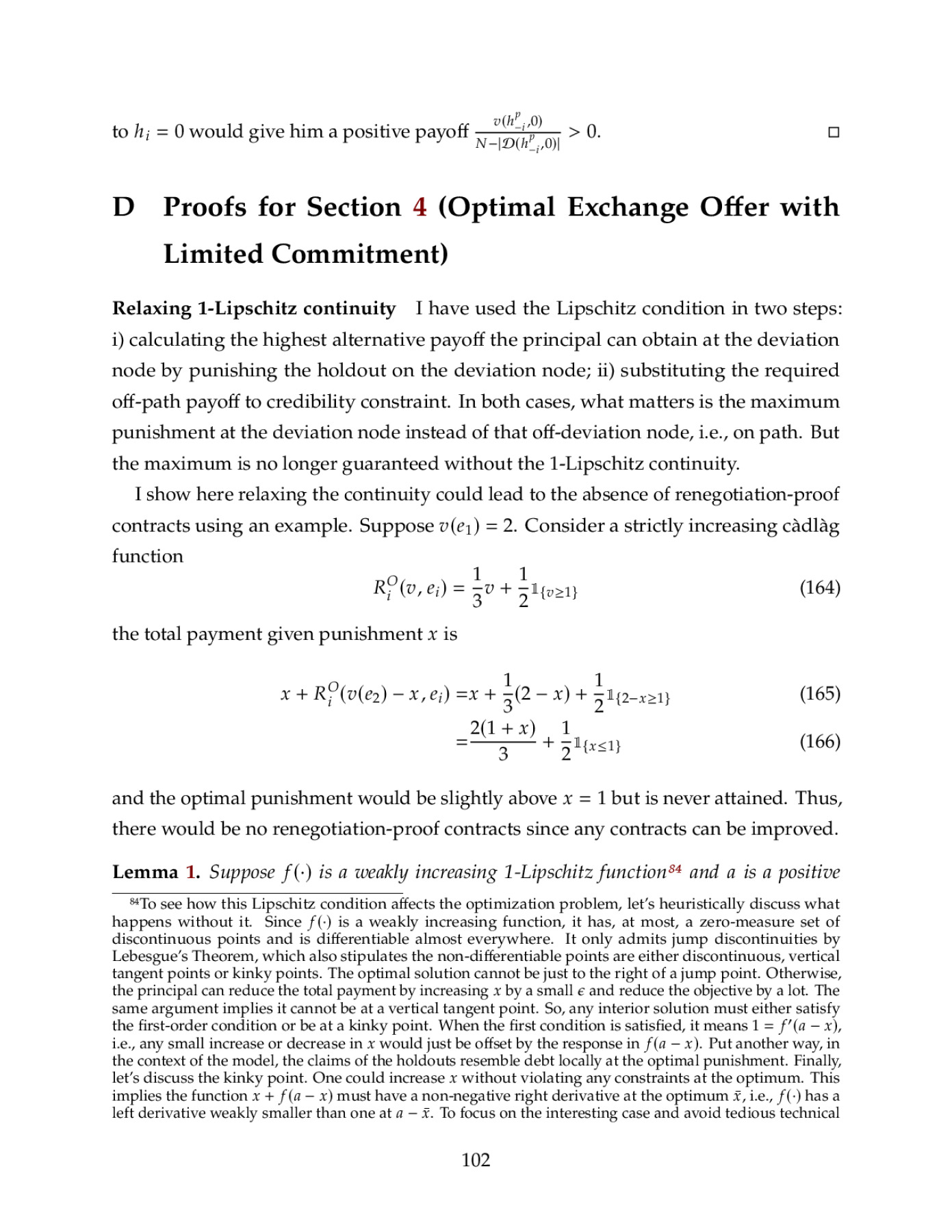

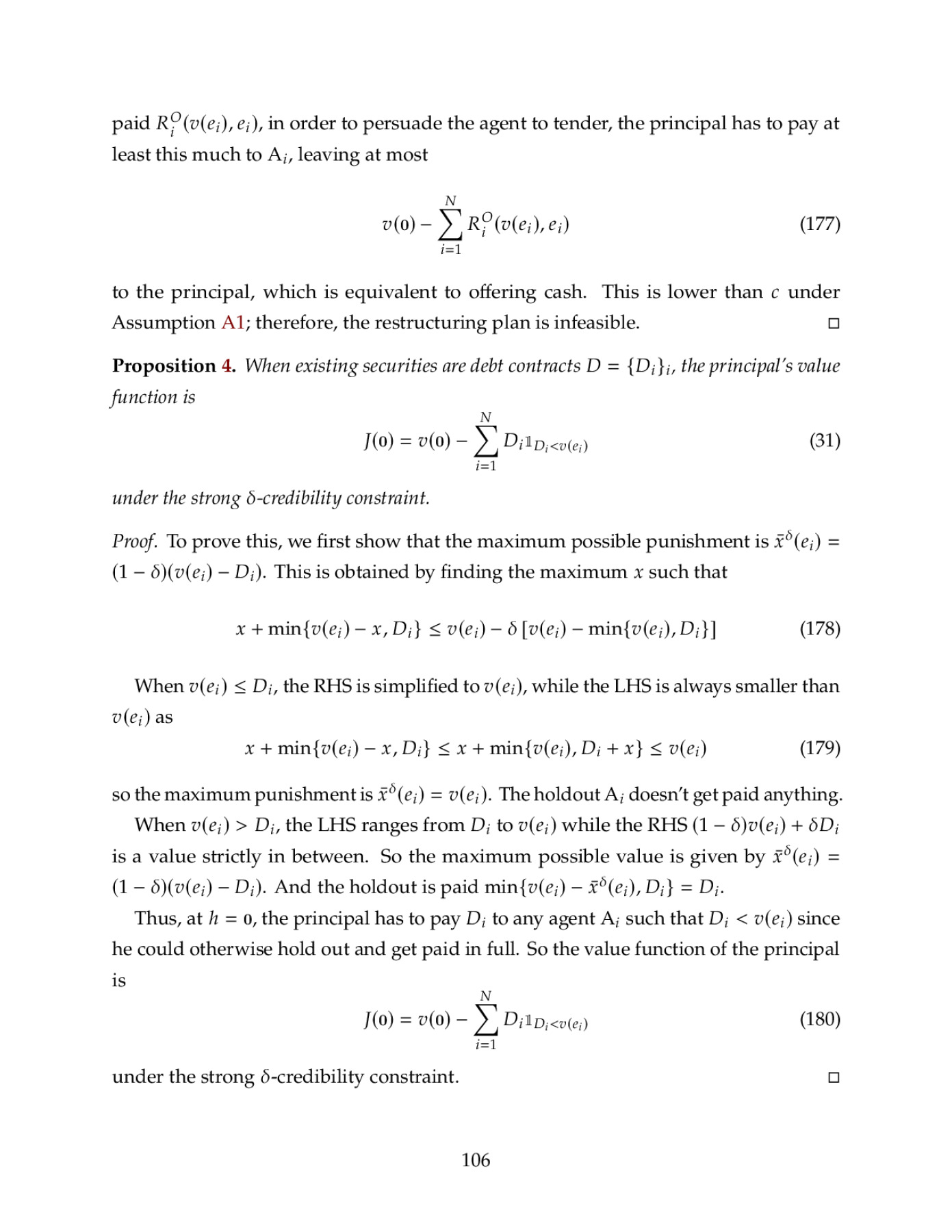

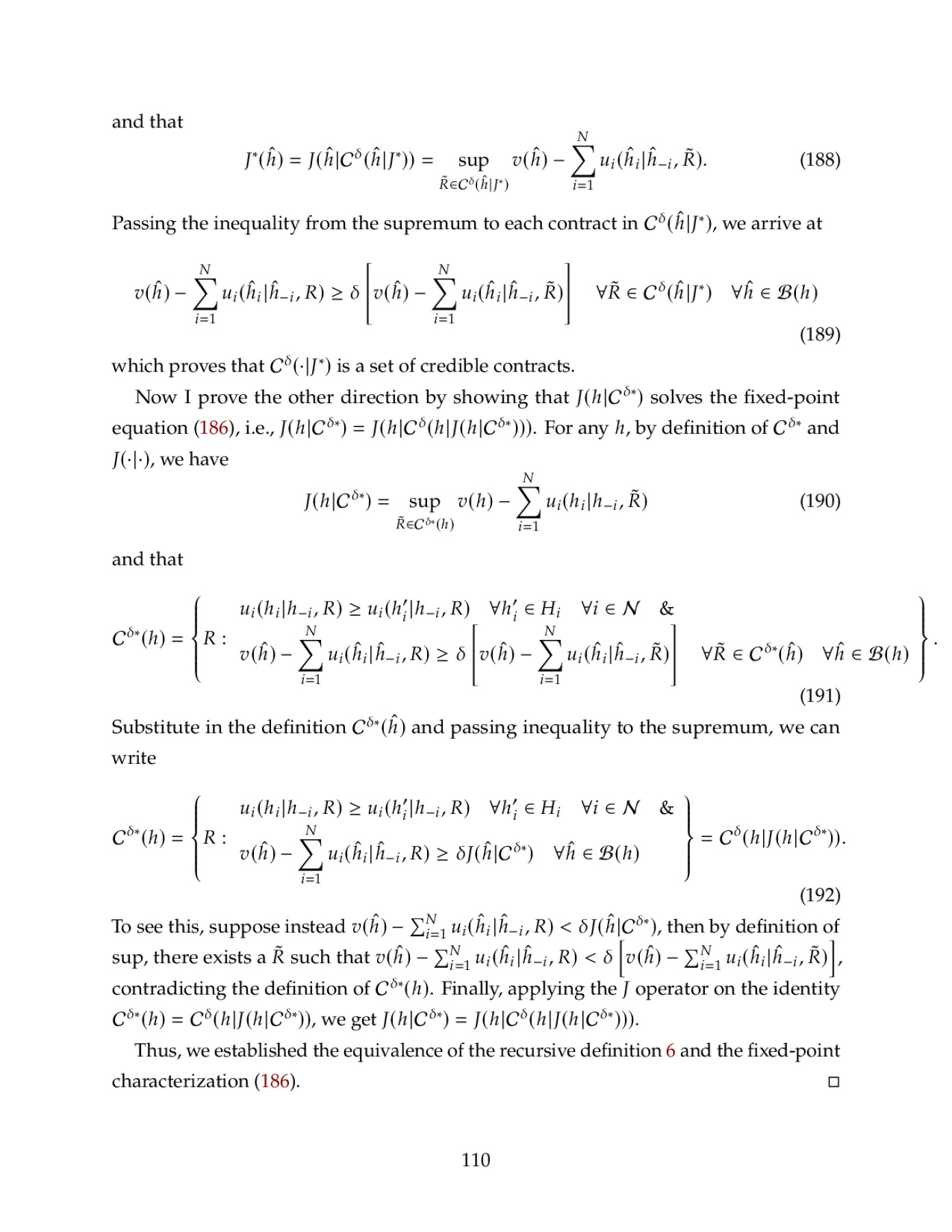

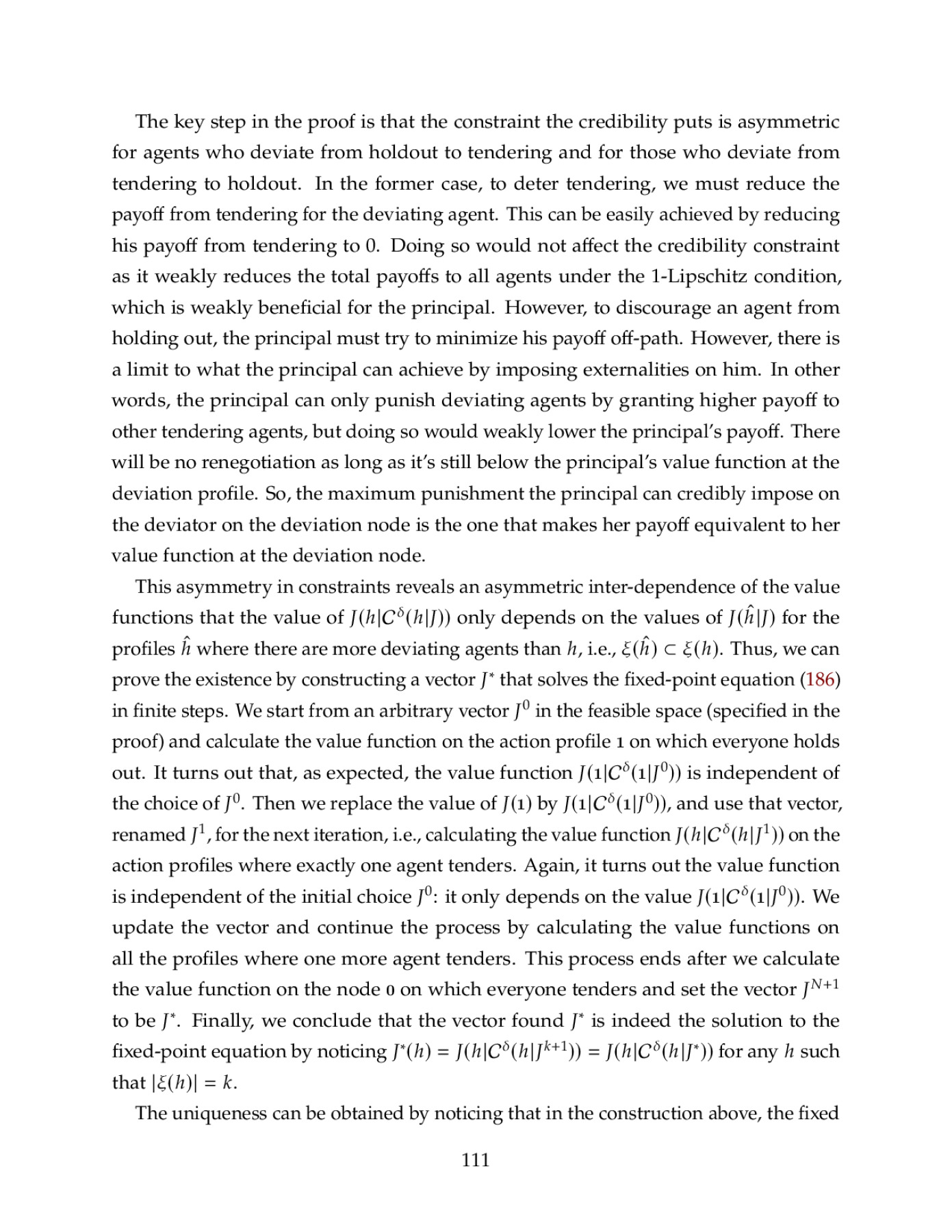

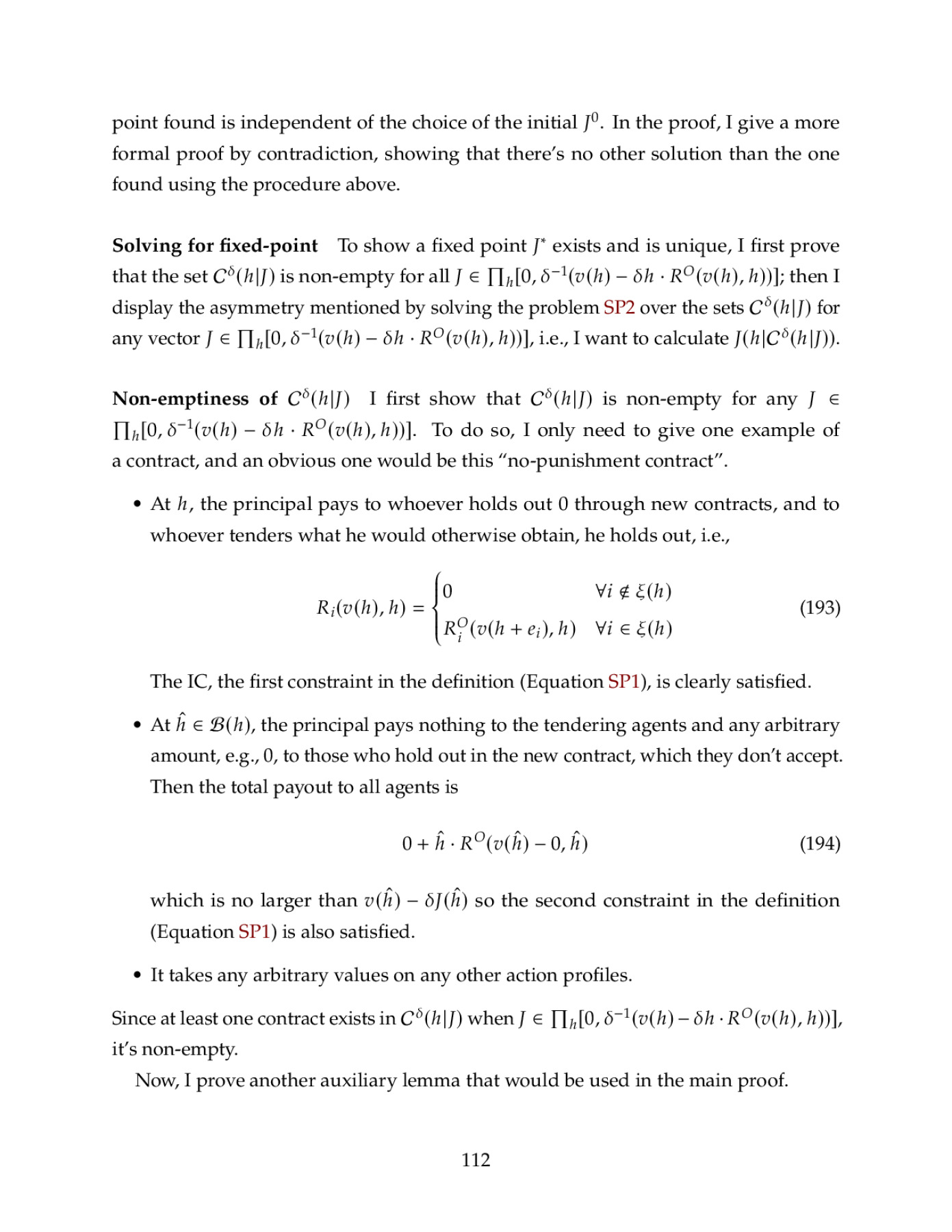

