2024 North American Summer Meeting: June, 2024

Credit Rationing in Unsecured Debt Markets

V. Filipe Martins-da-Rocha, Toan Phan, Yiannis Vailakis

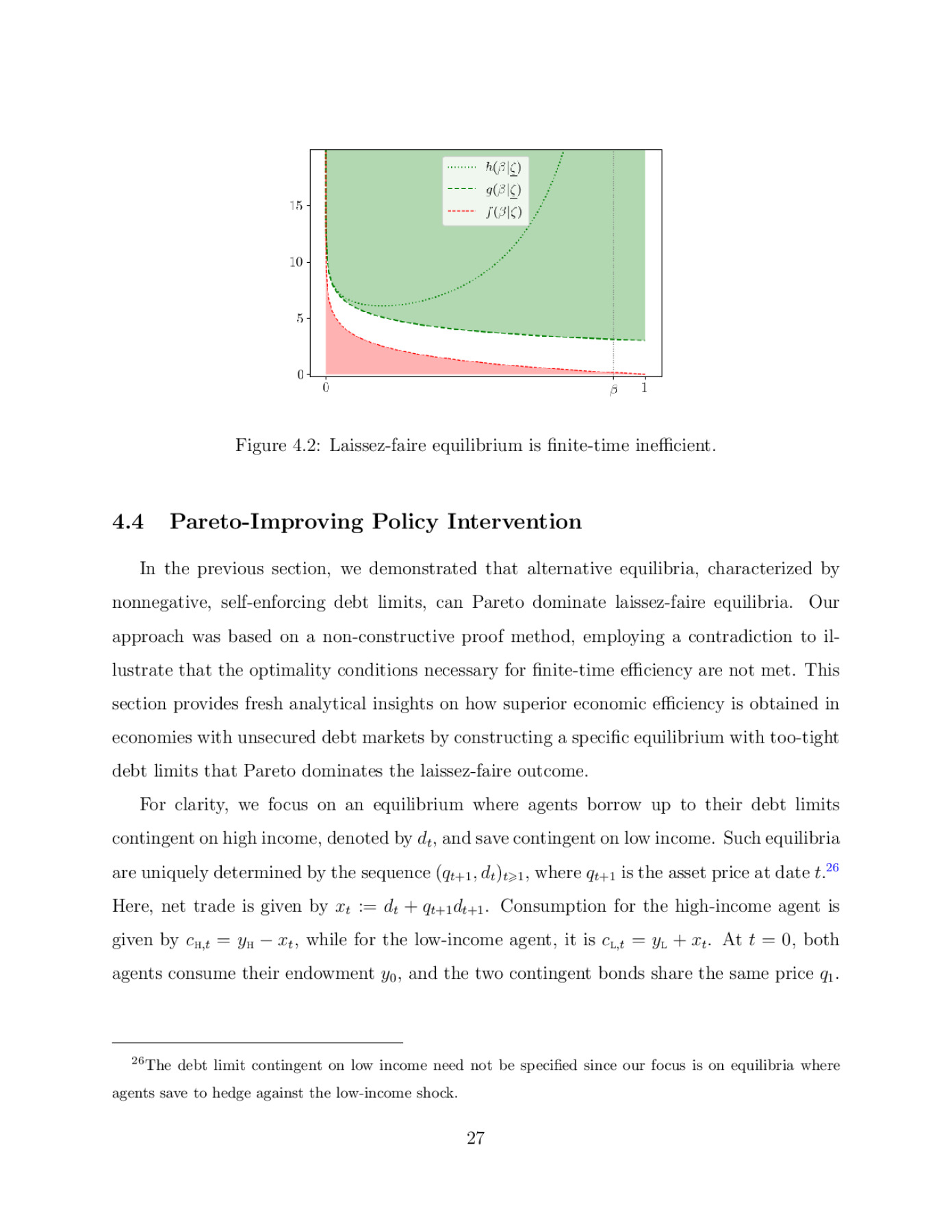

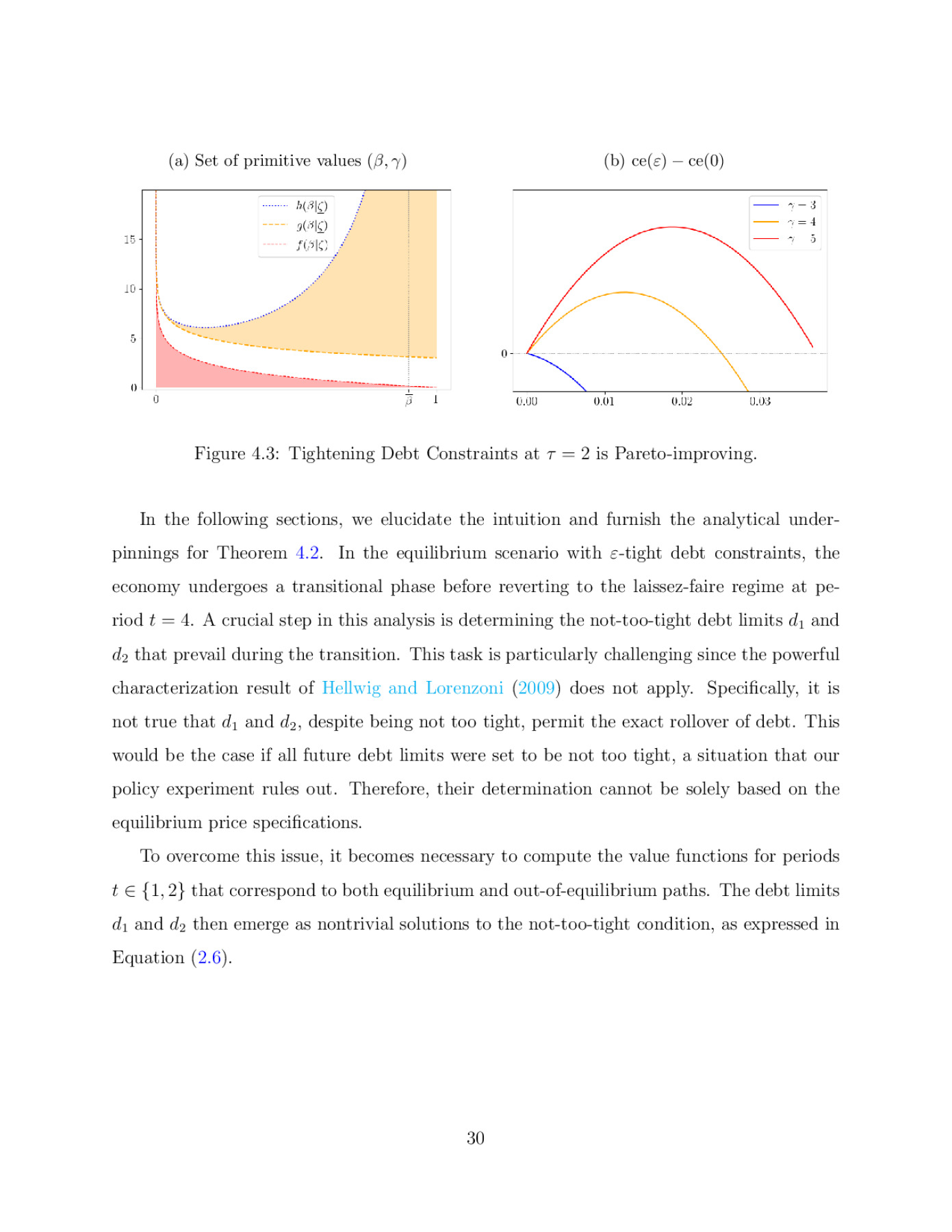

