2024 European Winter Meeting, Palma de Majorca, Spain: December, 2024

Housing Rent, Inelastic Housing Supply and International Business Cycles

Seungyub Han

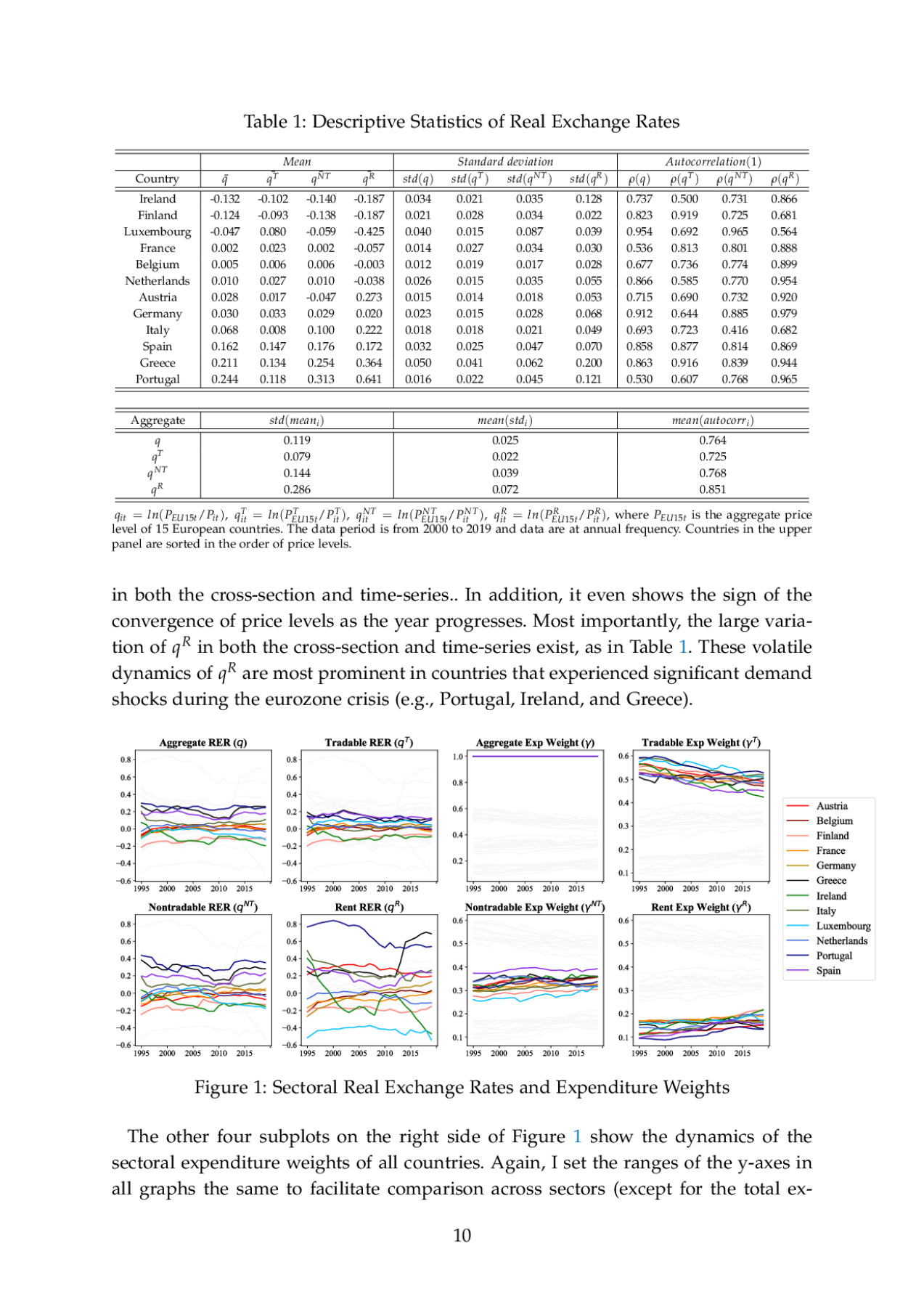

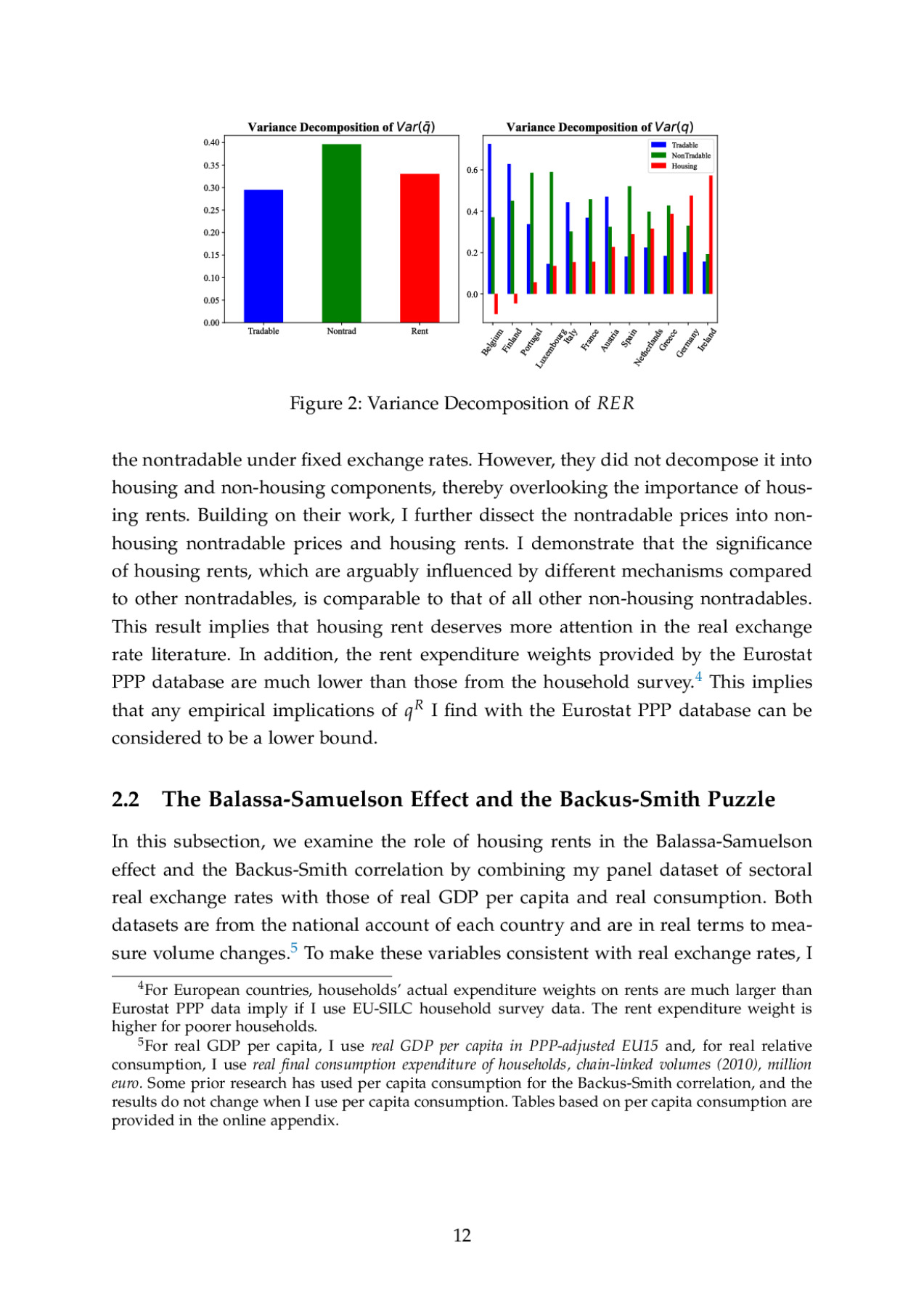

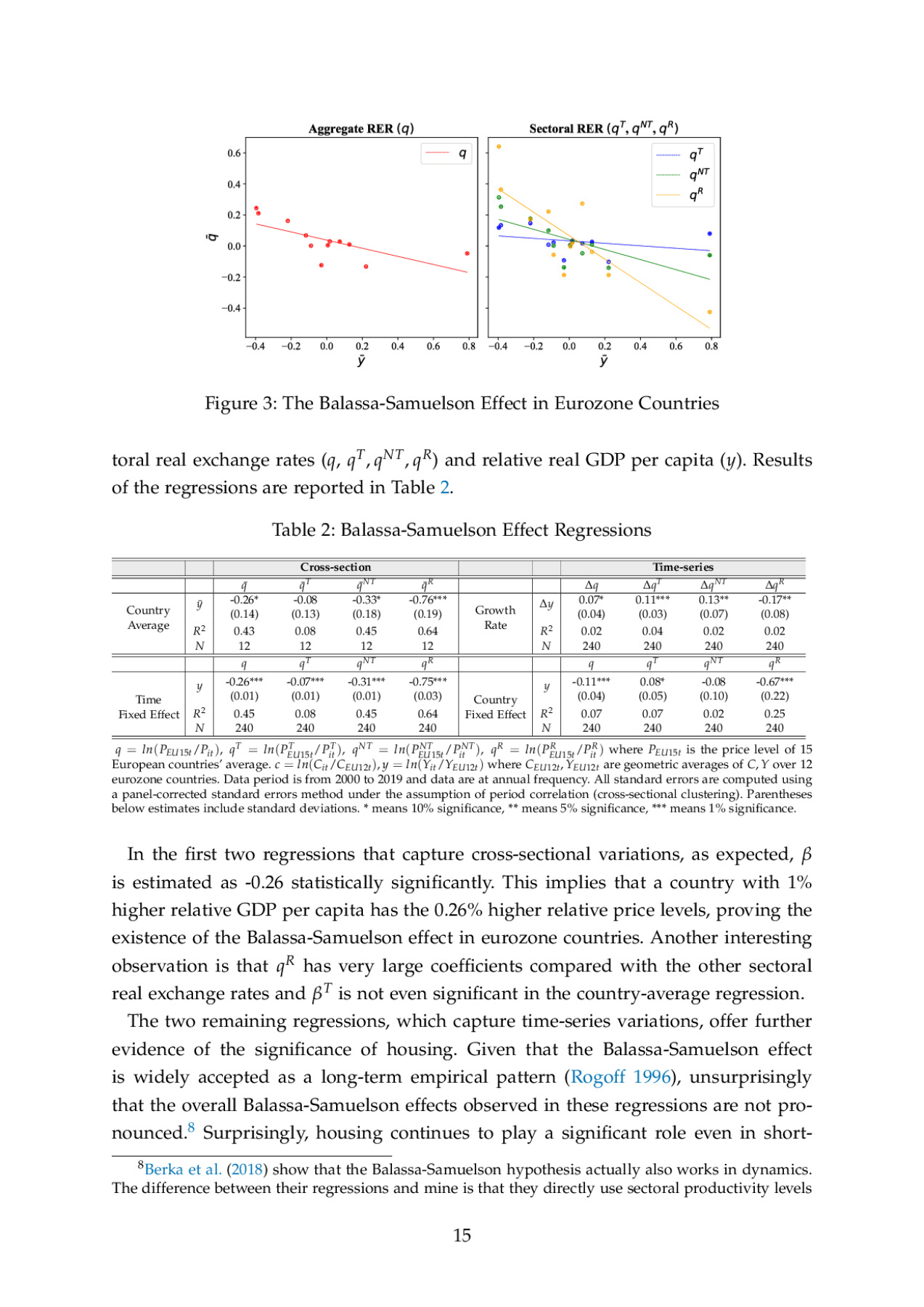

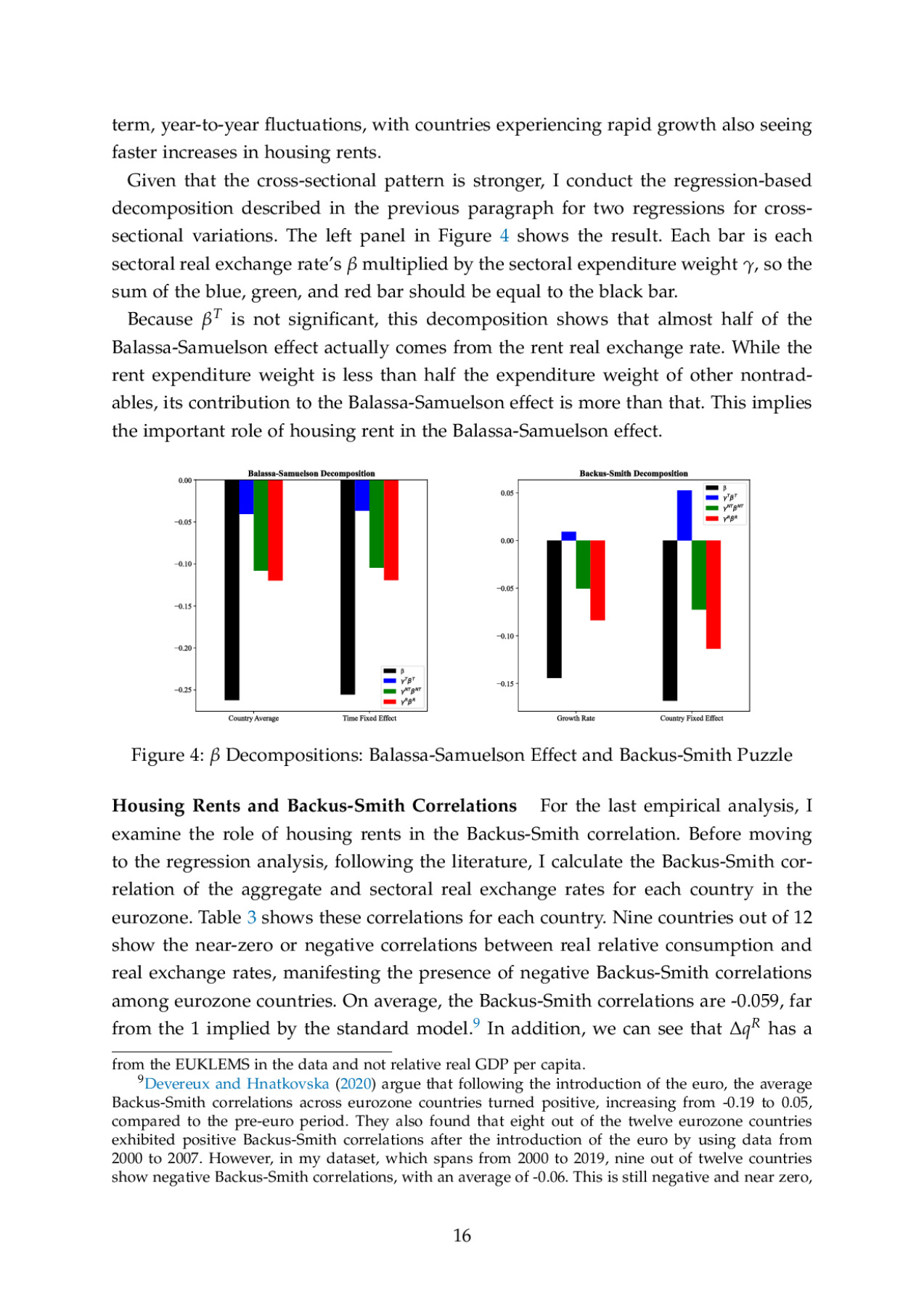

Despite their distinctive features—such as large expenditure shares and inelastic supply—housing services have received scant attention in the international macroeconomics literature. To fill this gap, I examine the role of housing in international business cycles for eurozone countries. I show that housing rents exhibit larger variations than the prices of tradables and other nontradables, both in cross-country and time-series. In addition, among all prices, housing rent stands out as the dominant contributor to both the Balassa-Samuelson effect and the negative Backus-Smith correlation. By simulating eurozone economies using a two-country model with a realistically calibrated housing sector, I show that the cross-country distribution of sectoral productivities, inelastic housing supply, and its interaction with the wealth effect via incomplete markets are crucial to understanding the empirical moments of real exchange rates. Compared with the standard model, the model with the housing sector generates larger real exchange rate variations, a more substantial Balassa-Samuelson effect, and more realistic Backus-Smith correlations.

