2024 European Winter Meeting, Palma de Majorca, Spain: December, 2024

Risk for Price: Using Generalized Demand System for Asset Pricing

Yu Li

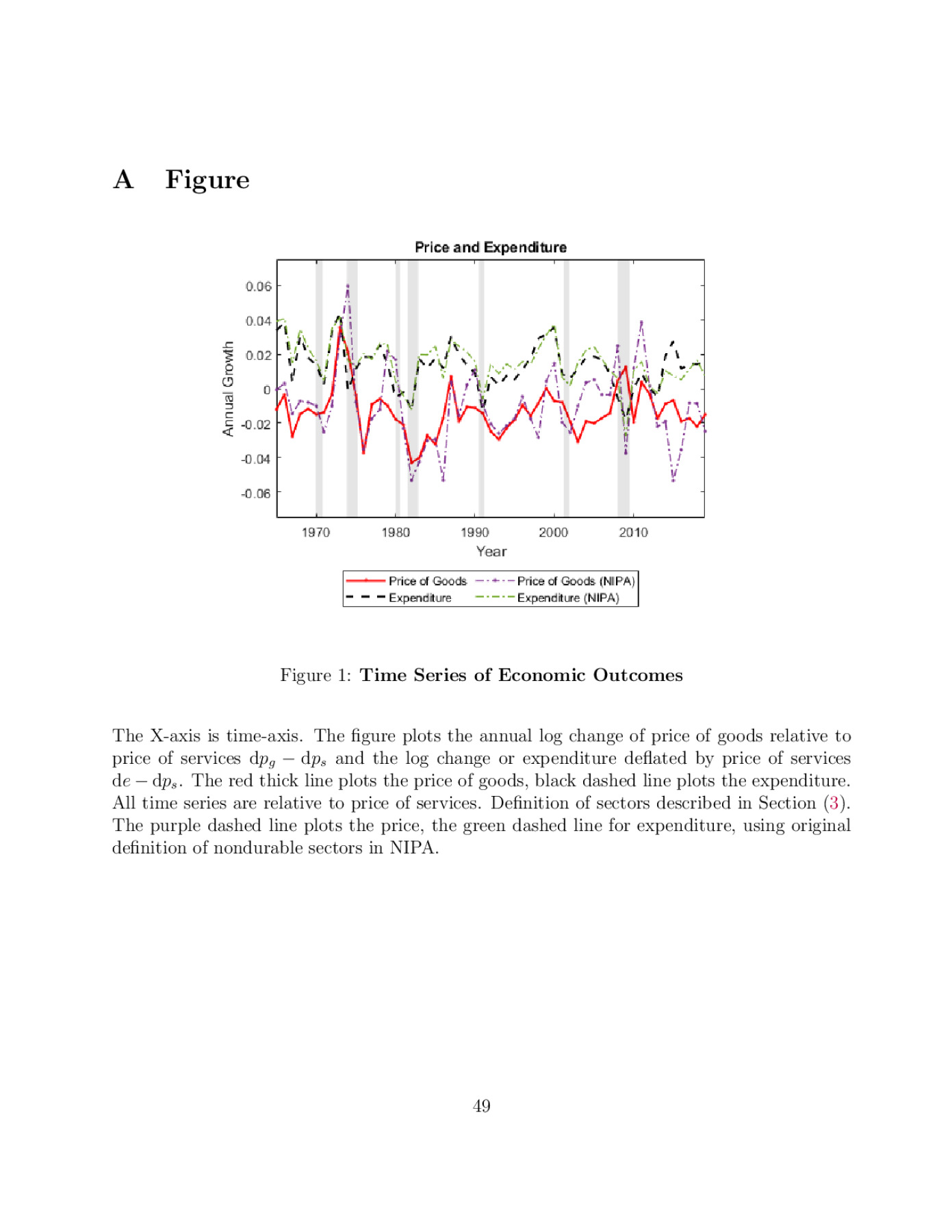

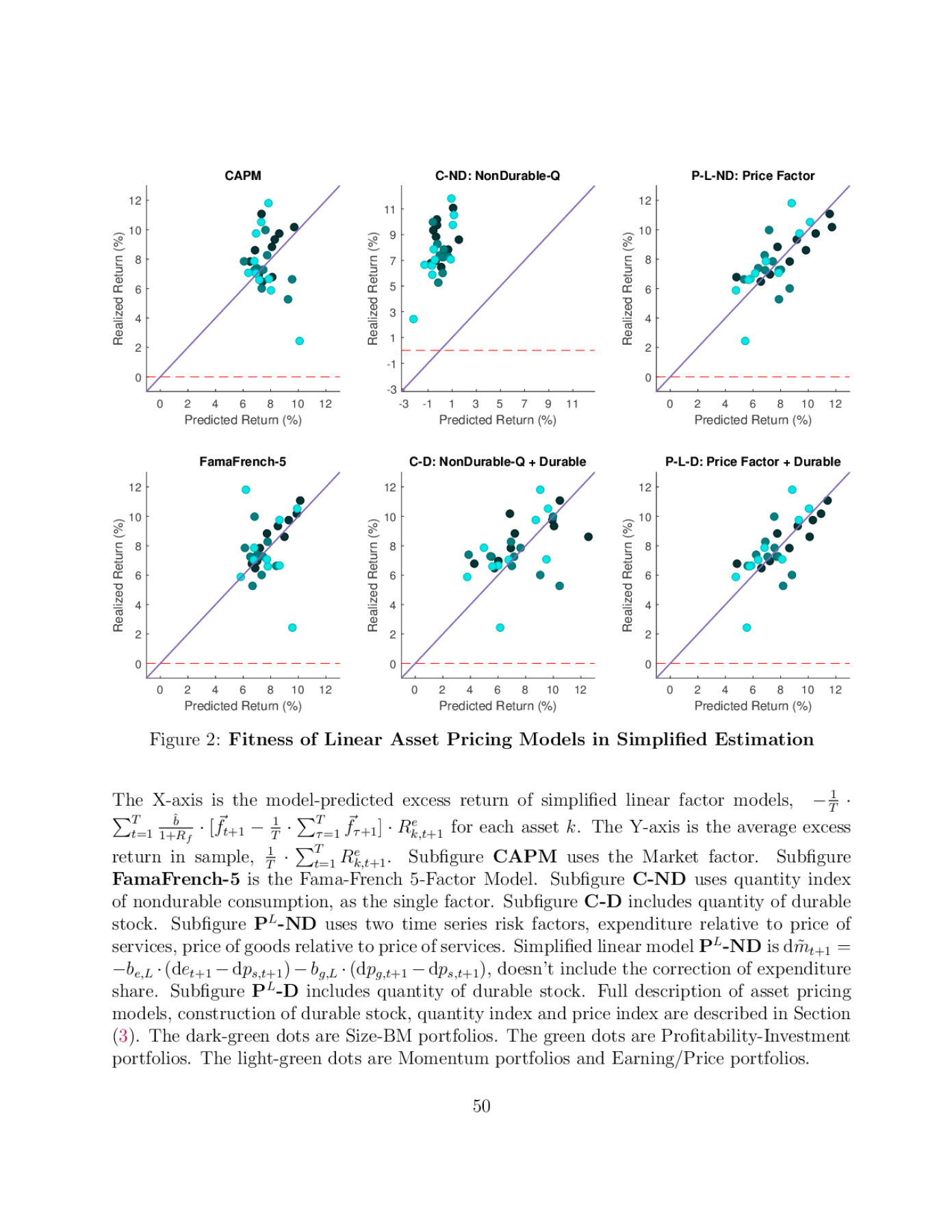

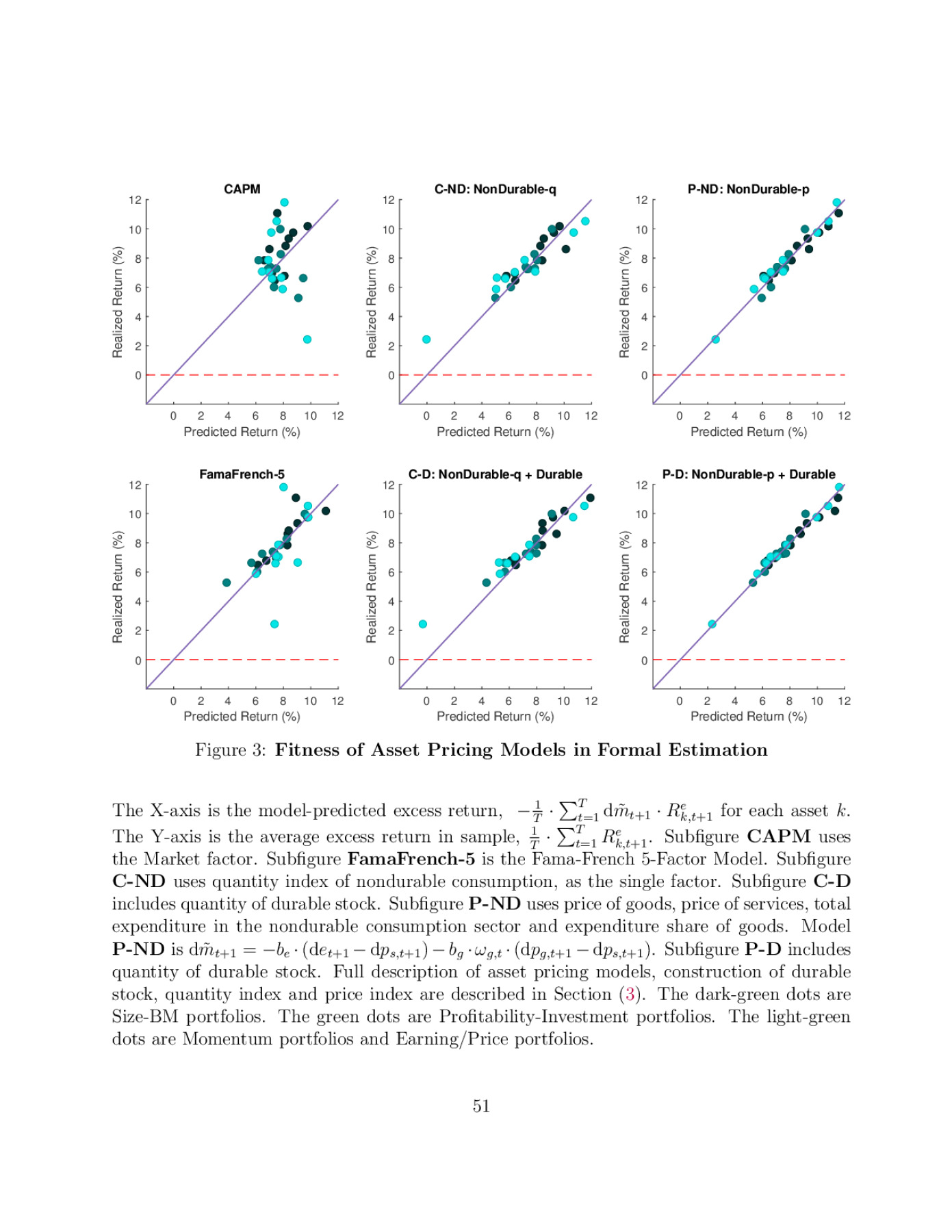