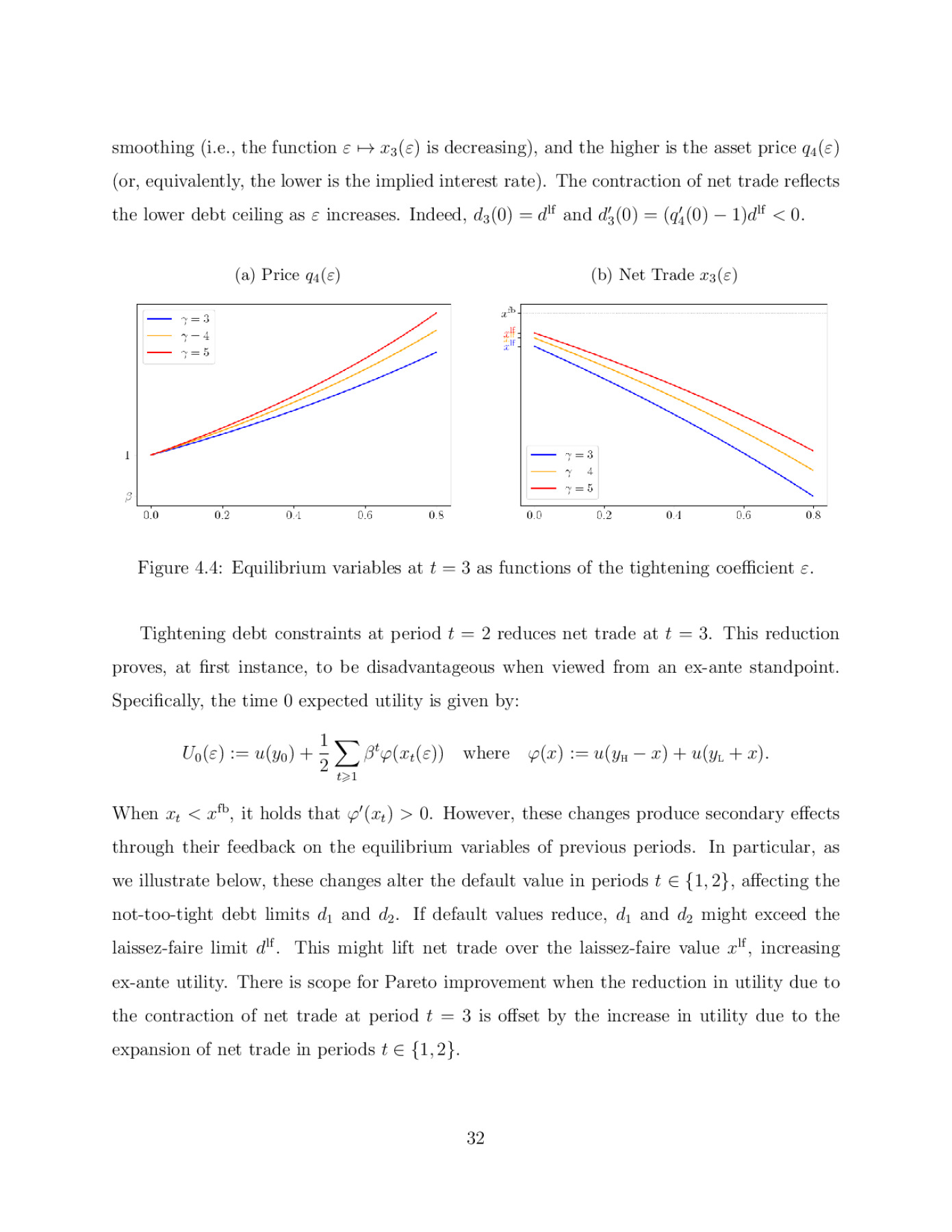

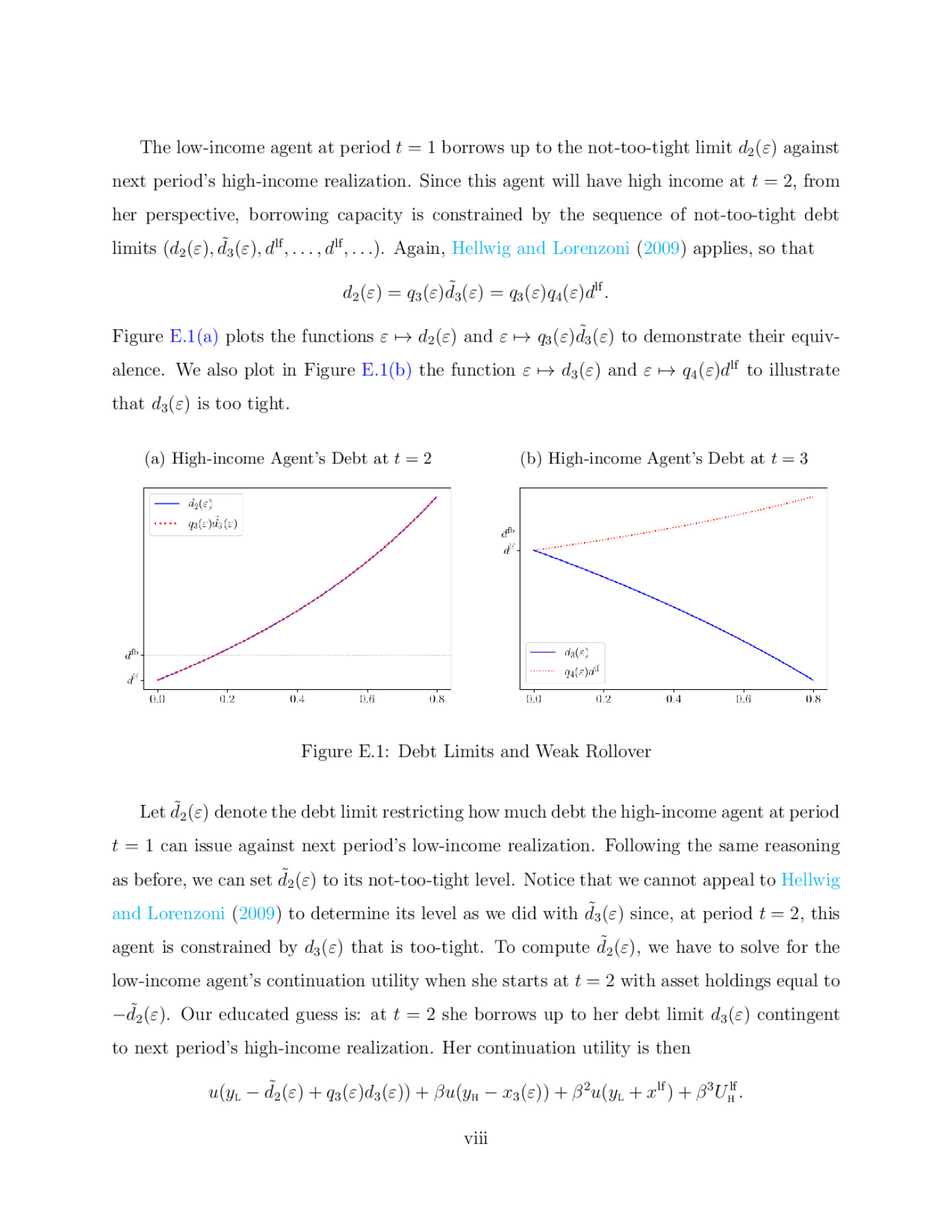

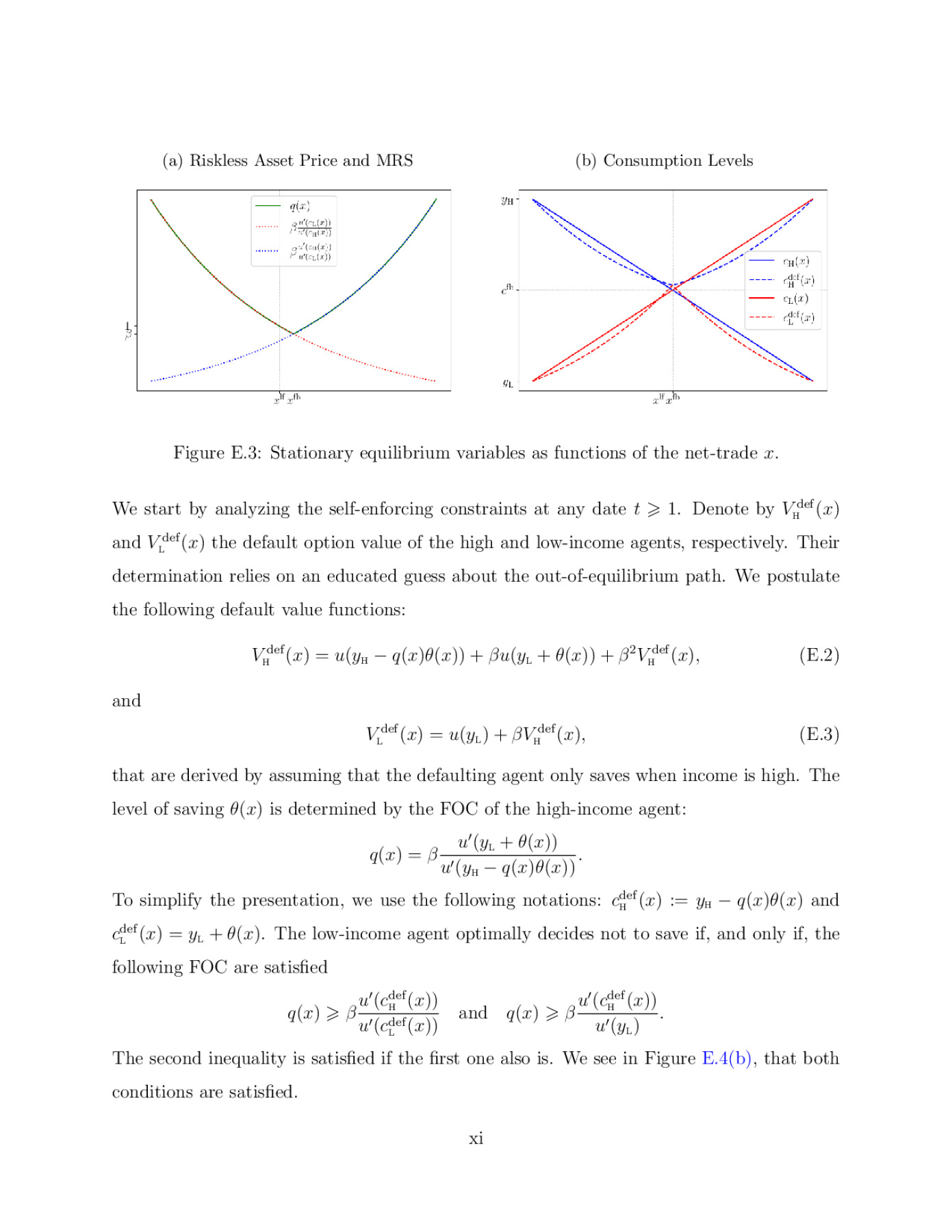

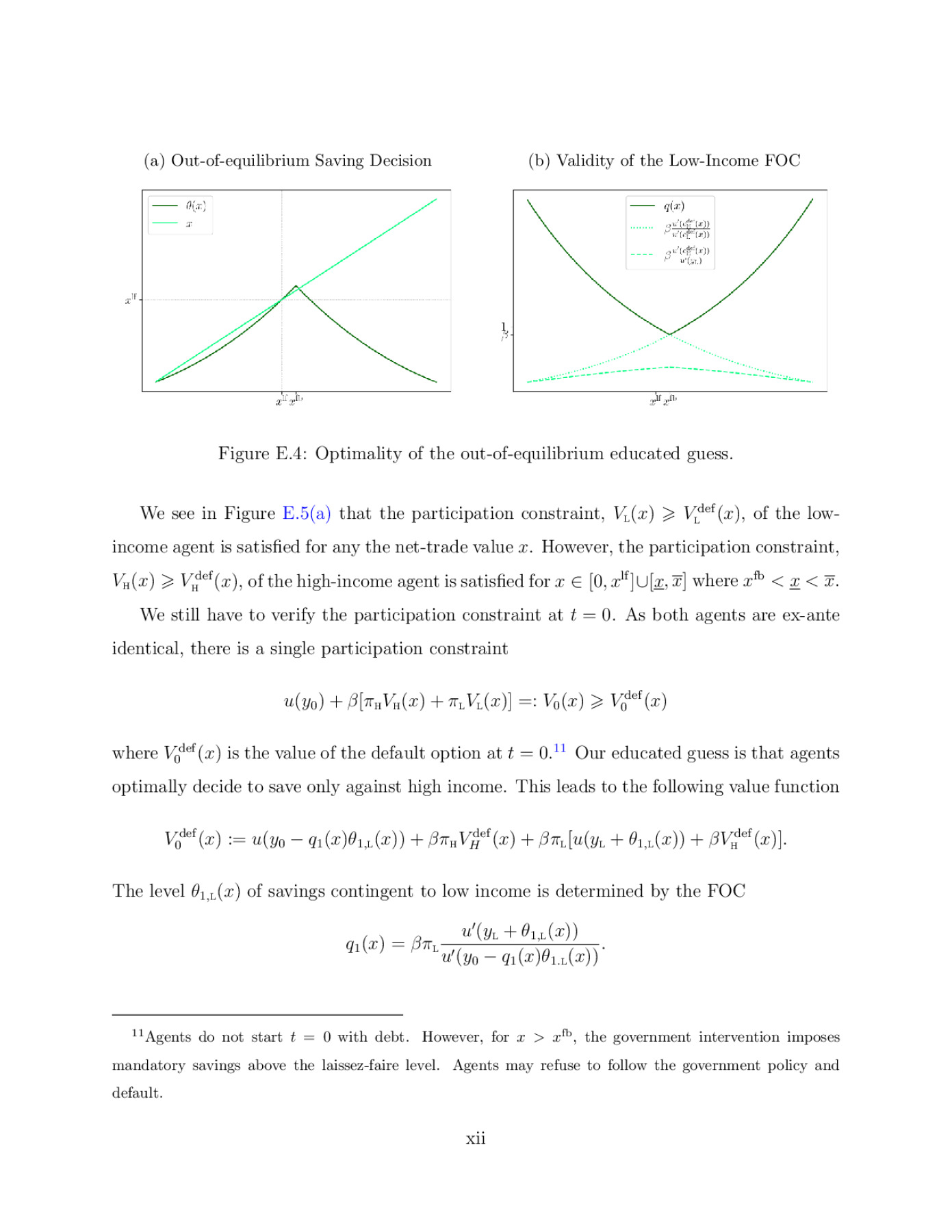

We revisit the welfare properties of competitive credit markets with endogenous debt limits that arise from limited commitment. We introduce a novel concept of constrained efficiency to encompass economies where market interest rates influence default values and participation constraints. We explore this concept through a baseline economy featuring heterogeneous agents with cyclical endowments. The analysis shows that the efficiency of market equilibria and welfare outcomes are sensitive to the nature of default punishments. It suggests that laissez-faire debt limits, while supportive of risk-sharing, might not always optimize welfare. The study illustrates how credit rationing—tightening future debt limits—can enhance current risk-sharing and overall welfare. This occurs because such interventions influence market interest rates and the default option’s value, thereby affecting agents’ present consumption and saving choices, and enabling a more efficient allocation of resources.