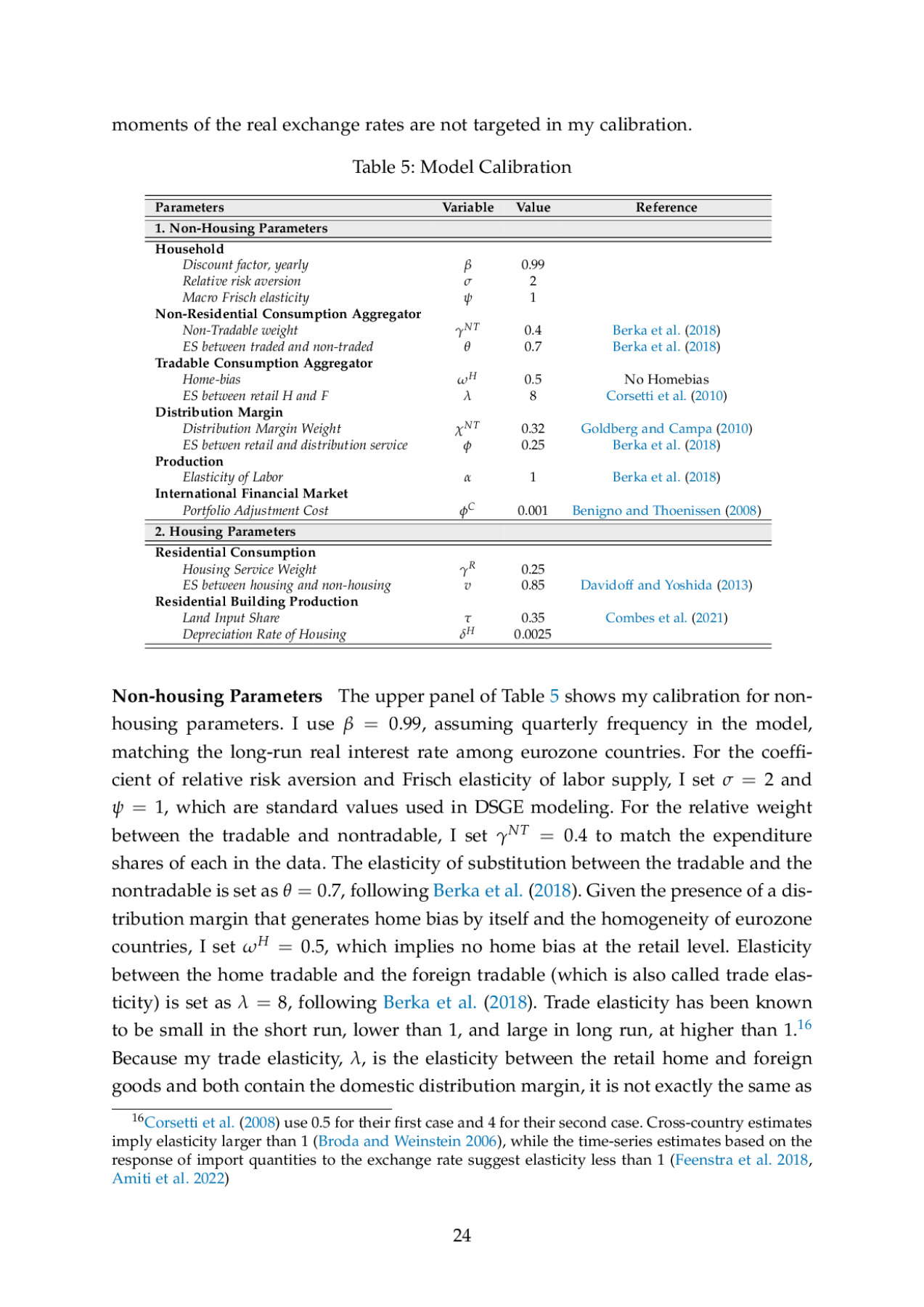

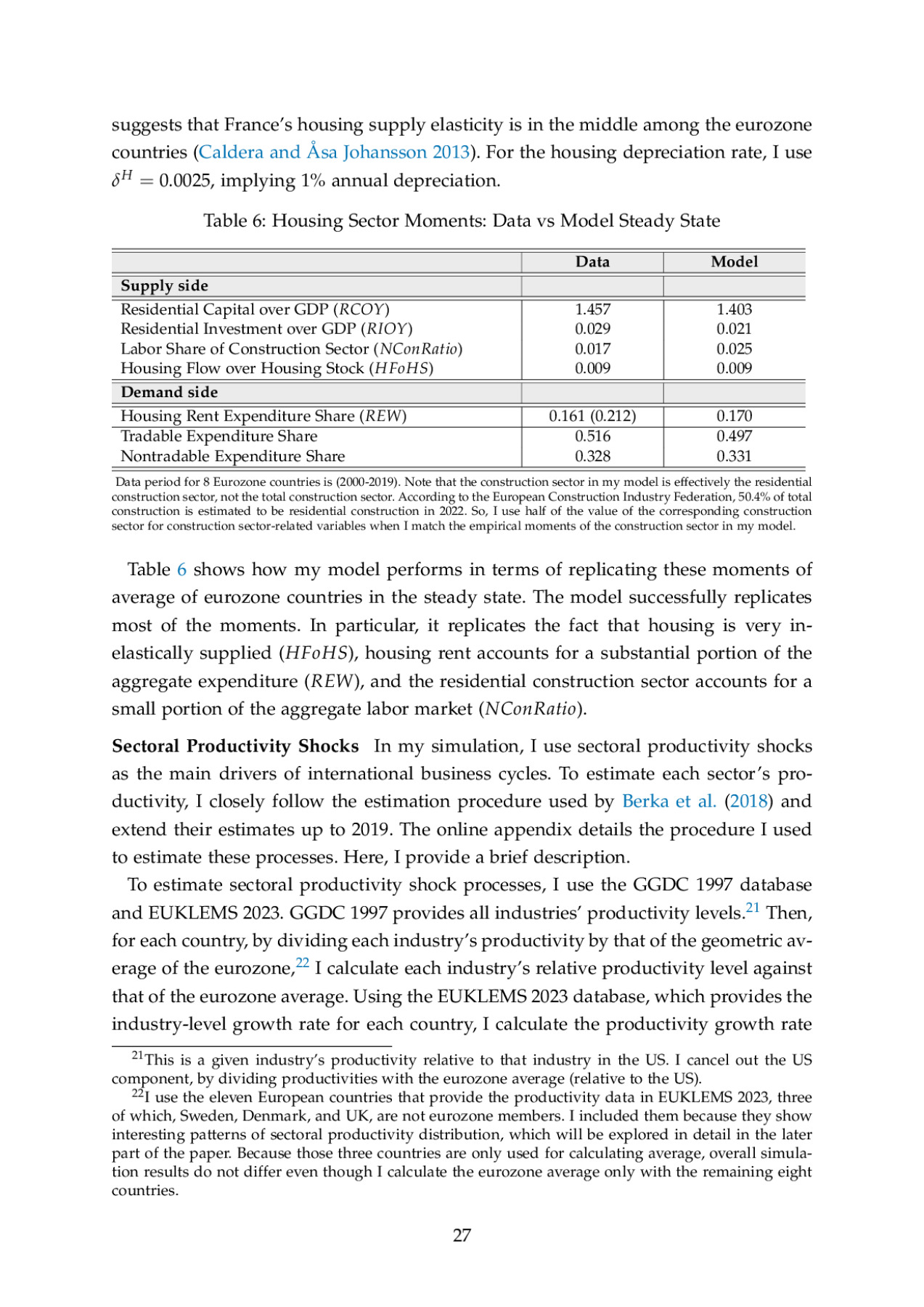