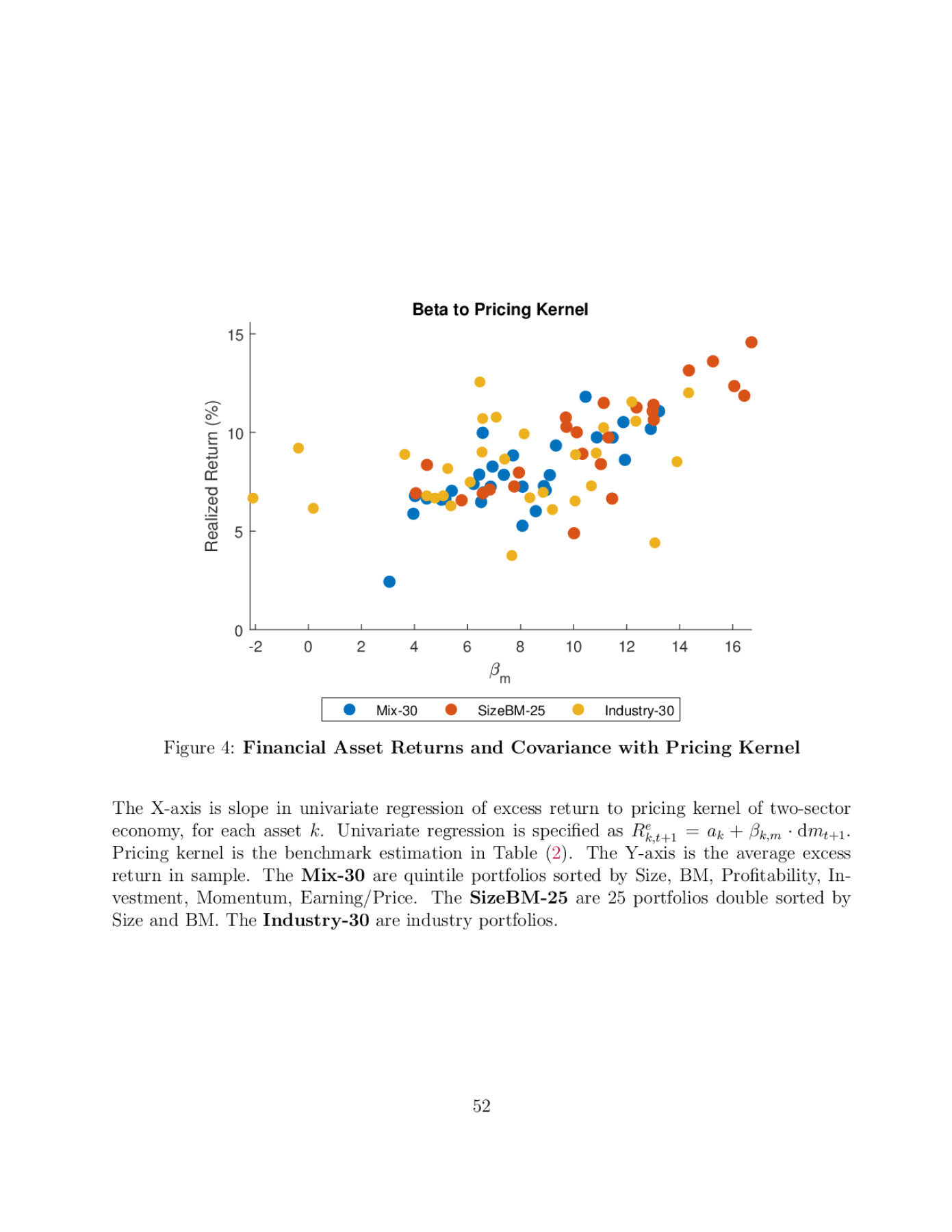

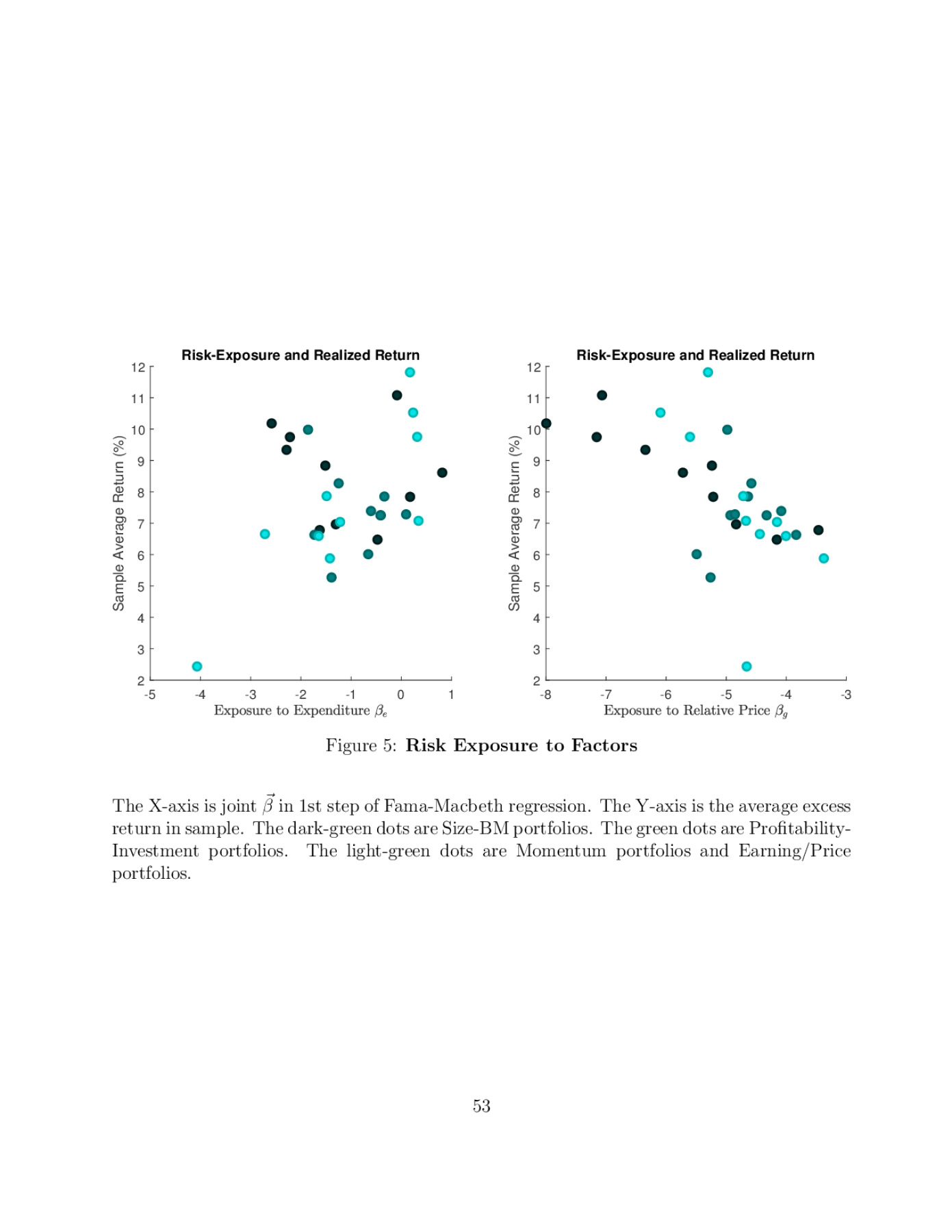

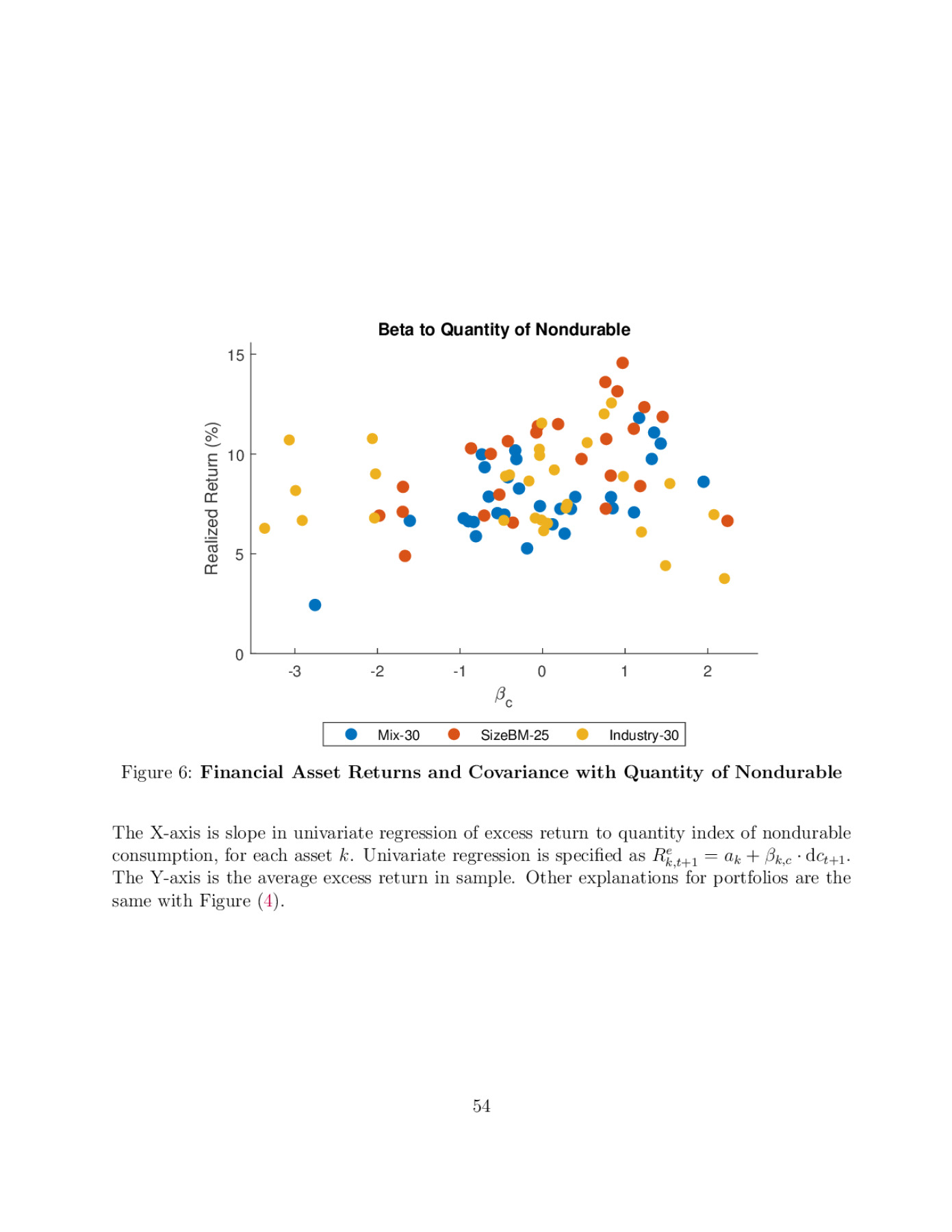

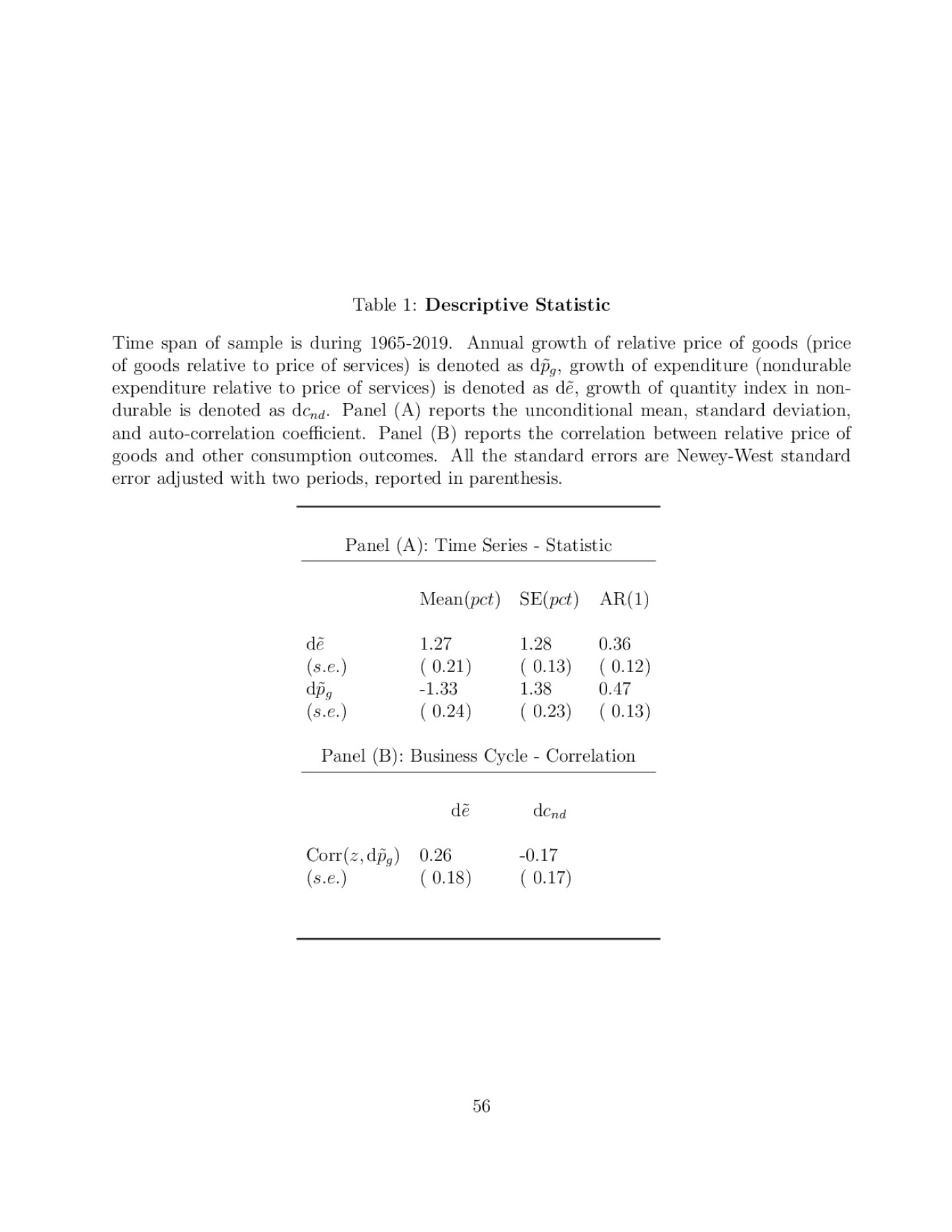

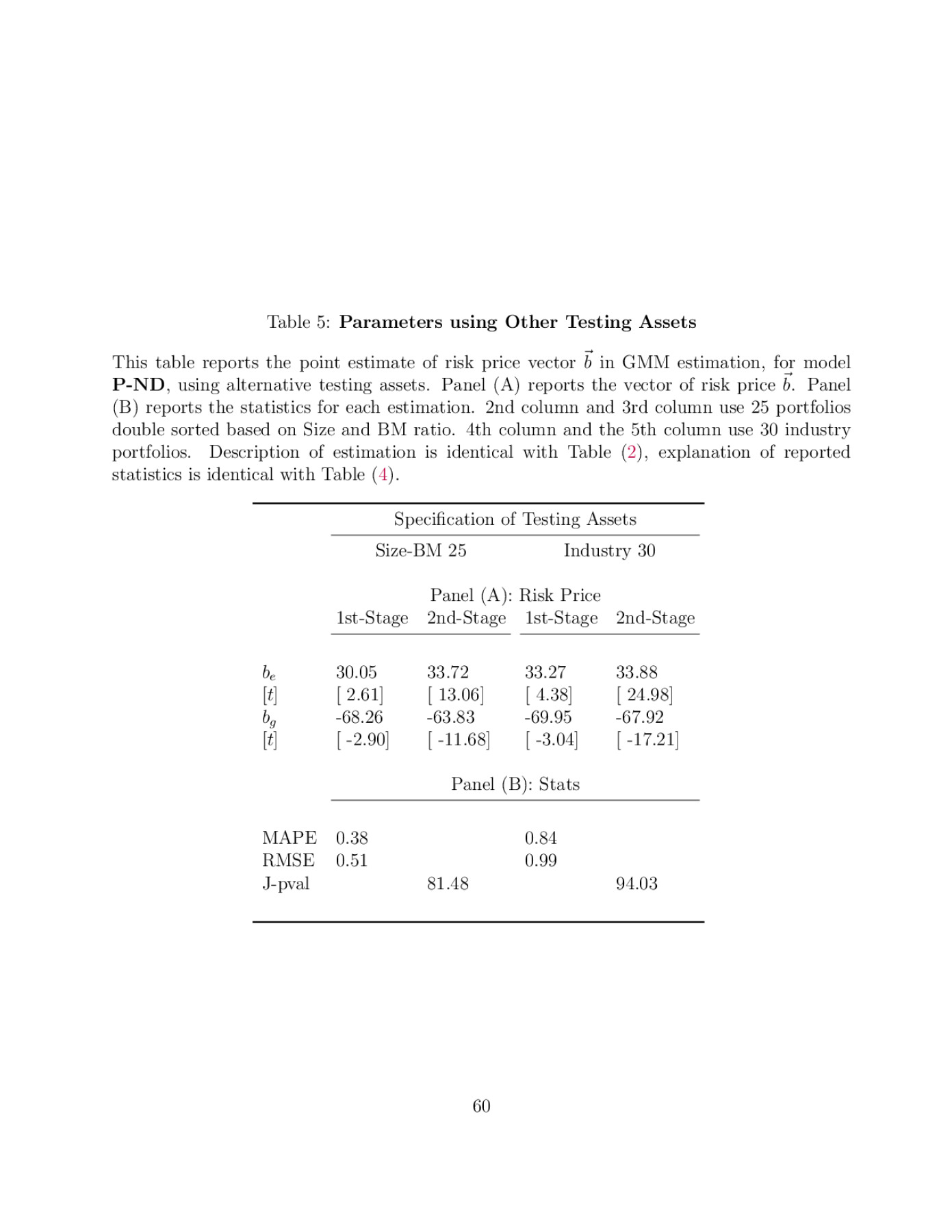

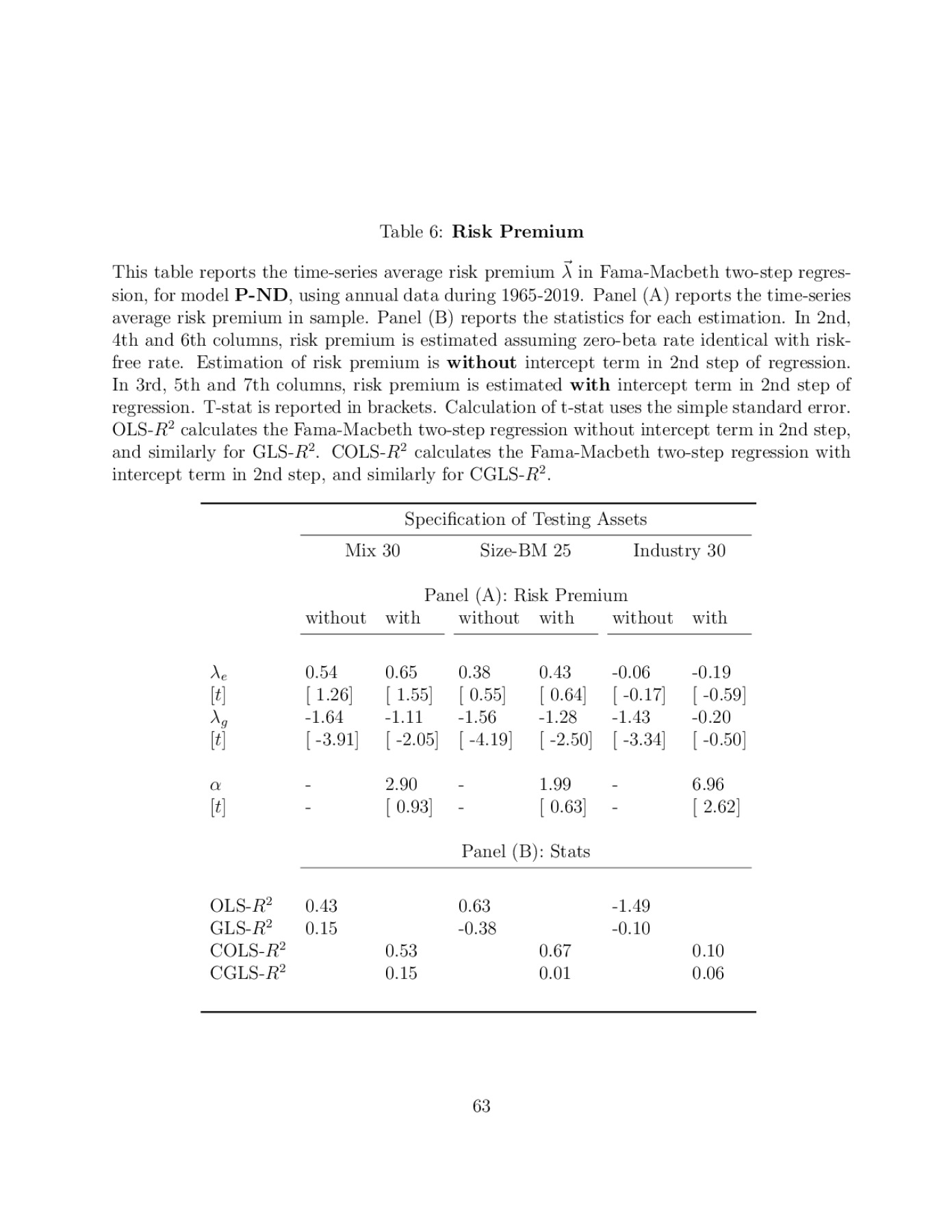

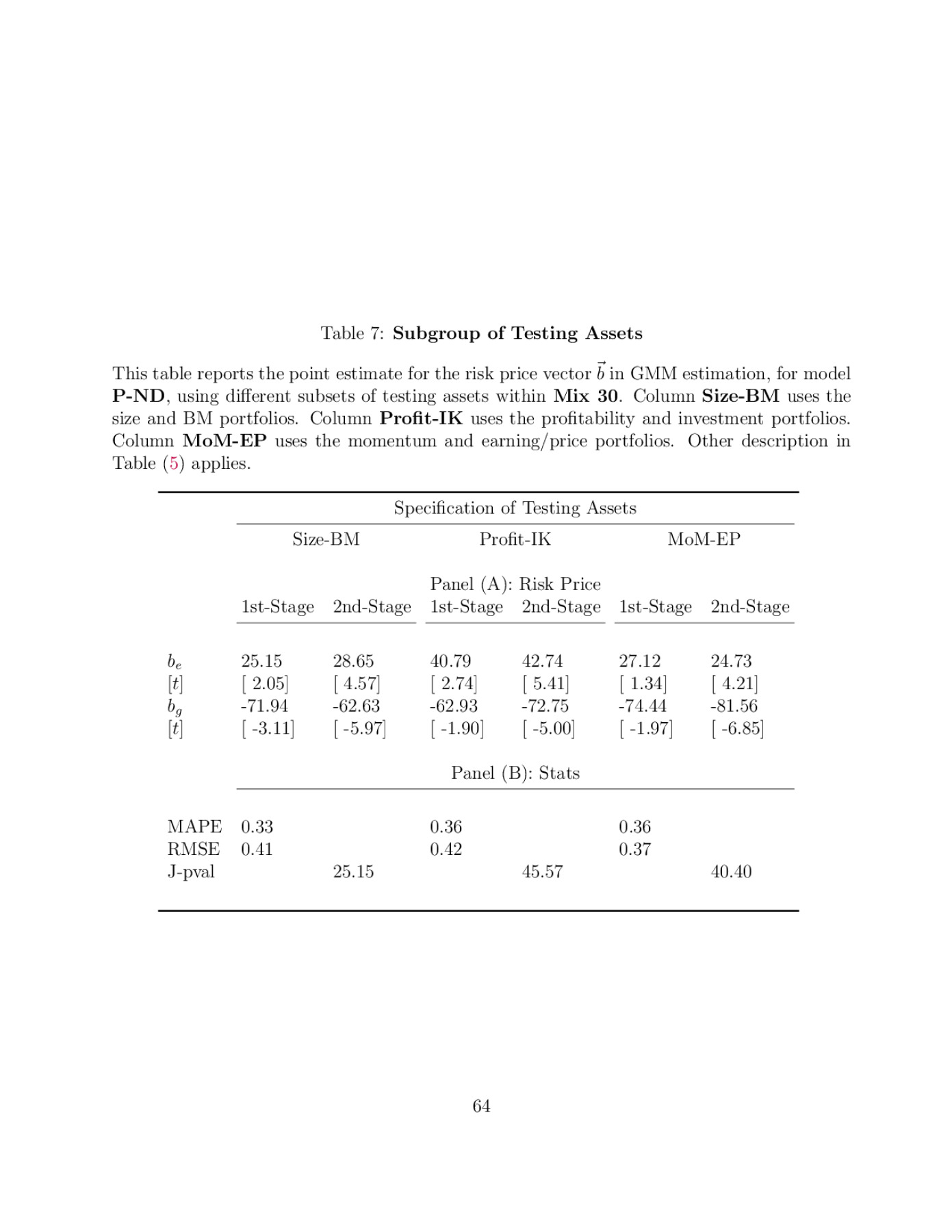