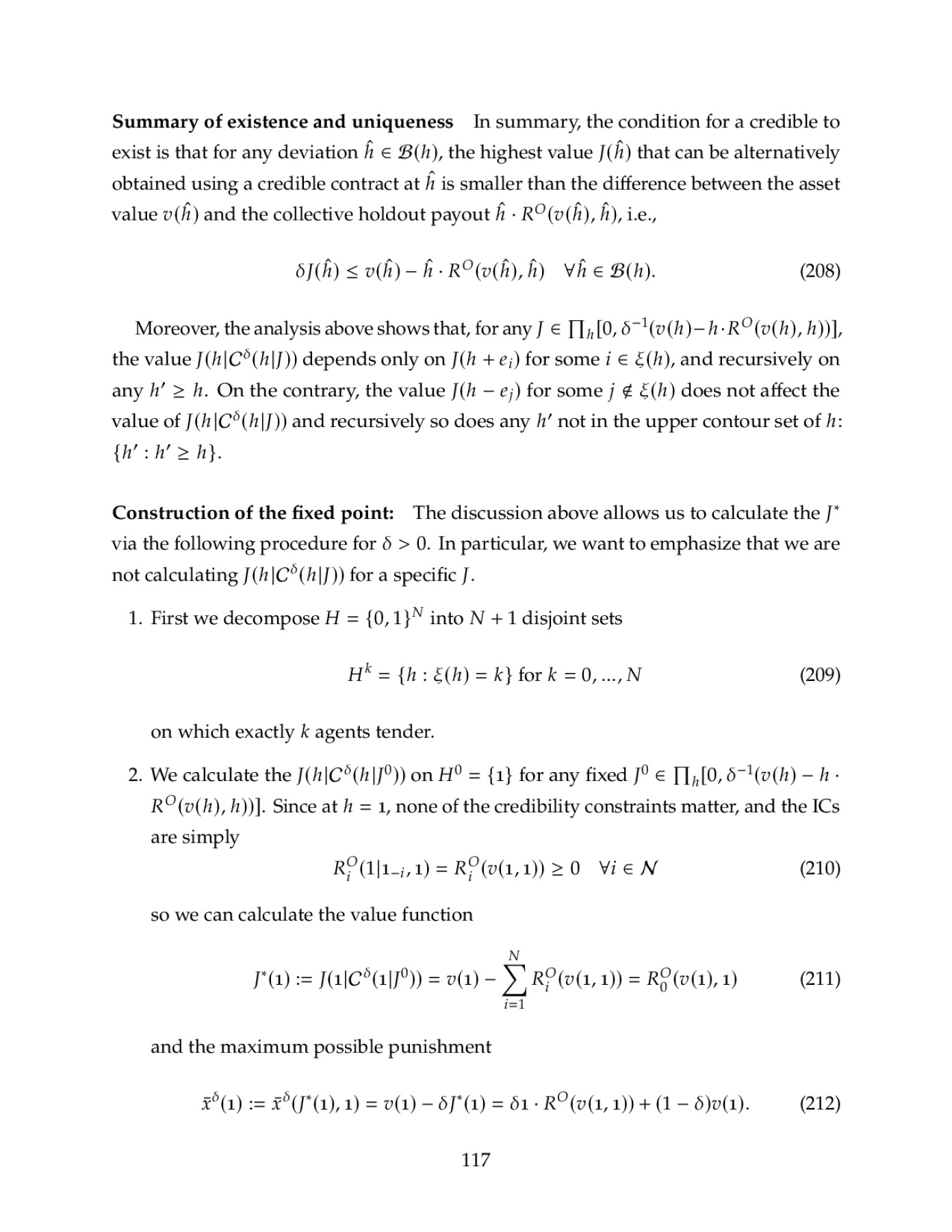

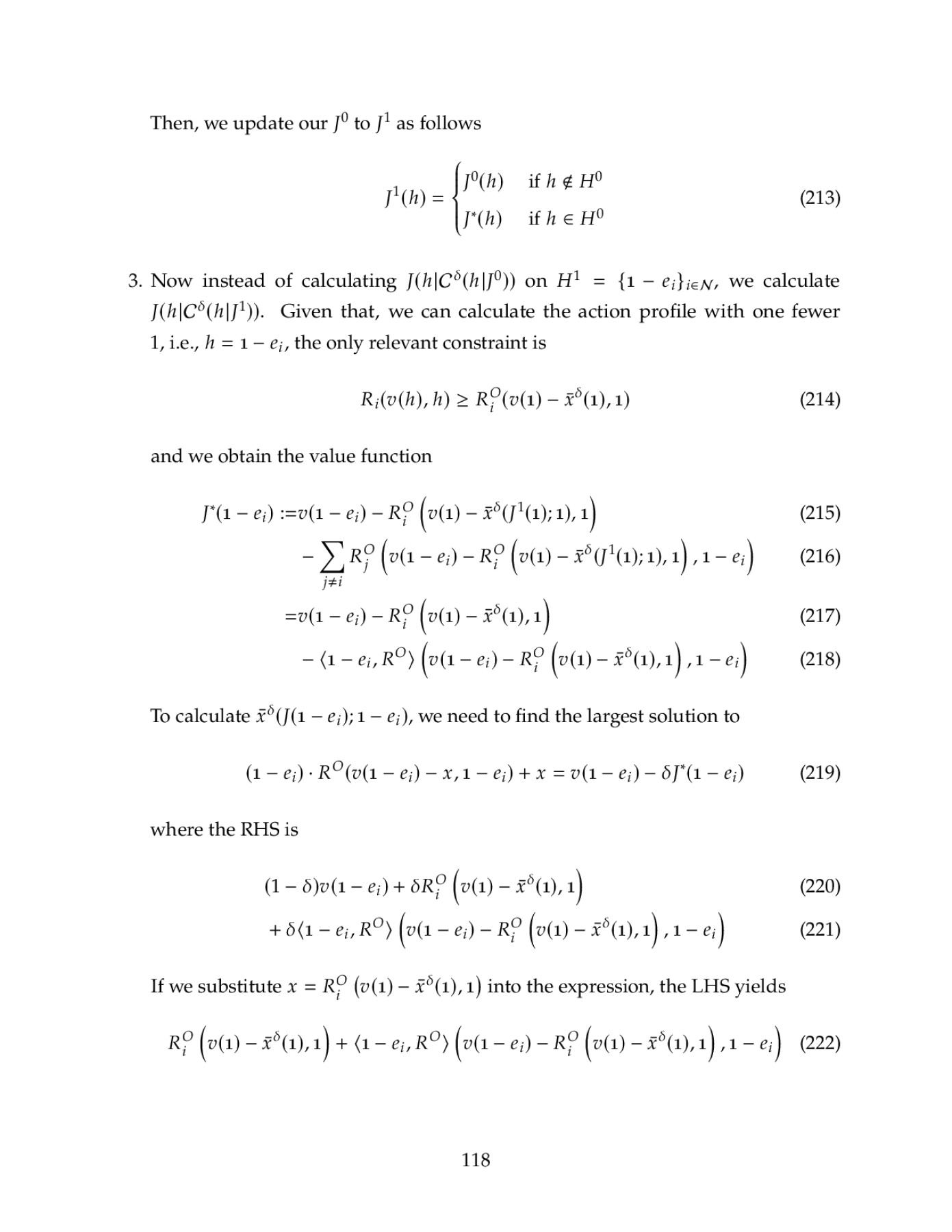

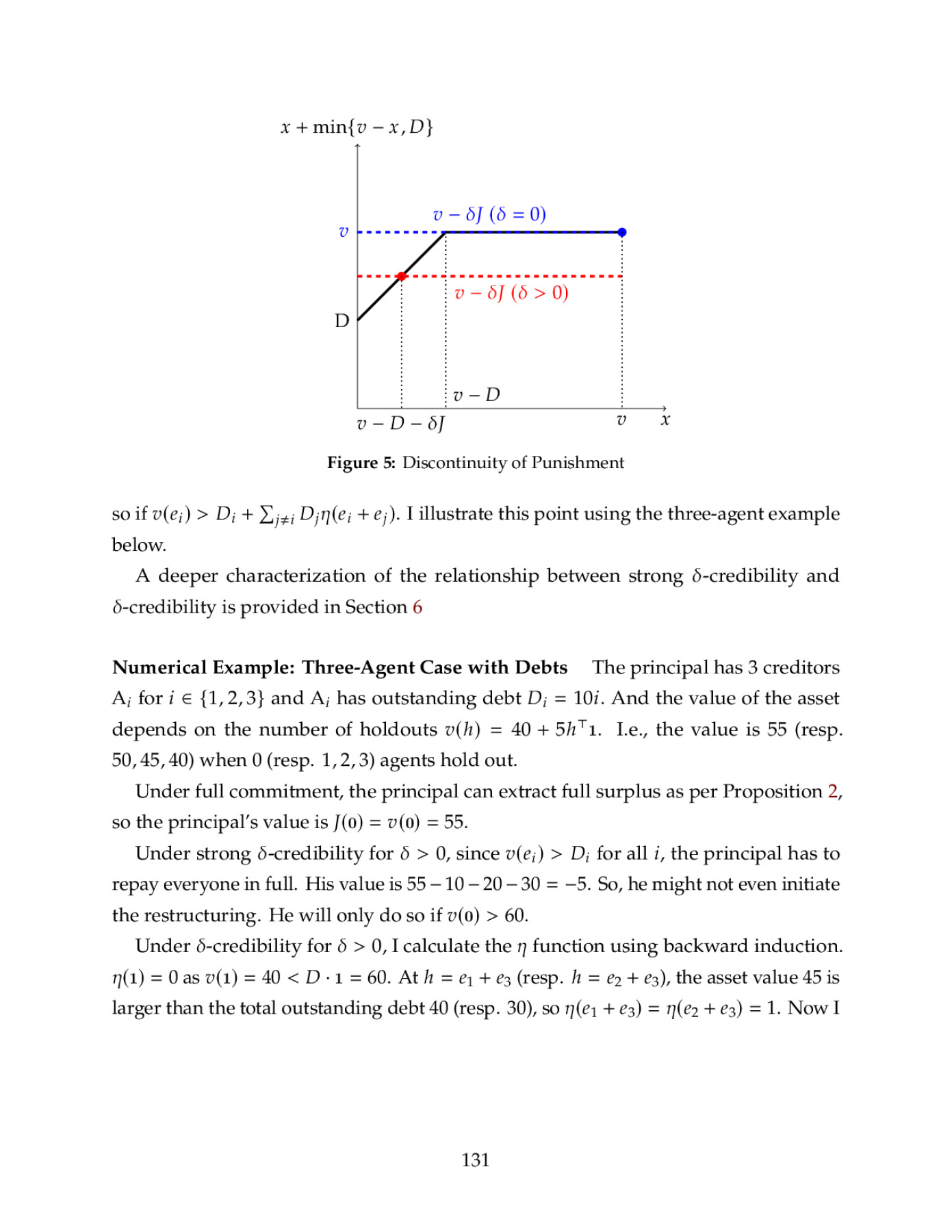

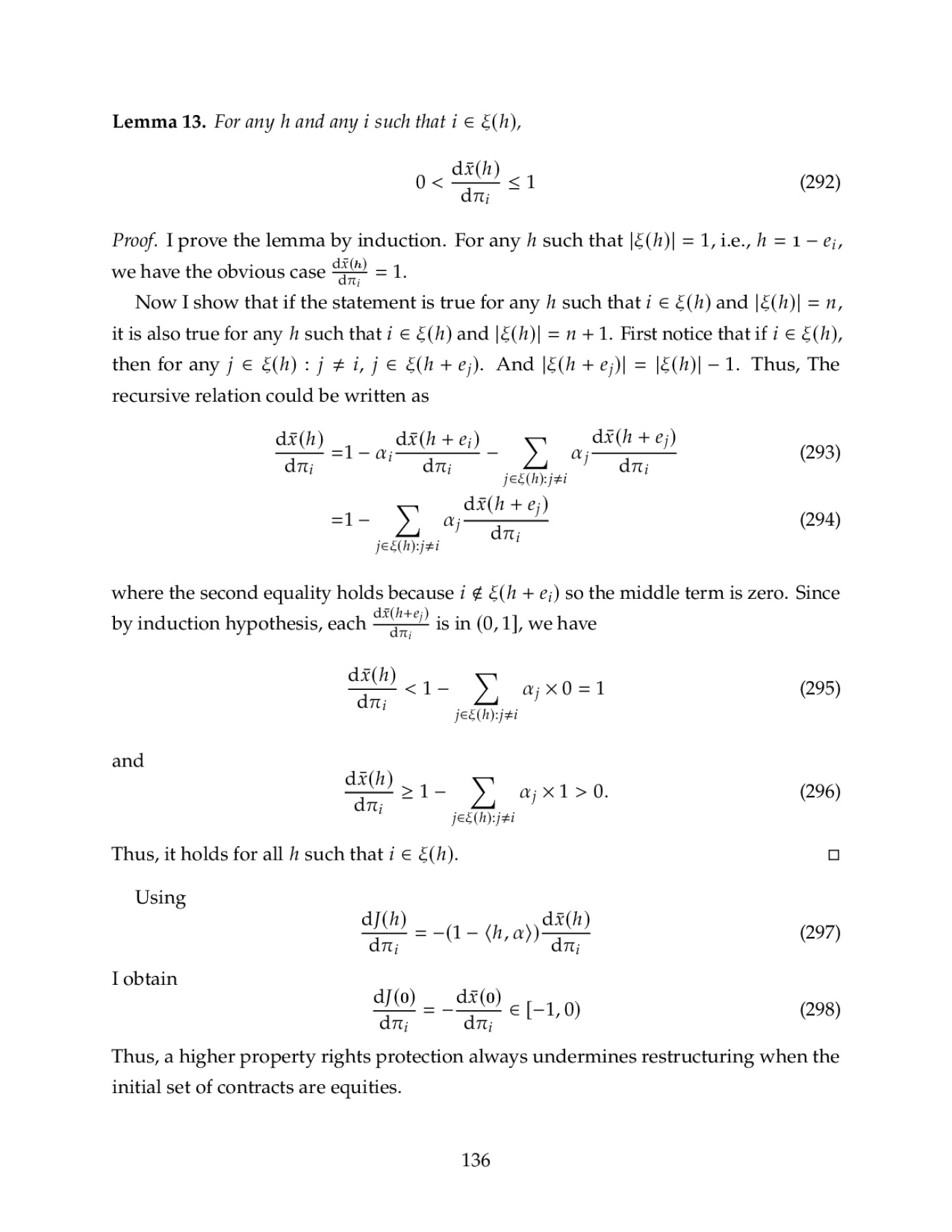

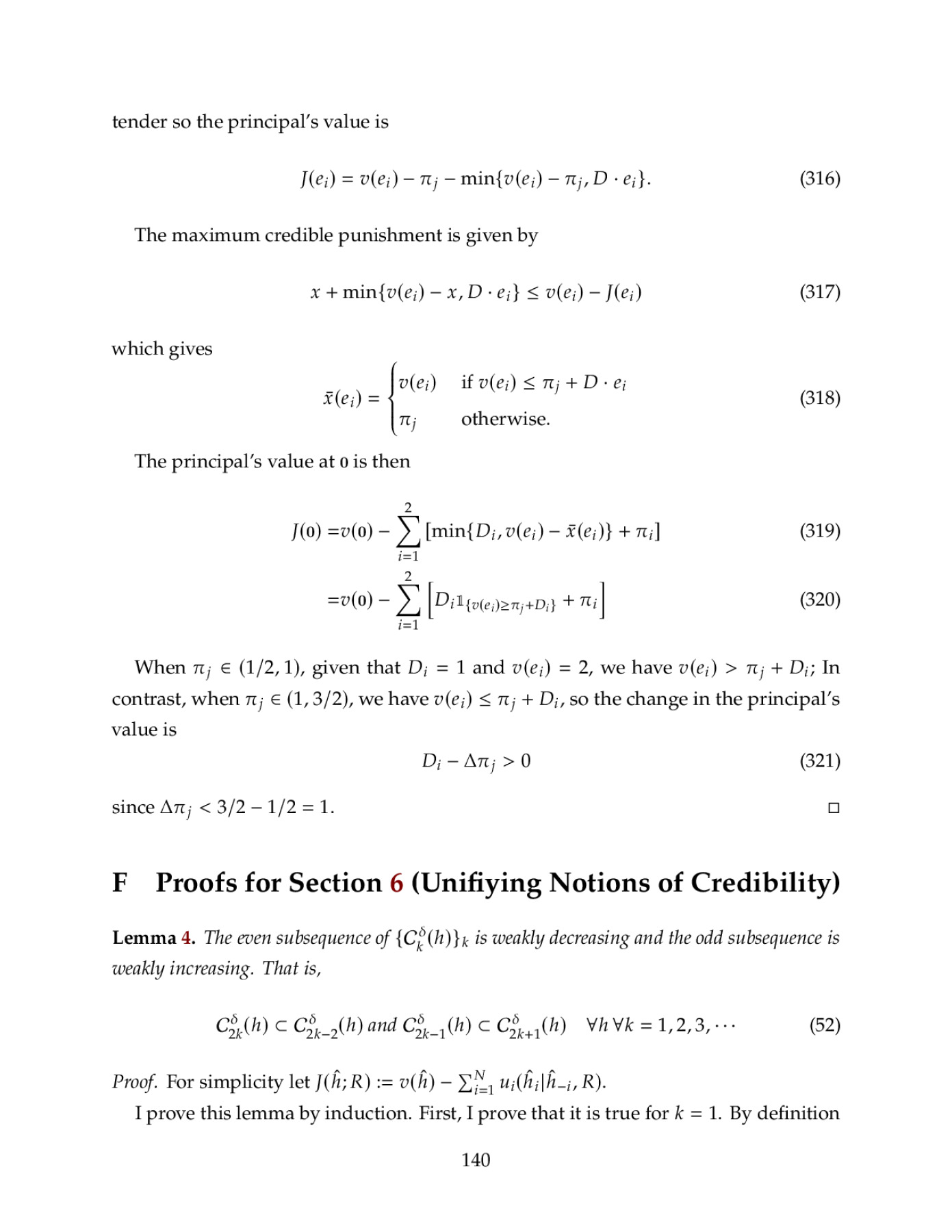