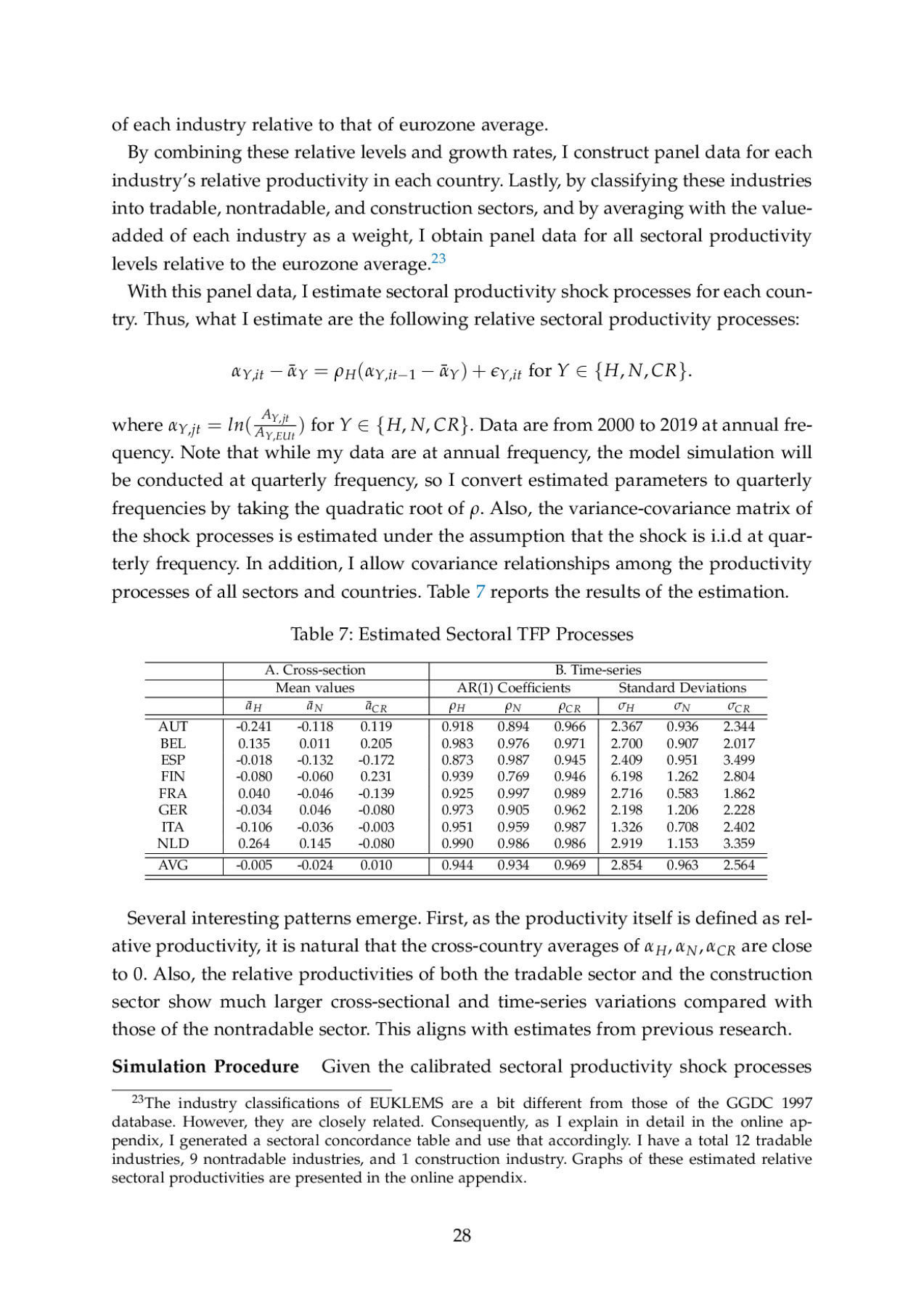