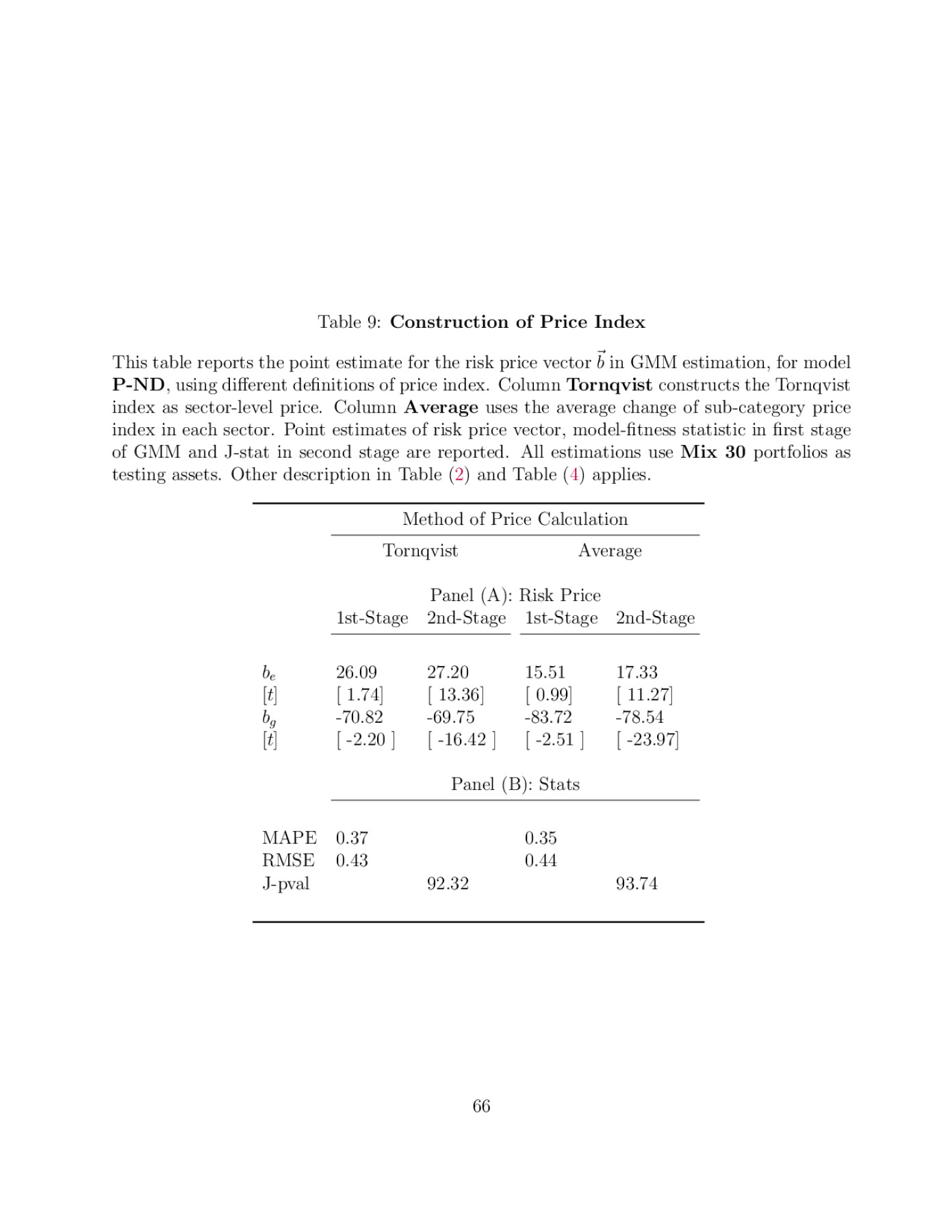

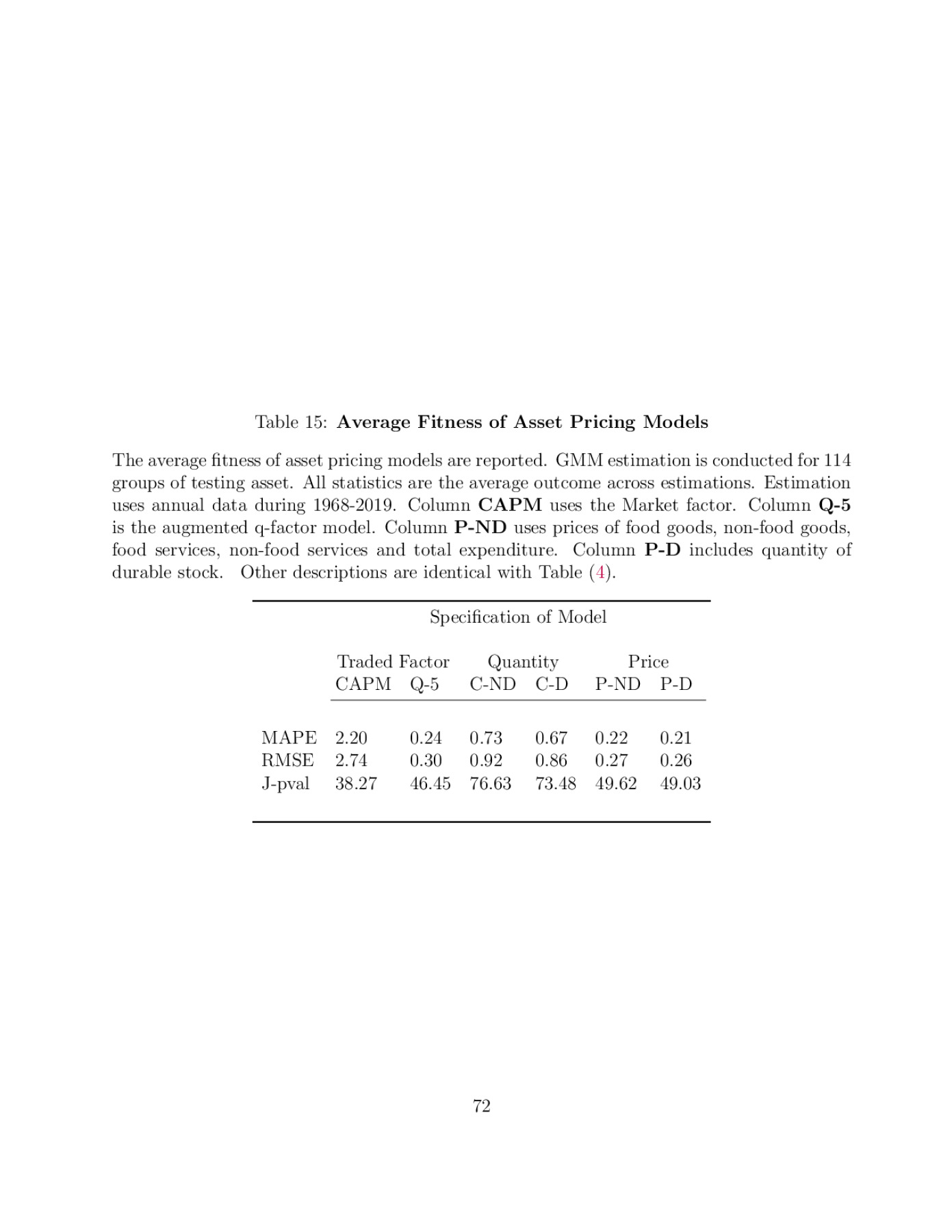

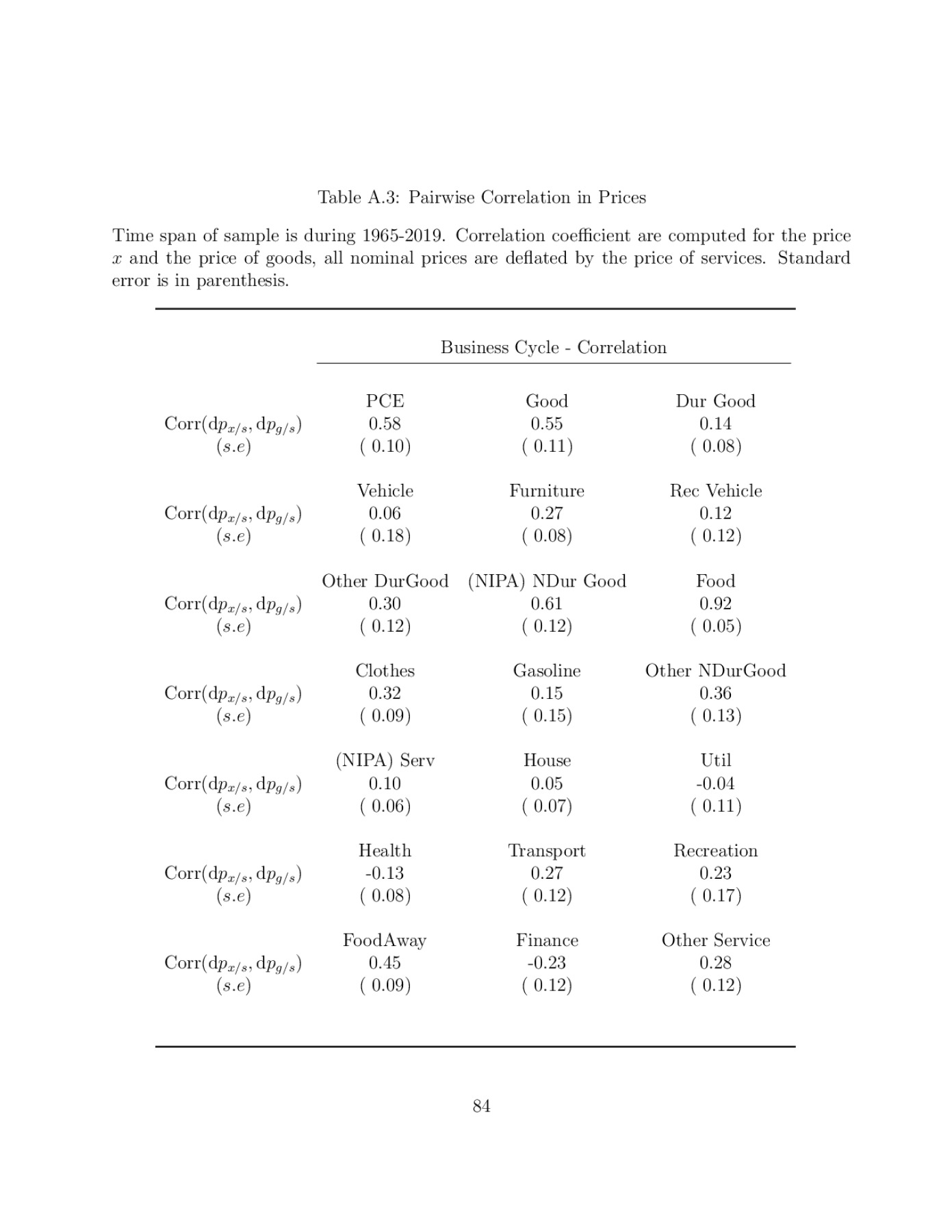

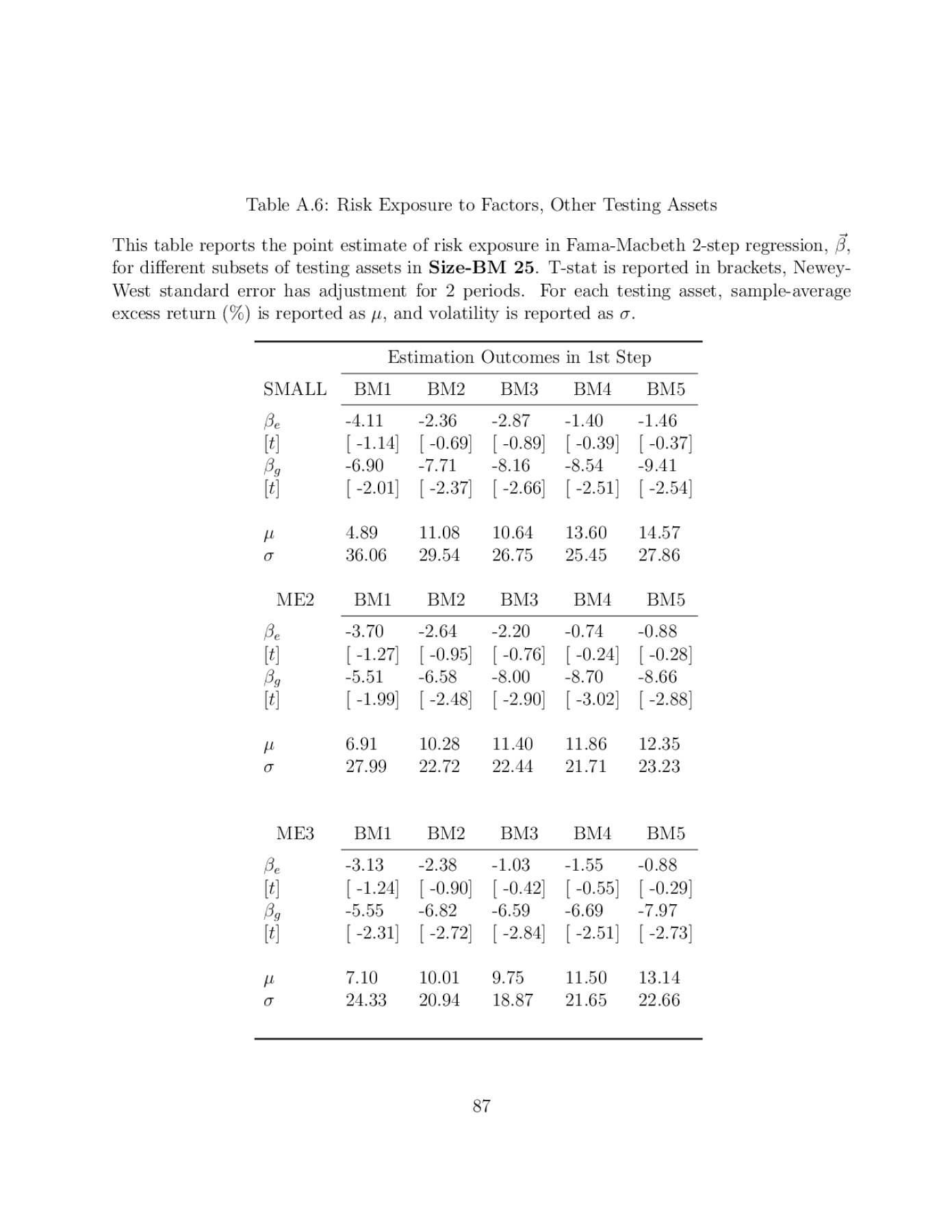

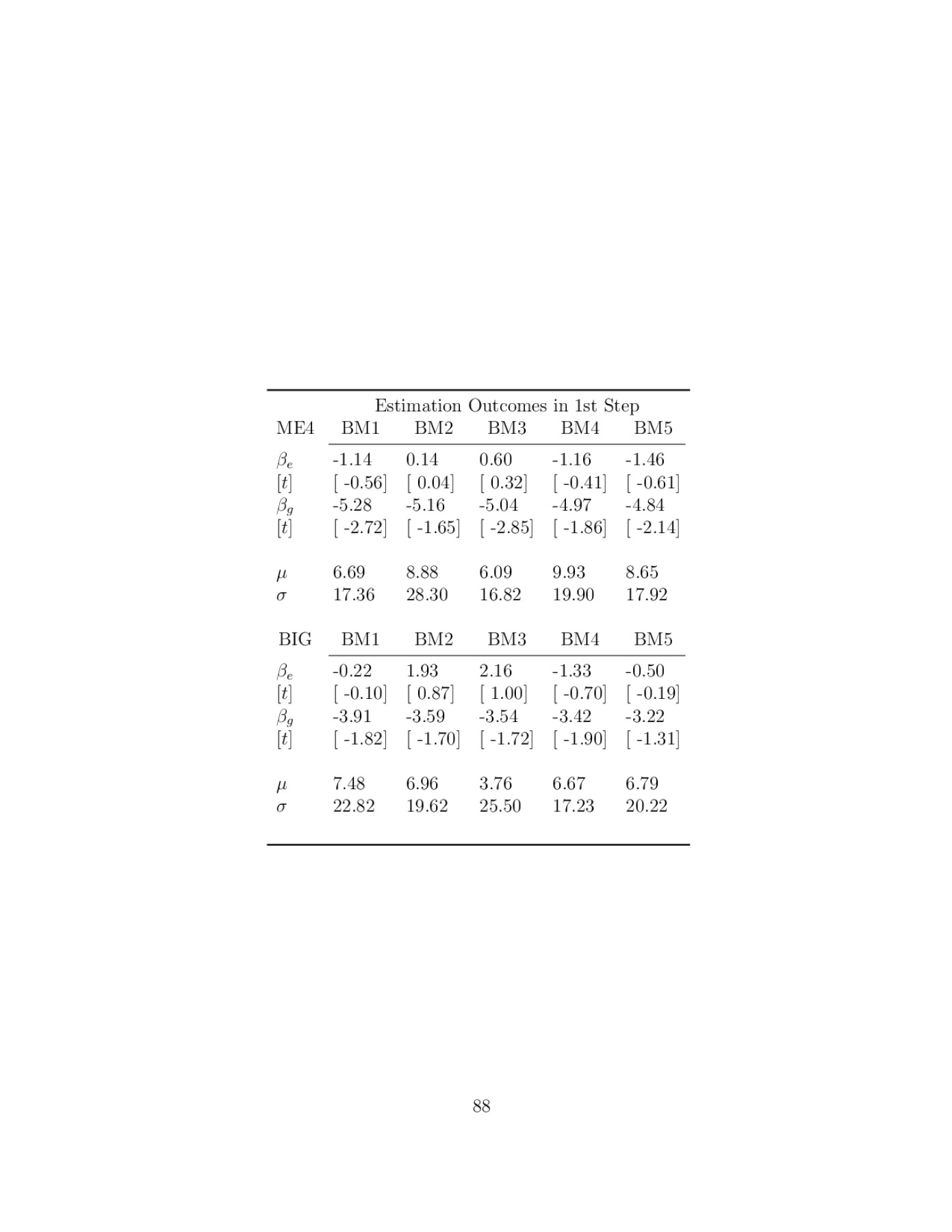

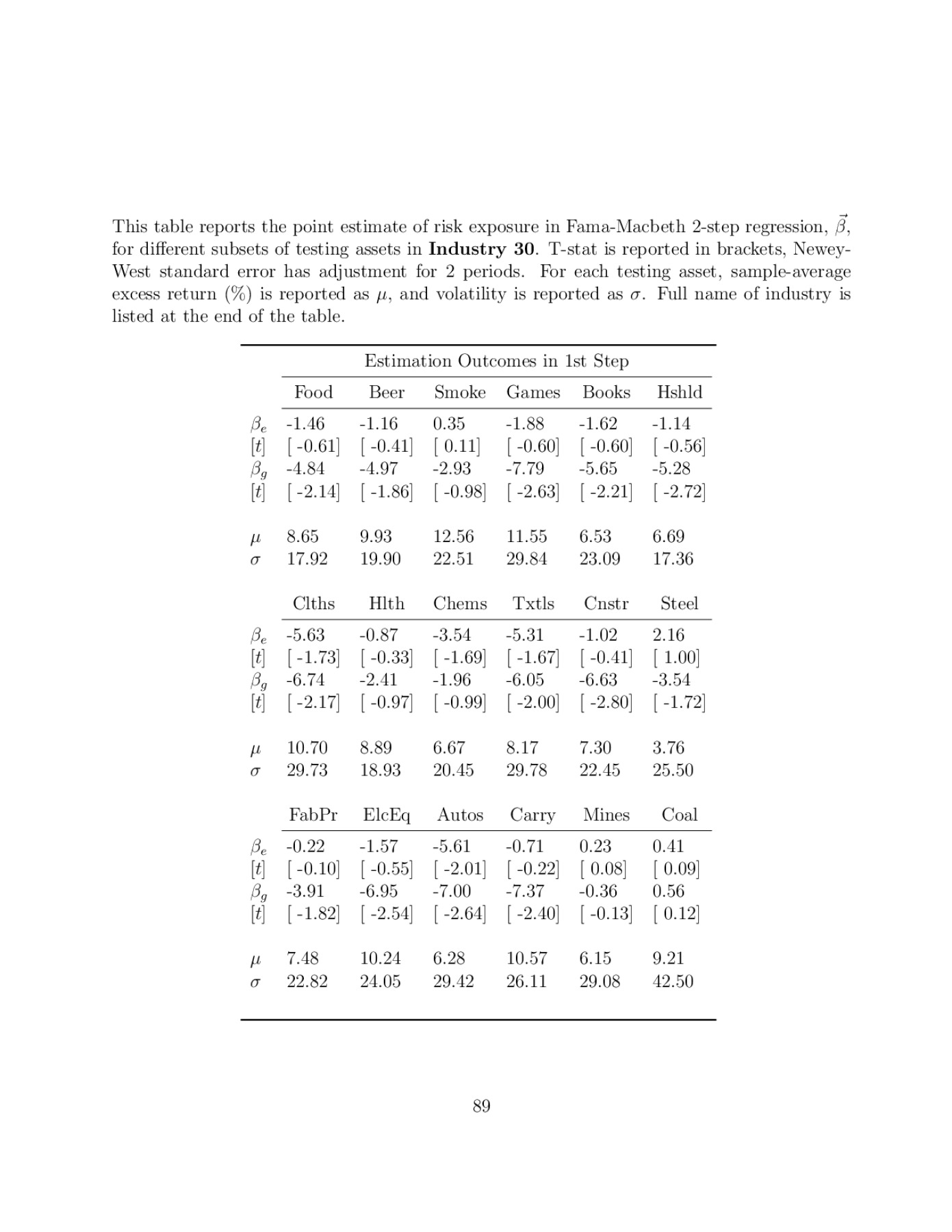