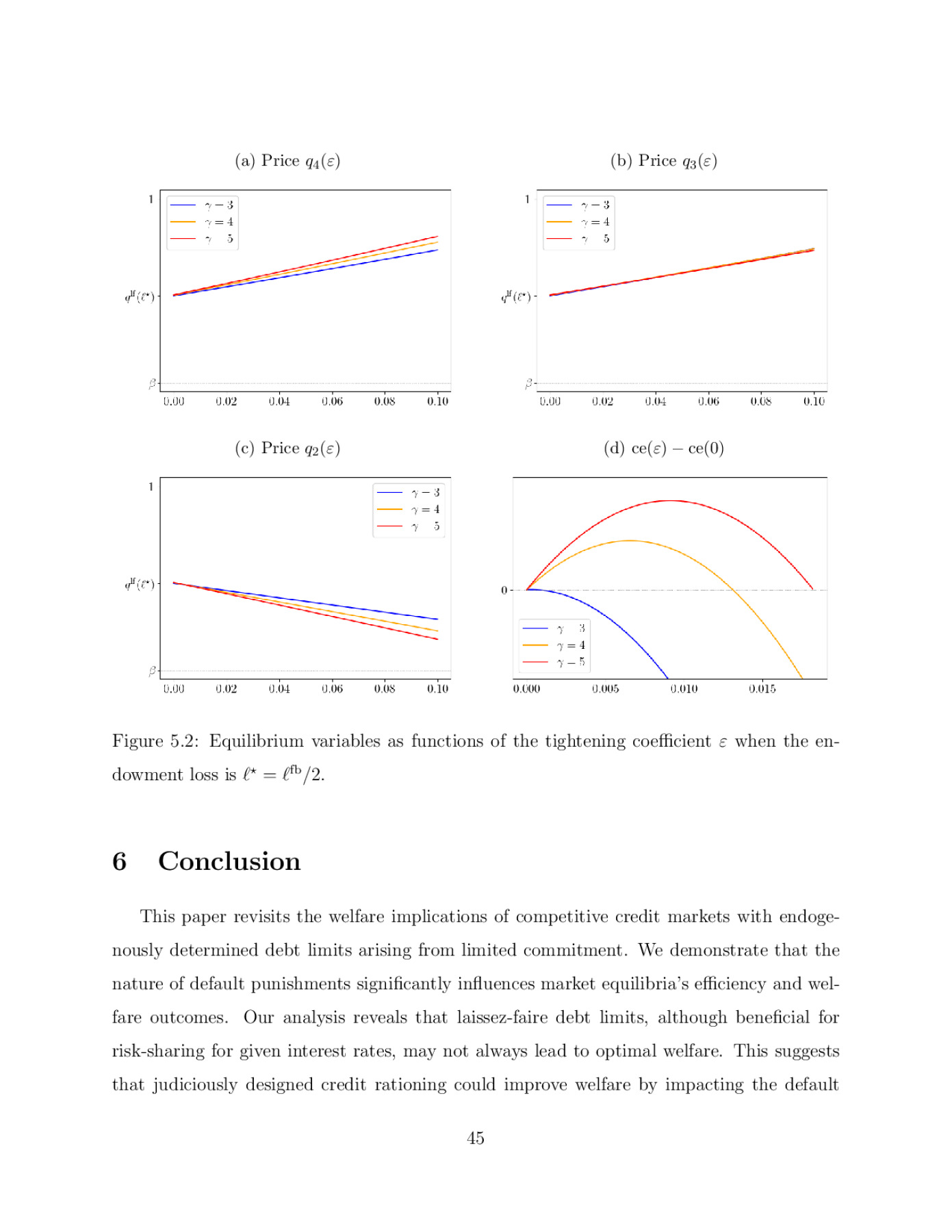

Preview