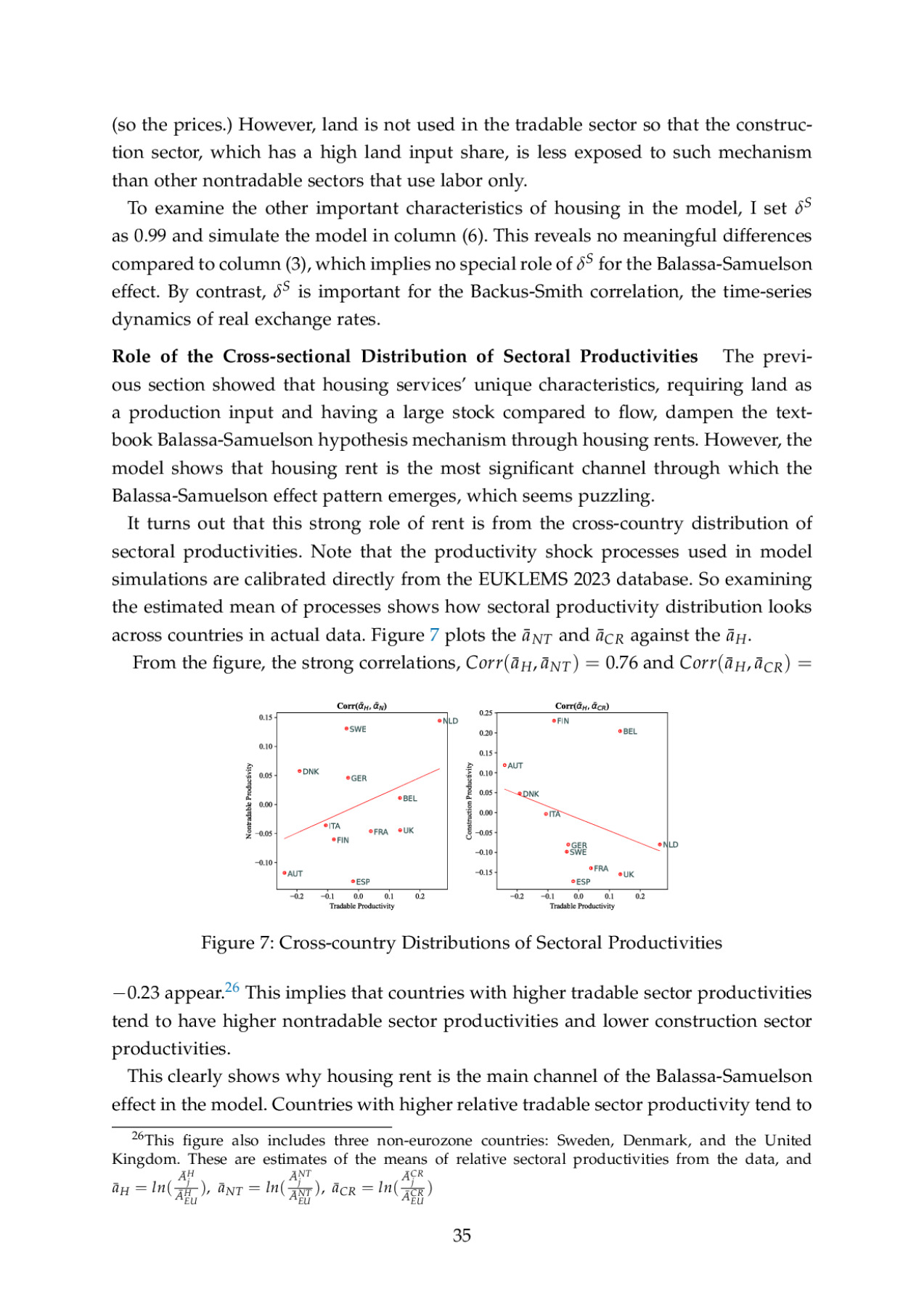

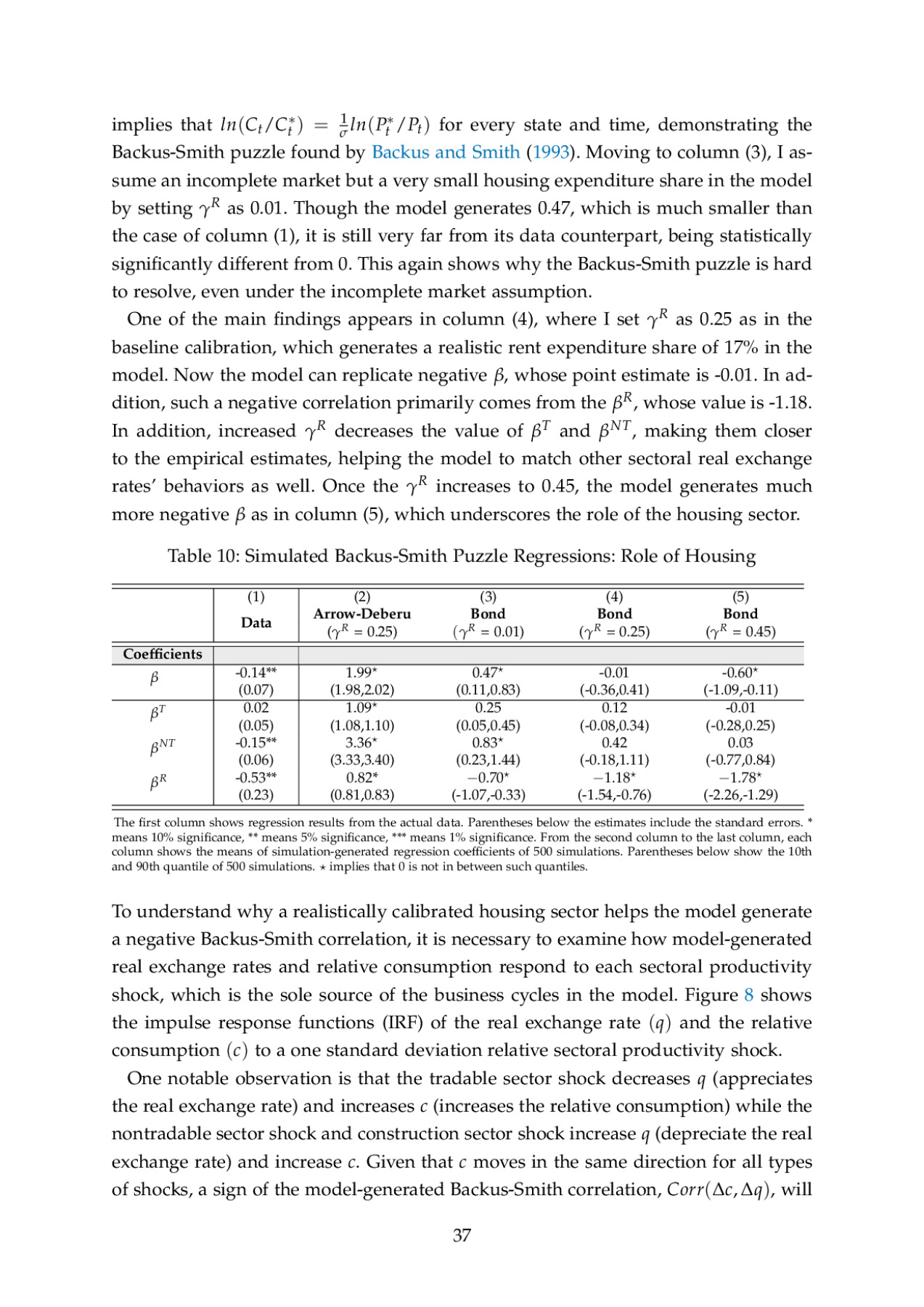