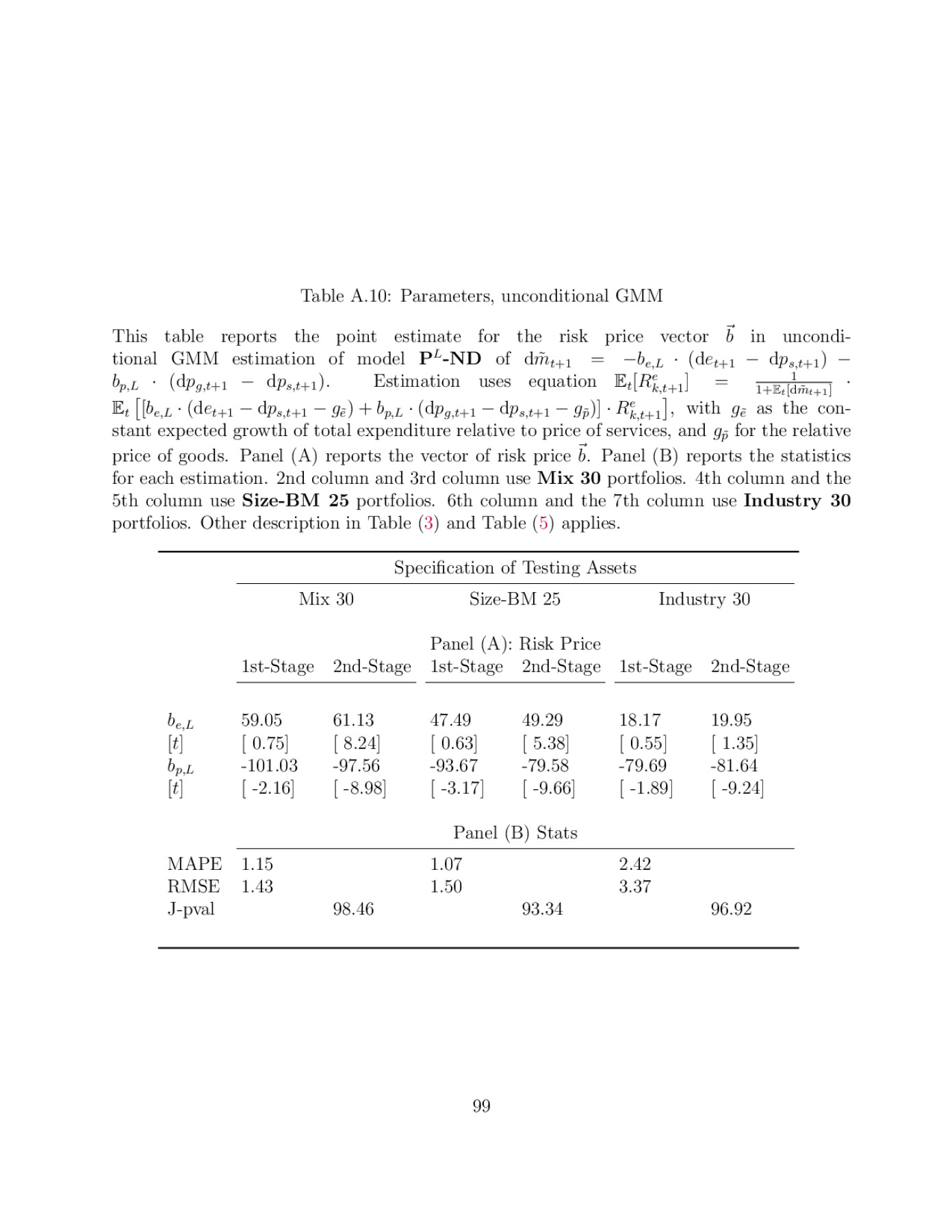

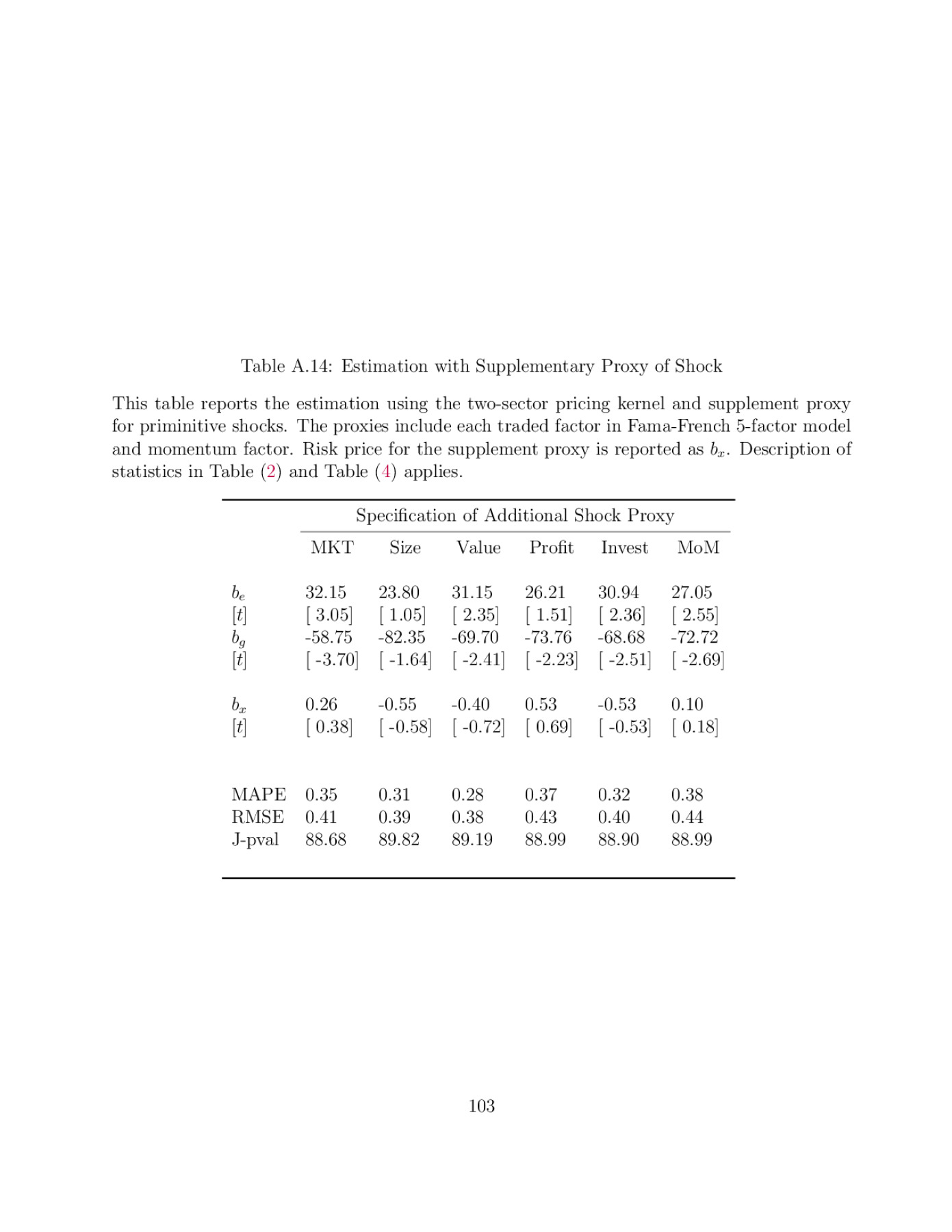

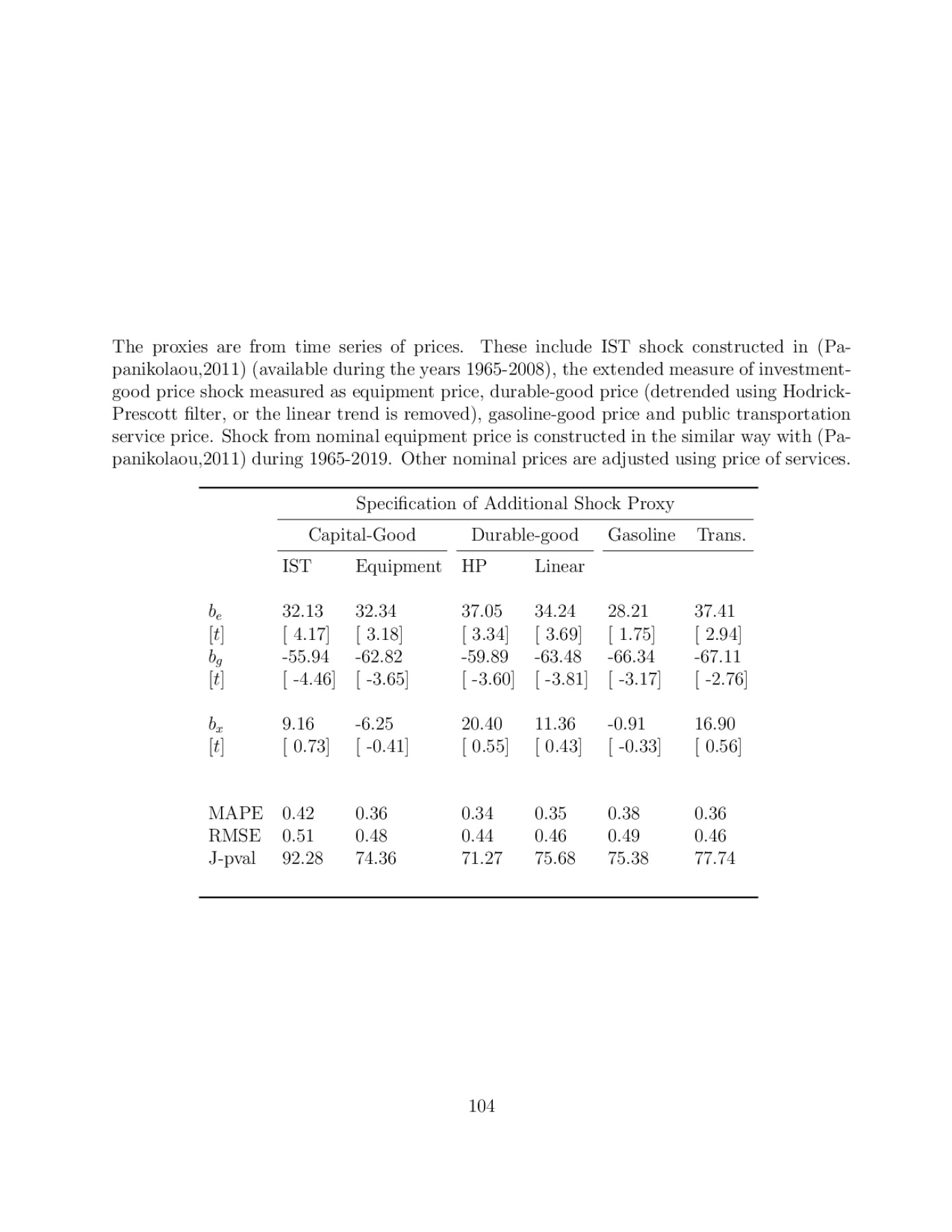

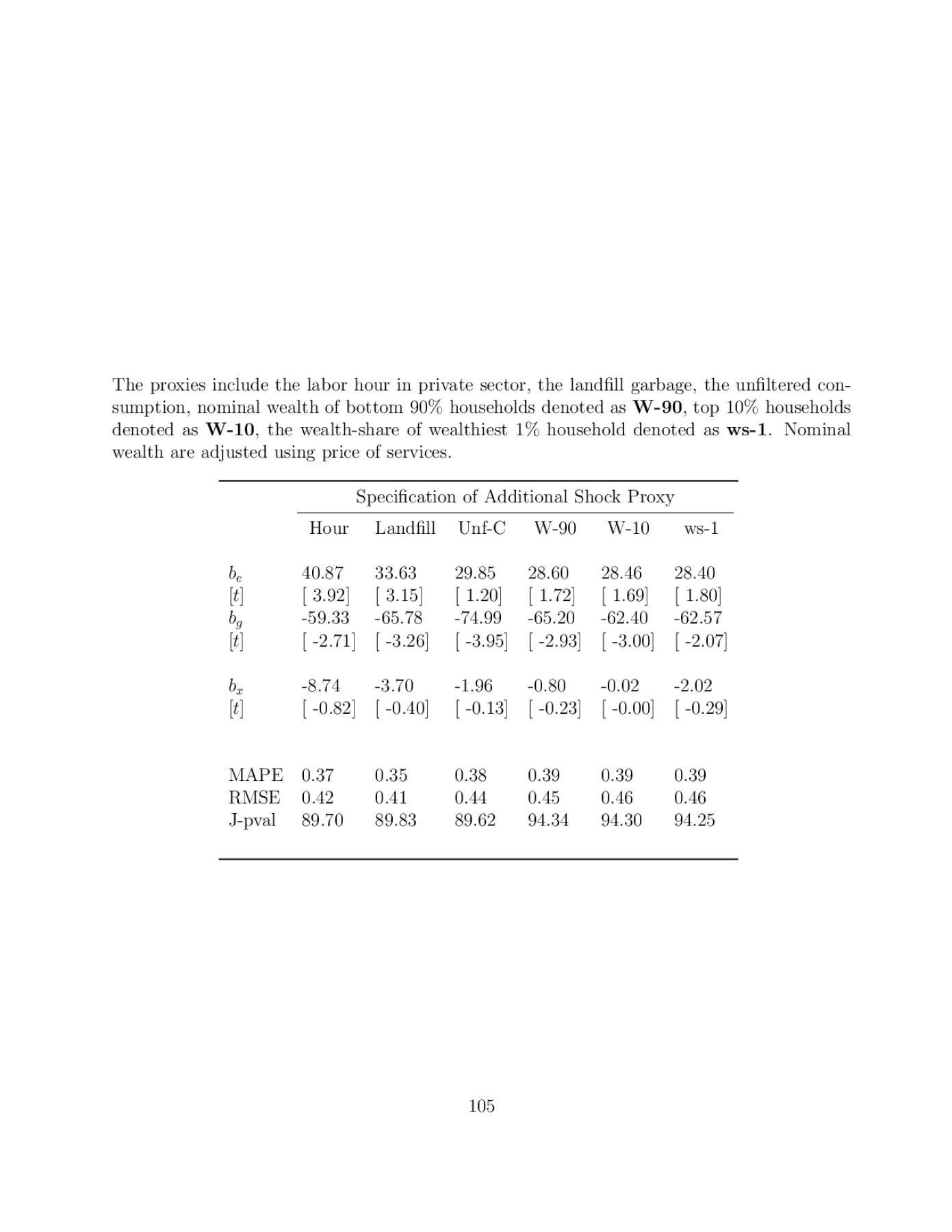

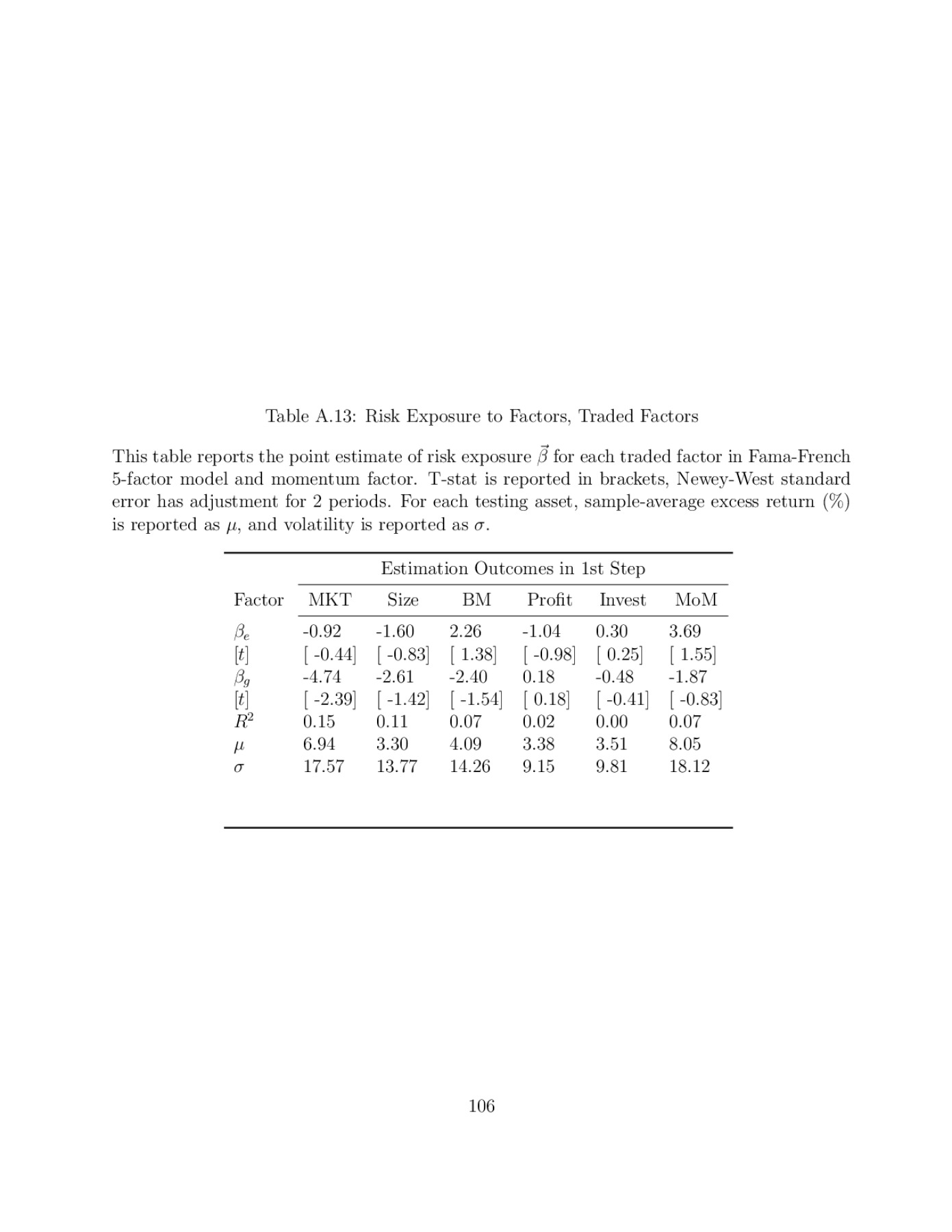

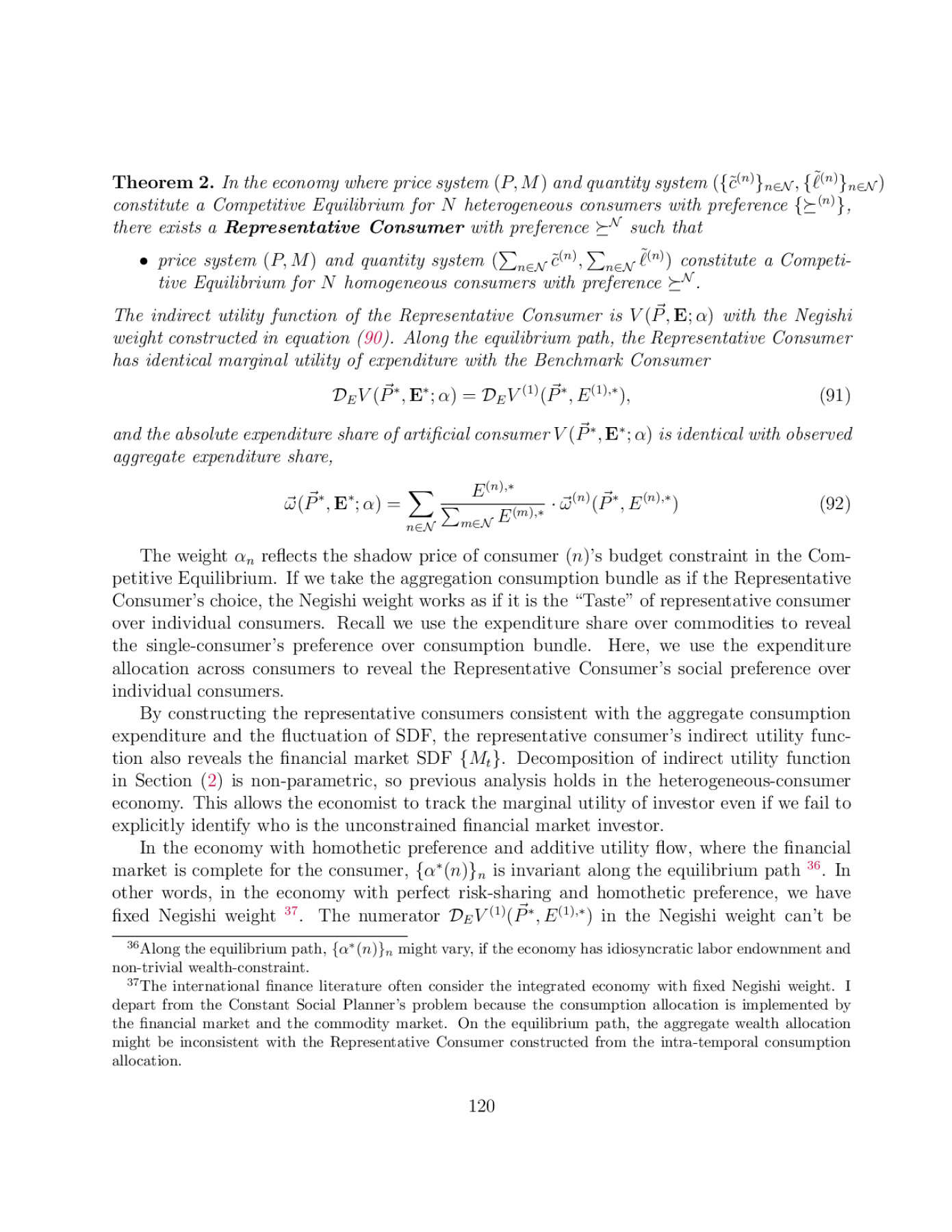

I decompose Stochastic Discount Factor (SDF) using detailed consumption prices and expenditure. Prices and expenditure work as sufficient statistics for marginal utility, as indirect utility function describes consumer’s preference. This decomposition is general and flexible, applies for a wide set of consumer utility functions. When marginal utility has different sensitivities to prices, fluctuations in detailed prices help to measure variation in SDF. I estimate the pricing kernel in a two-sector economy of goods and services. Pricing kernel is summarized by two time-series factors, expenditure relative to price of services, price of goods relative to price of services. This new model explains the cross-section variation of expected returns in equity portfolios, better than simple consumption-based asset pricing models and traded-factor models. Variation in relative price of goods contributes to volatile SDF. Point estimate of relative risk-aversion coefficient is small. Equity assets in U.S. market have negative risk exposure to relative price of goods. Additional negative risk exposure yields higher return.

Preview