This paper presents a unified framework for analyzing the holdout problem, a pervasive economic phenomenon in which value creation is hindered by the incentive to free-ride on other agents' participation. My framework nests many classic applications, such as takeovers and debt restructuring, and highlights the role of the commitment power: The holdout problem can be resolved using contingent contracts with commitment, e.g., by a unanimity rule if the principal can commit to calling off the deal when anyone holds out. In contrast, a lack of commitment substantially alters the optimal offers depending on the payoff sensitivities of the existing contracts, which explains the absence of the unanimity rule despite its efficacy, and cross-sectional heterogeneity in offers. (E.g., senior debt used in debt restructuring but not in takeovers.) Furthermore, I show that stronger partial commitment can backfire via renegotiation, exacerbating the holdout problem. This non-monotonicity reconciles contradictory empirical findings on the use of CACs in the sovereign debt market and sheds light on various policies. Lastly, the paper shows stronger investor protection could facilitate instead of hinder restructuring under limited commitment.

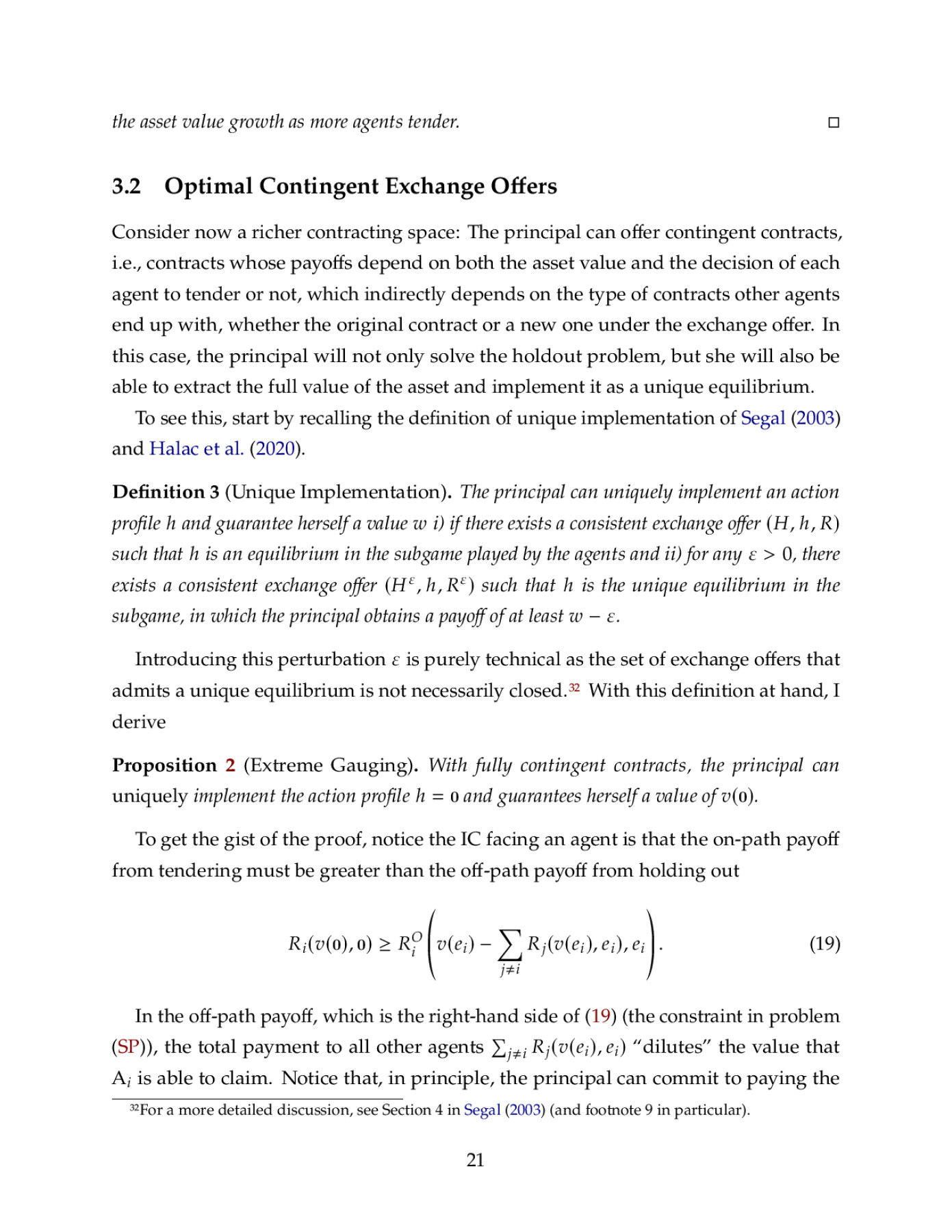

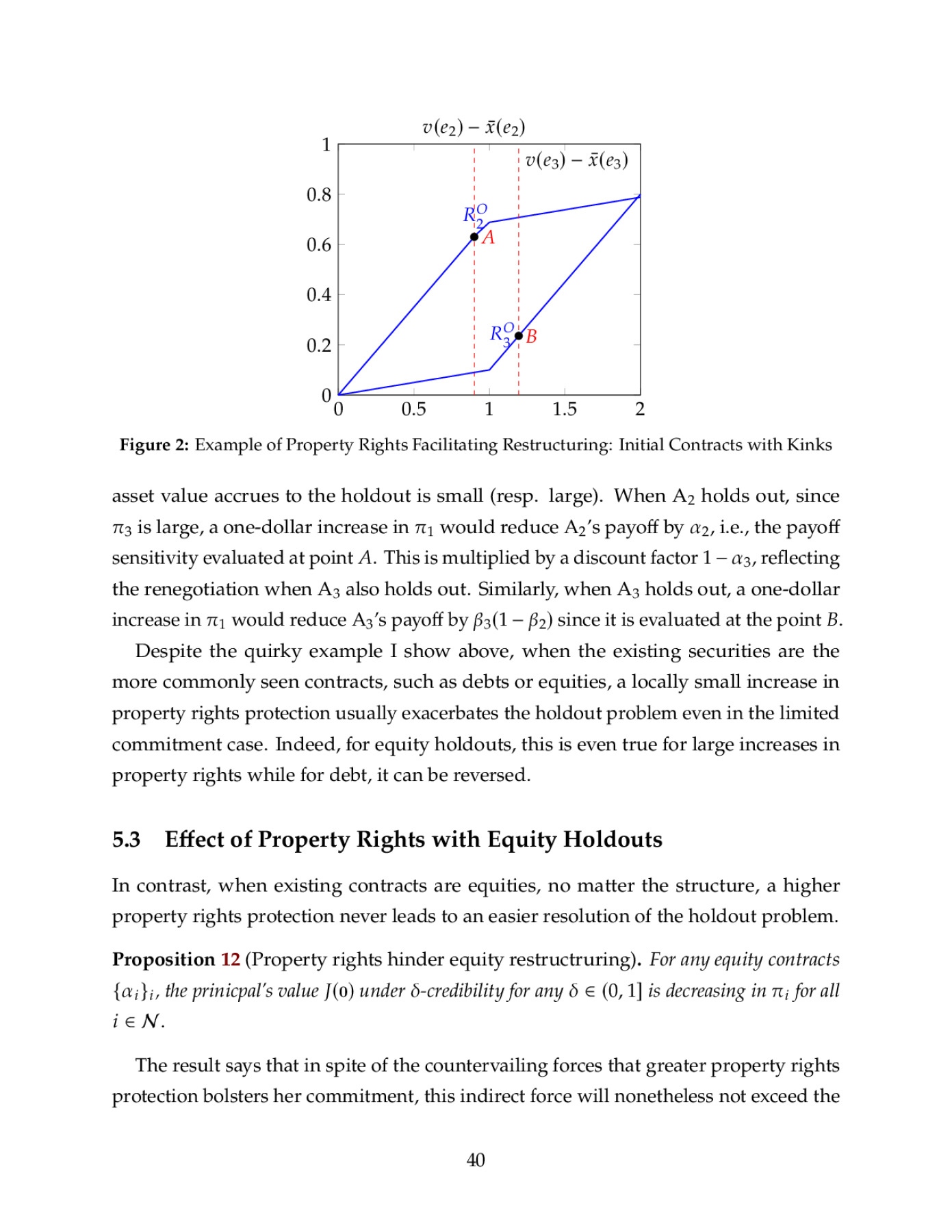

Preview