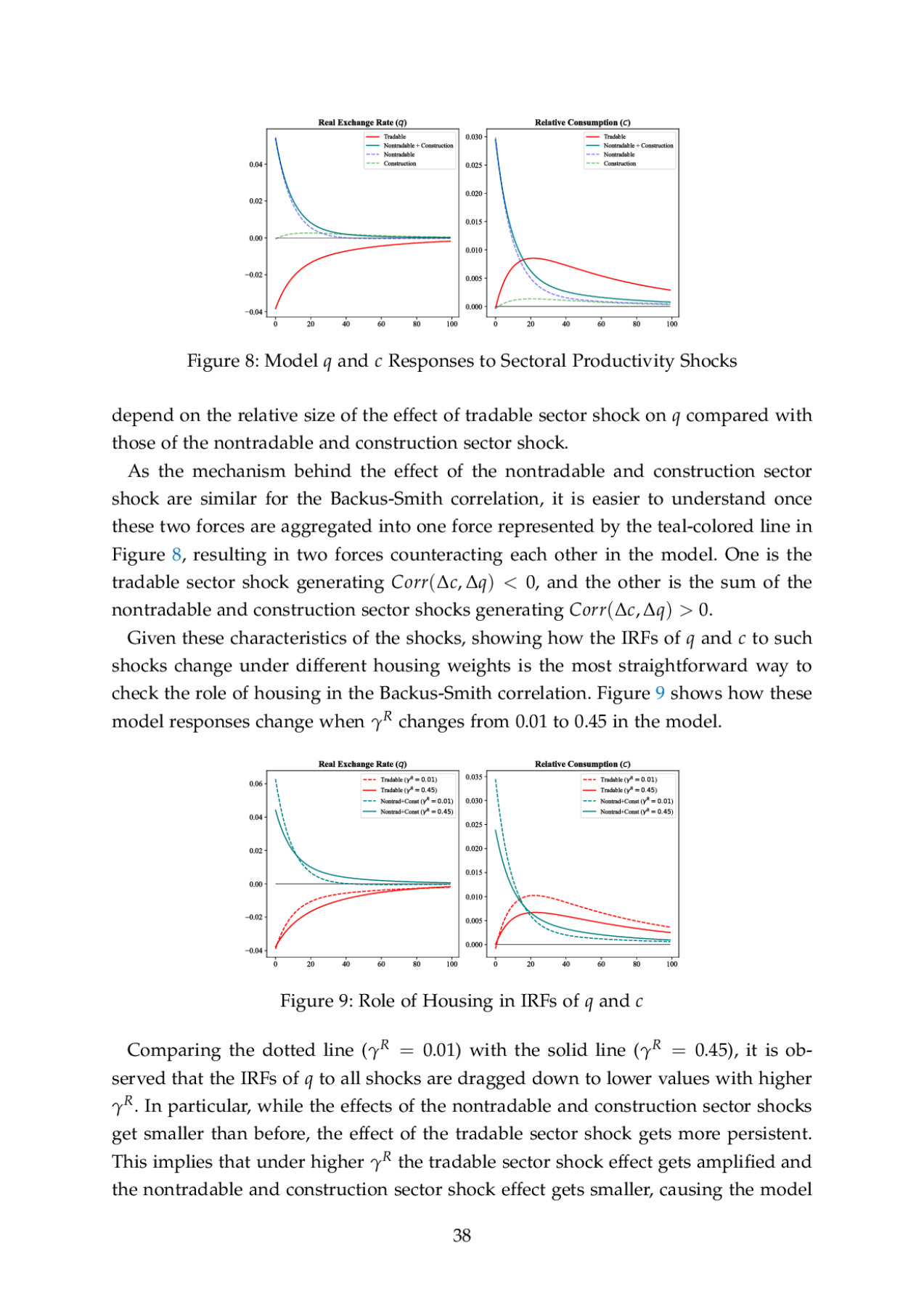

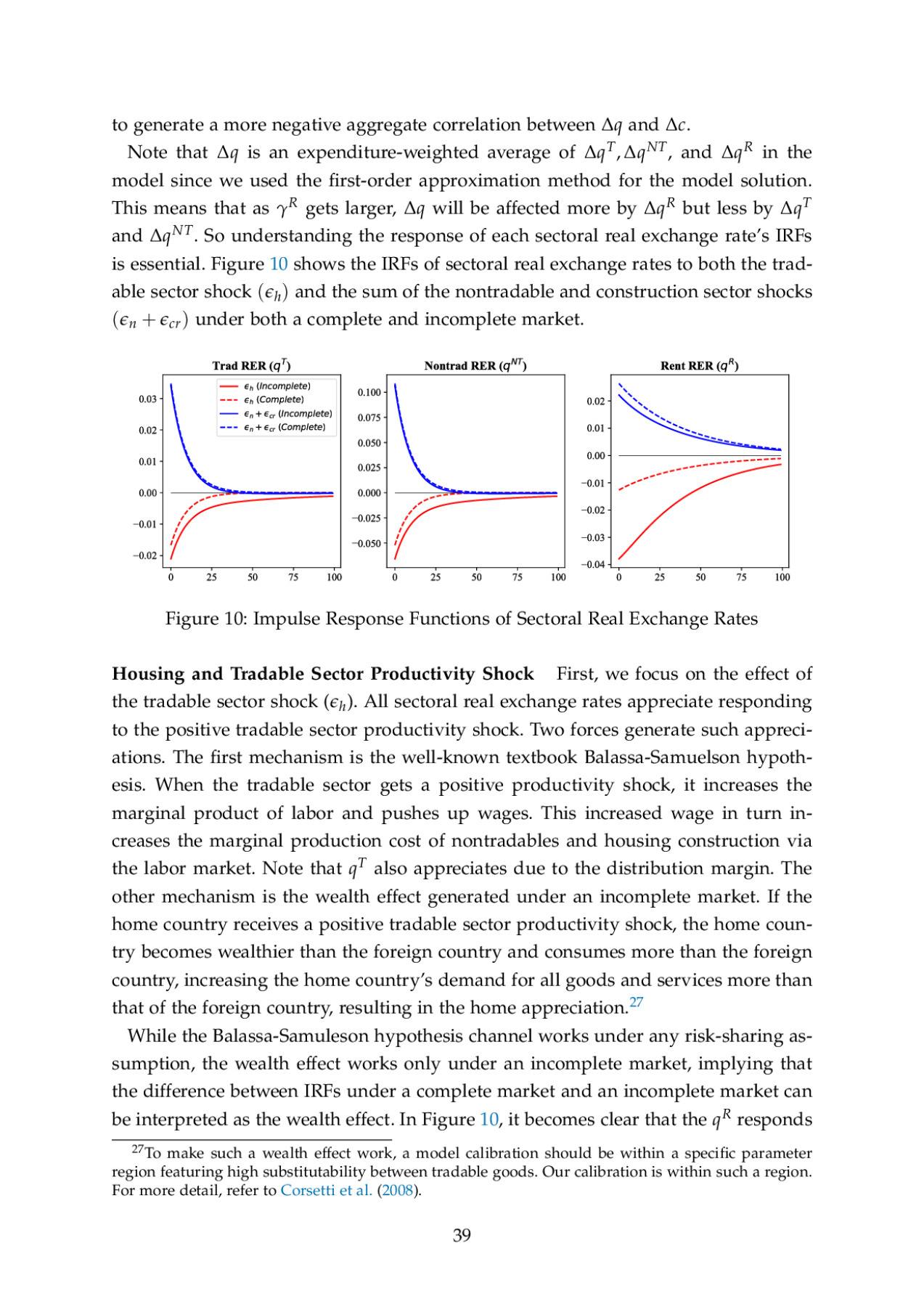

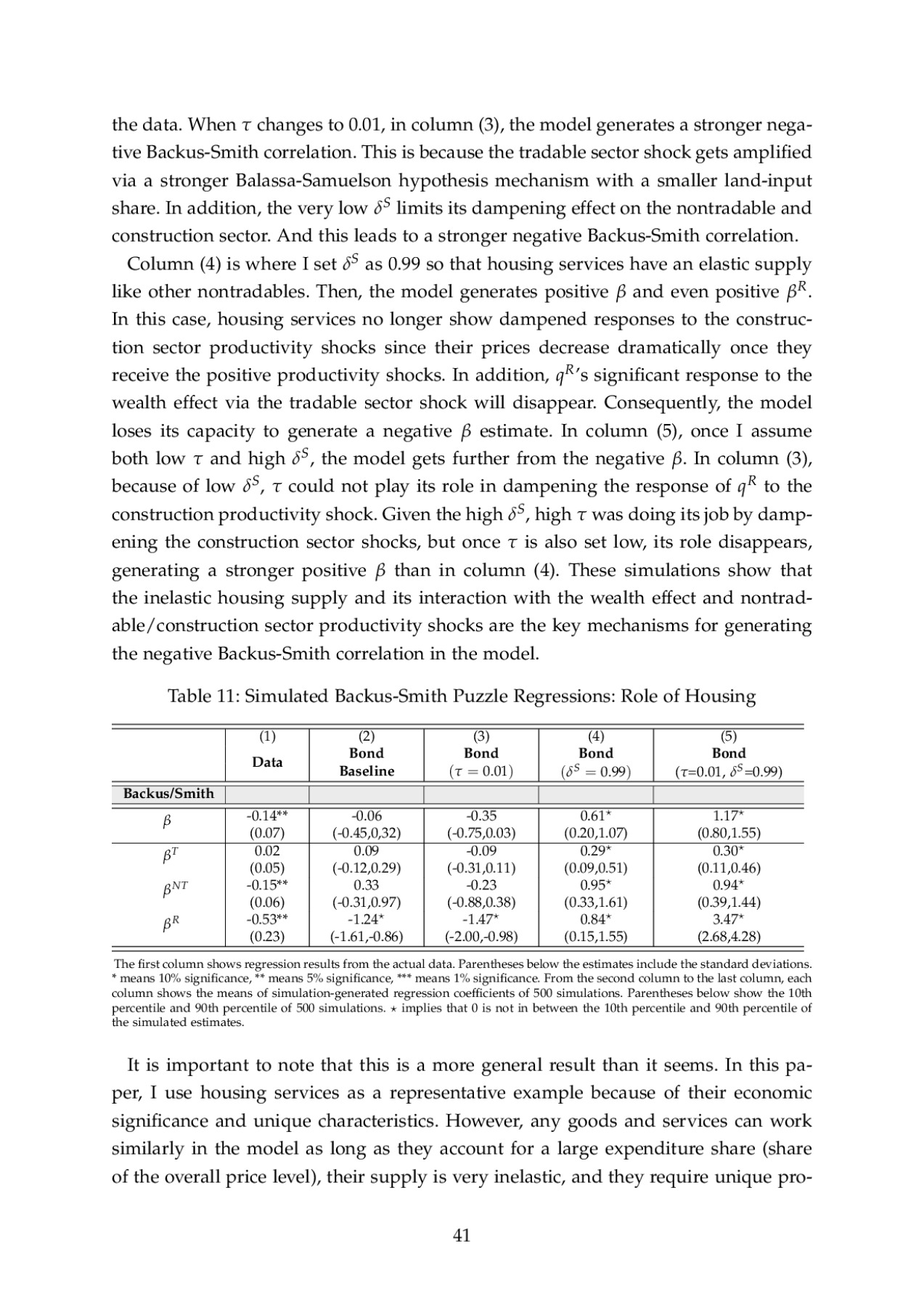

Preview